Selina SPAC

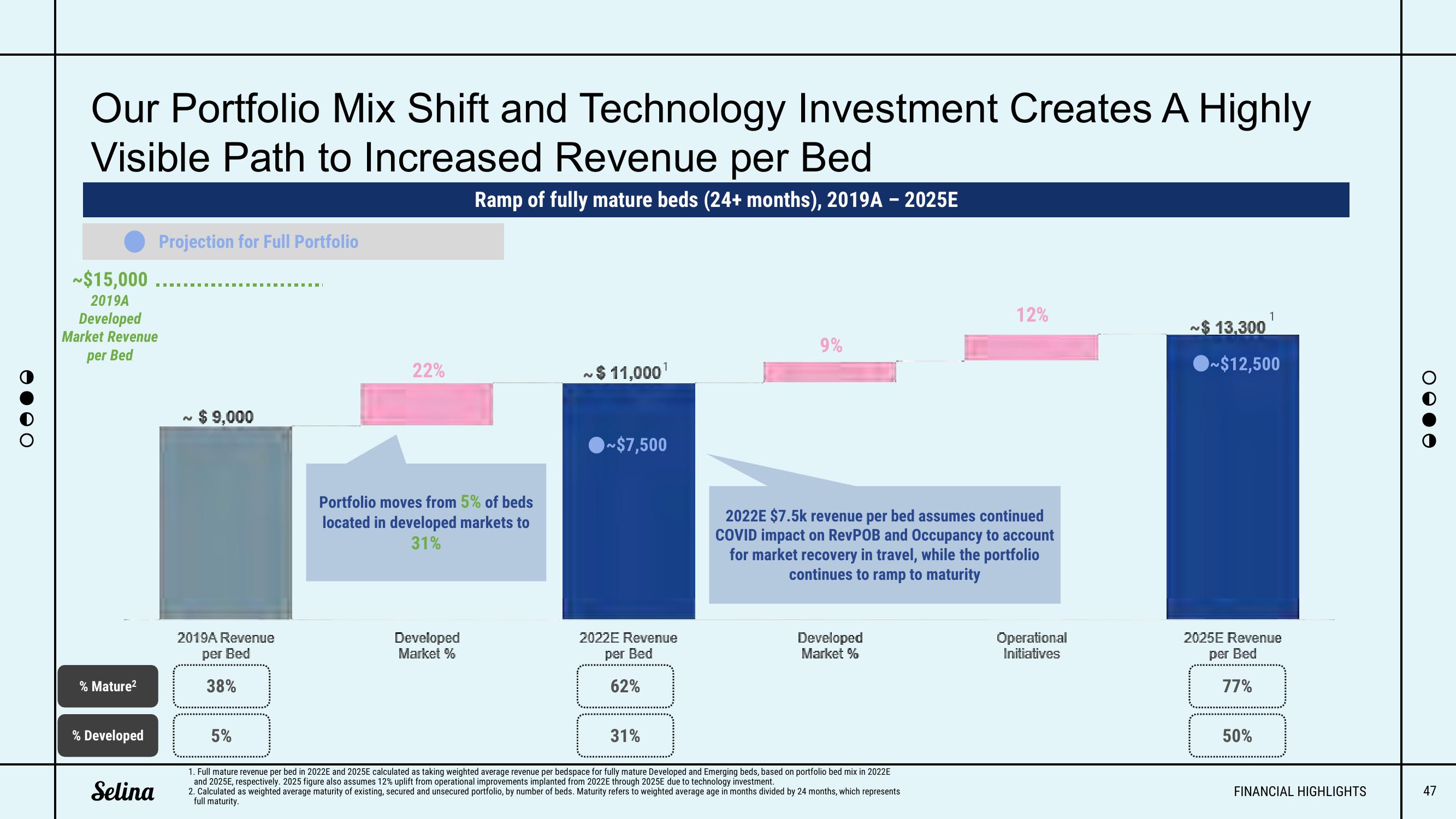

Our Portfolio Mix Shift and Technology Investment Creates A Highly

Visible Path to Increased Revenue per Bed

Ramp of fully mature beds (24+ months), 2019A - 2025E

~$15,000

2019A

Developed

Market Revenue

per Bed

% Mature²

% Developed

Projection for Full Portfolio

Selina

‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒‒

N

$ 9,000

2019A Revenue

per Bed

38%

5%

22%

Portfolio moves from 5% of beds

located in developed markets to

31%

Developed

Market %

N

$ 11,000¹

~$7,500

2022E Revenue

per Bed

62%

31%

9%

2022E $7.5k revenue per bed assumes continued

COVID impact on RevPOB and Occupancy to account

for market recovery in travel, while the portfolio

continues to ramp to maturity

Developed

Market %

12%

1. Full mature revenue per bed in 2022E and 2025E calculated as taking weighted average revenue per bedspace for fully mature Developed and Emerging beds, based on portfolio bed mix in 2022E

and 2025E, respectively. 2025 figure also assumes 12% uplift from operational improvements implanted from 2022E through 2025E due to technology investment.

2. Calculated as weighted average maturity of existing, secured and unsecured portfolio, by number of beds. Maturity refers to weighted average age in months divided by 24 months, which represents

full maturity.

Operational

Initiatives

1

$ 13.300

~$12,500

2025E Revenue

per Bed

77%

50%

FINANCIAL HIGHLIGHTS

47View entire presentation