Main Street Capital Investor Day Presentation Deck

(In millions)

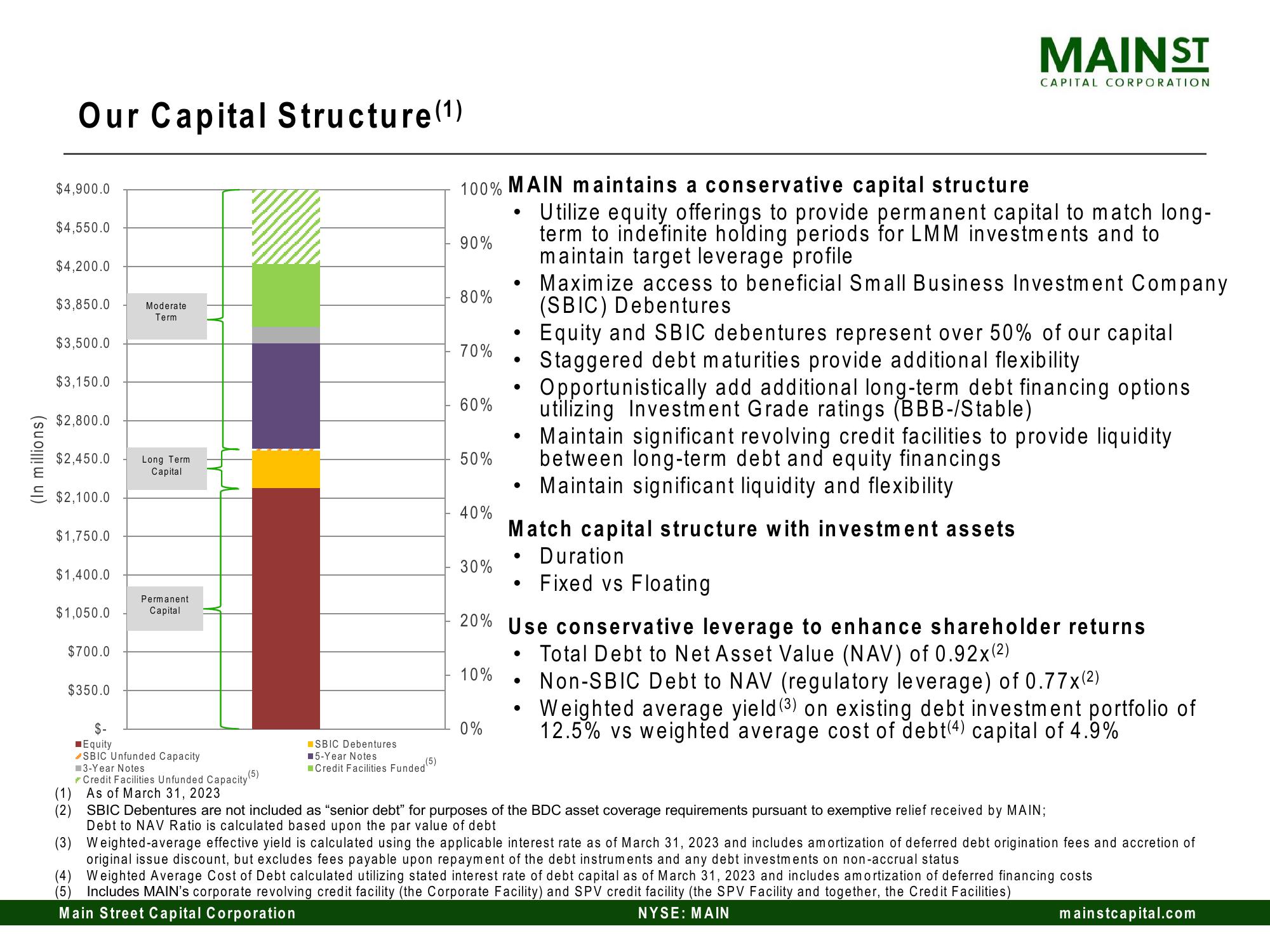

Our Capital Structure (¹)

$4,900.0

$4,550.0

$4,200.0

$3,850.0

$3,500.0

$3,150.0

$2,800.0

$2,450.0 Long Term

Capital

$2,100.0

$1,750.0

$1,400.0

$1,050.0

$700.0

Moderate

Term

$350.0

Permanent

Capital

$-

■Equity

SBIC Unfunded Capacity.

3-Year Notes

(5)

Credit Facilities Unfunded Capacity

As of March 31, 2023

SBIC Debentures.

■5-Year Notes

(5)

Credit Facilities Funded)

100% MAIN maintains a conservative capital structure

90%

80%

70%

60%

50%

40%

30%

10%

●

0%

●

●

Maximize access to beneficial Small Business Investment Company

(SBIC) Debentures

Equity and SBIC debentures represent over 50% of our capital

Staggered debt maturities provide additional flexibility

Opportunistically add additional long-term debt financing options

utilizing Investment Grade ratings (BBB-/Stable)

Maintain significant revolving credit facilities to provide liquidity

between long-term debt and equity financings

Maintain significant liquidity and flexibility

Match capital structure with investment assets

●

●

●

●

●

●

20% Use conservative leverage to enhance shareholder returns

Total Debt to Net Asset Value (NAV) of 0.92x(2)

●

MAIN ST

●

CAPITAL CORPORATION

Utilize equity offerings to provide permanent capital to match long-

term to indefinite holding periods for LMM investments and to

maintain target leverage profile

Duration

Fixed vs Floating

Non-SBIC Debt to NAV (regulatory leverage) of 0.77x(²)

Weighted average yield (3) on existing debt investment portfolio of

12.5% vs weighted average cost of debt(4) capital of 4.9%

(1)

(2) SBIC Debentures are not included as "senior debt" for purposes of the BDC asset coverage requirements pursuant to exemptive relief received by MAIN;

Debt to NAV Ratio is calculated based upon the par value of debt

(3) Weighted-average effective yield is calculated using the applicable interest rate as of March 31, 2023 and includes amortization of deferred debt origination fees and accretion of

original issue discount, but excludes fees payable upon repayment of the debt instruments and any debt investments on non-accrual status

(4) Weighted Average Cost of Debt calculated utilizing stated interest rate of debt capital as of March 31, 2023 and includes amortization of deferred financing costs

(5) Includes MAIN's corporate revolving credit facility (the Corporate Facility) and SPV credit facility (the SPV Facility and together, the Credit Facilities)

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.comView entire presentation