Spirit Mergers and Acquisitions Presentation Deck

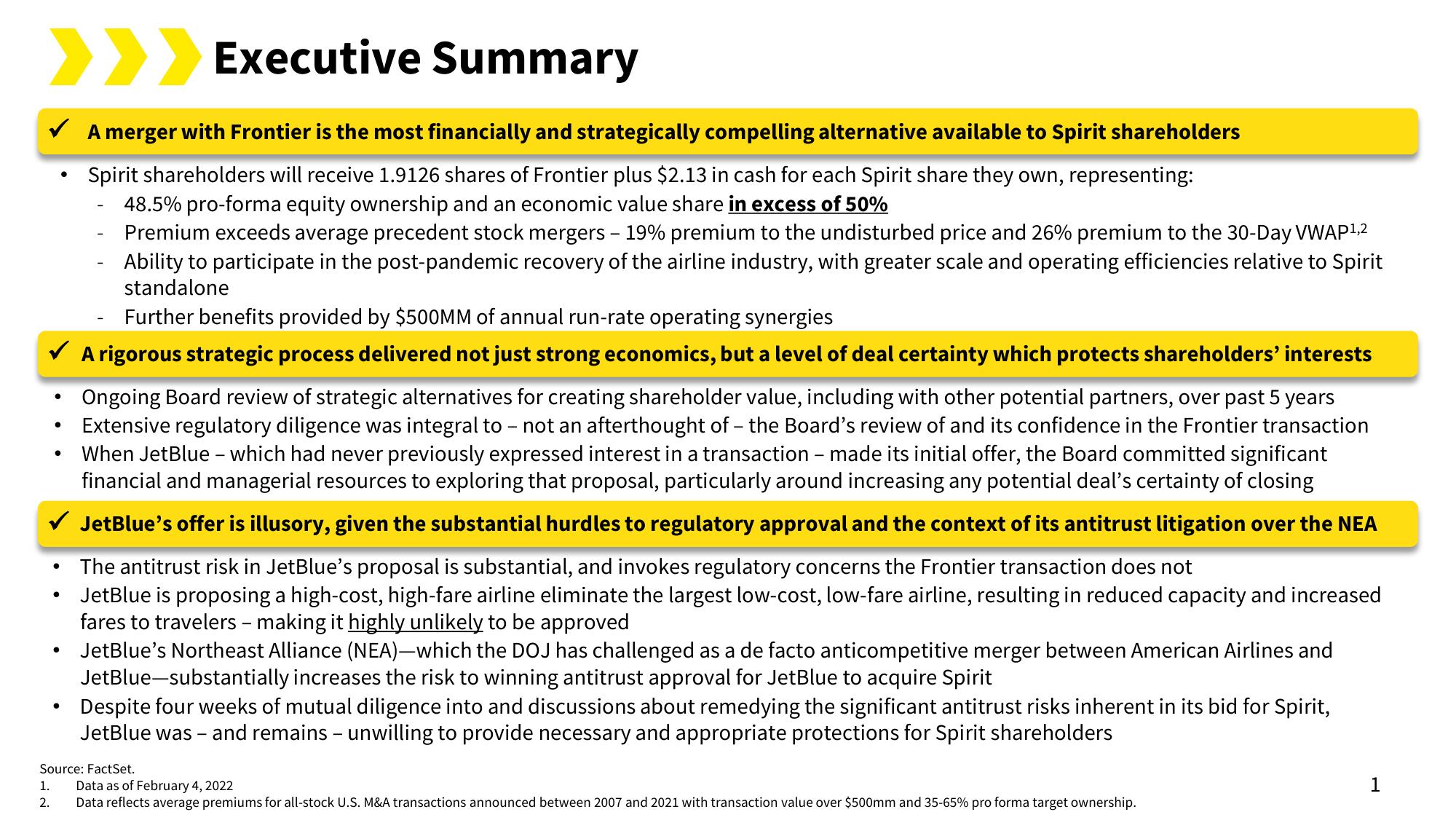

>>> Executive Summary

✓ A merger with Frontier is the most financially and strategically compelling alternative available to Spirit shareholders

Spirit shareholders will receive 1.9126 shares of Frontier plus $2.13 in cash for each Spirit share they own, representing:

48.5% pro-forma equity ownership and an economic value share in excess of 50%

Premium exceeds average precedent stock mergers - 19% premium to the undisturbed price and 26% premium to the 30-Day VWAP¹,2

Ability to participate in the post-pandemic recovery of the airline industry, with greater scale and operating efficiencies relative to Spirit

standalone

Further benefits provided by $500MM of annual run-rate operating synergies

✓ A rigorous strategic process delivered not just strong economics, but a level of deal certainty which protects shareholders' interests

-

Ongoing Board review of strategic alternatives for creating shareholder value, including with other potential partners, over past 5 years

Extensive regulatory diligence was integral to - not an afterthought of the Board's review of and its confidence in the Frontier transaction

When JetBlue - which had never previously expressed interest in a transaction - made its initial offer, the Board committed significant

financial and managerial resources to exploring that proposal, particularly around increasing any potential deal's certainty of closing

✓ JetBlue's offer is illusory, given the substantial hurdles to regulatory approval and the context of its antitrust litigation over the NEA

●

●

●

●

The antitrust risk in JetBlue's proposal is substantial, and invokes regulatory concerns the Frontier transaction does not

JetBlue is proposing a high-cost, high-fare airline eliminate the largest low-cost, low-fare airline, resulting in reduced capacity and increased

fares to travelers - making it highly unlikely to be approved

JetBlue's Northeast Alliance (NEA)—which the DOJ has challenged as a de facto anticompetitive merger between American Airlines and

JetBlue-substantially increases the risk to winning antitrust approval for JetBlue to acquire Spirit

Despite four weeks of mutual diligence into and discussions about remedying the significant antitrust risks inherent in its bid for Spirit,

JetBlue was - and remains - unwilling to provide necessary and appropriate protections for Spirit shareholders

Source: FactSet.

1. Data as of February 4, 2022

2. Data reflects average premiums for all-stock U.S. M&A transactions announced between 2007 and 2021 with transaction value over $500mm and 35-65% pro forma target ownership.

1View entire presentation