Levi Strauss Investor Day Presentation Deck

RETURN ON

INVESTED CAPITAL

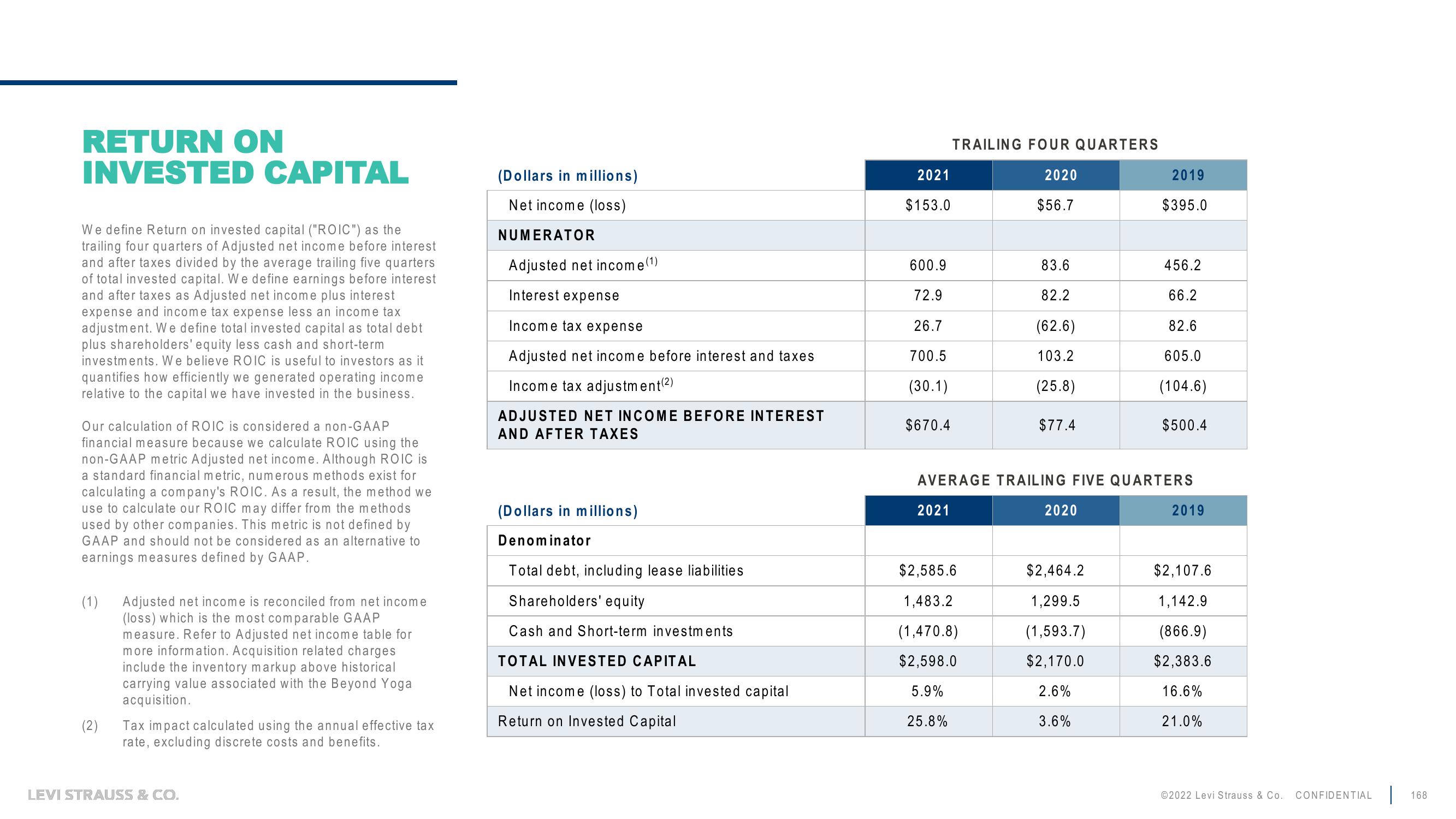

We define Return on invested capital ("ROIC") as the

trailing four quarters of Adjusted net income before interest.

and after taxes divided by the average trailing five quarters

of total invested capital. We define earnings before interest

and after taxes as Adjusted net income plus interest

expense and income tax expense less an income tax

adjustment. We define total invested capital as total debt

plus shareholders' equity less cash and short-term

investments. We believe ROIC is useful to investors as it

quantifies how efficiently we generated operating income

relative to the capital we have invested in the business.

Our calculation of ROIC is considered a non-GAAP

financial measure because we calculate ROIC using the

non-GAAP metric Adjusted net income. Although ROIC is

a standard financial metric, numerous methods exist for

calculating a company's ROIC. As a result, the method we

use to calculate our ROIC may differ from the methods

used by other companies. This metric is not defined by

GAAP and should not be considered as an alternative to

earnings measures defined by GAAP.

(1) Adjusted net income is reconciled from net income

(loss) which is the most comparable GAAP

measure. Refer to Adjusted net income table for

more information. Acquisition related charges

include the inventory markup above historical

carrying value associated with the Beyond Yoga

acquisition.

(2)

Tax impact calculated using the annual effective tax

rate, excluding discrete costs and benefits.

LEVI STRAUSS & CO.

(Dollars in millions)

Net income (loss)

NUMERATOR

Adjusted net income (1)

Interest expense

Income tax expense

Adjusted net income before interest and taxes

Income tax adjustment (2)

ADJUSTED NET INCOME BEFORE INTEREST

AND AFTER TAXES

(Dollars in millions)

Denominator

Total debt, including lease liabilities

Shareholders' equity

Cash and Short-term investments

TOTAL INVESTED CAPITAL

Net income (loss) to Total invested capital

Return on Invested Capital

2021

$153.0

600.9

72.9

26.7

700.5

(30.1)

$670.4

TRAILING FOUR QUARTERS

2021

2020

$56.7

$2,585.6

1,483.2

(1,470.8)

$2,598.0

5.9%

25.8%

83.6

82.2

(62.6)

103.2

(25.8)

$77.4

2020

2019

AVERAGE TRAILING FIVE QUARTERS

$2,464.2

1,299.5

(1,593.7)

$2,170.0

2.6%

3.6%

$395.0

456.2

66.2

82.6

605.0

(104.6)

$500.4

2019

$2,107.6

1,142.9

(866.9)

$2,383.6

16.6%

21.0%

©2022 Levi Strauss & Co. CONFIDENTIAL 168View entire presentation