XP Inc Results Presentation Deck

Adjusted EBITDA and Adjusted Net Income

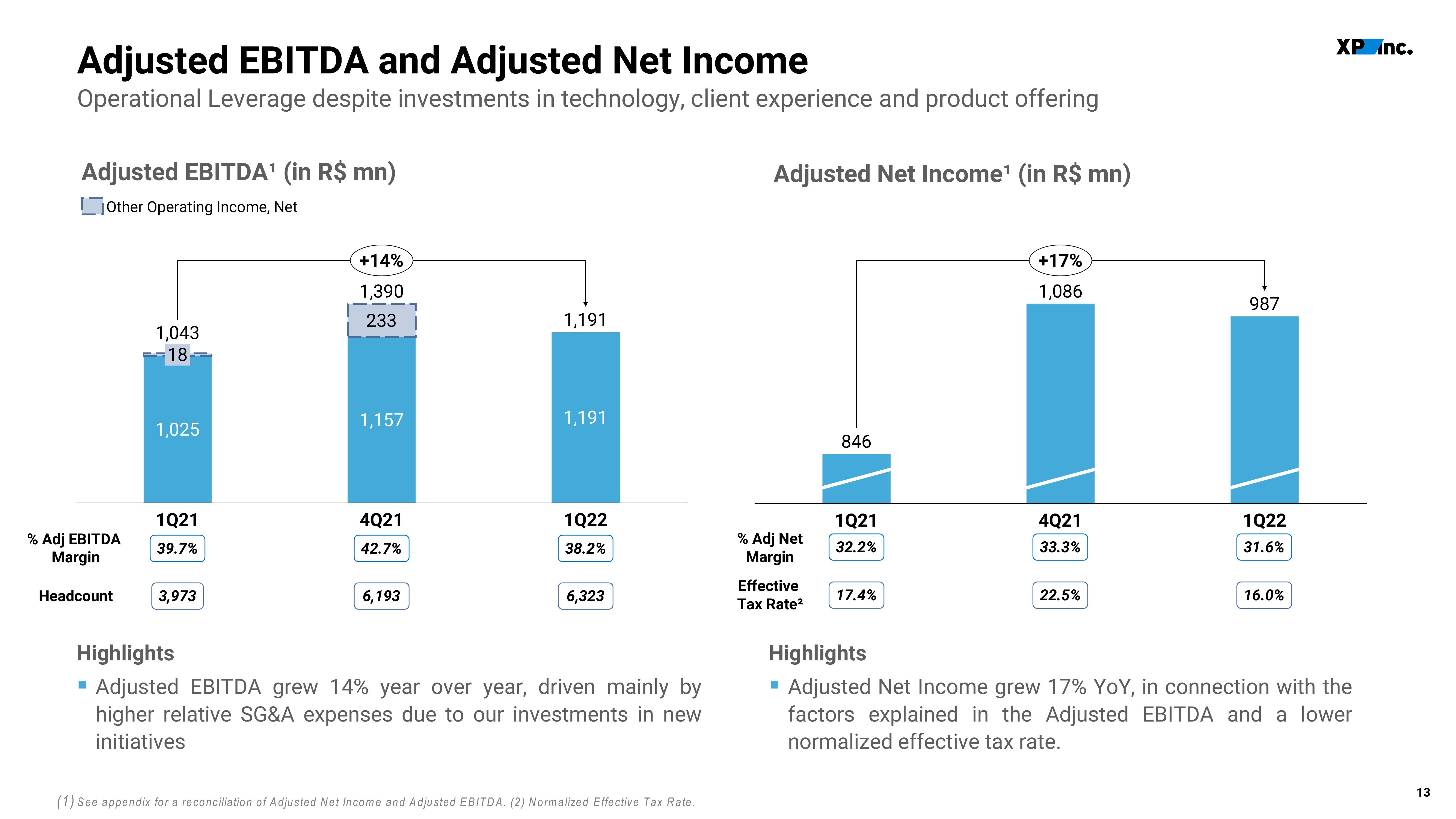

Operational Leverage despite investments in technology, client experience and product offering

Adjusted EBITDA¹ (in R$ mn)

Other Operating Income, Net

% Adj EBITDA

Margin

Headcount

1,043

18

■

1,025

1Q21

39.7%

3,973

+14%

1,390

233

1,157

4Q21

42.7%

6,193

1,191

1,191

1Q22

38.2%

6,323

Highlights

Adjusted EBITDA grew 14% year over year, driven mainly by

higher relative SG&A expenses due to our investments in new

initiatives

(1) See appendix for a reconciliation of Adjusted Net Income and Adjusted EBITDA. (2) Normalized Effective Tax Rate.

Adjusted Net Income¹ (in R$ mn)

% Adj Net

Margin

Effective

Tax Rate²

846

■

1Q21

32.2%

17.4%

+17%

1,086

4Q21

33.3%

22.5%

987

1Q22

31.6%

16.0%

XP Inc.

Highlights

Adjusted Net Income grew 17% YoY, in connection with the

factors explained in the Adjusted EBITDA and a lower

normalized effective tax rate.

13View entire presentation