Flutter Investor Day Presentation Deck

Cash flow

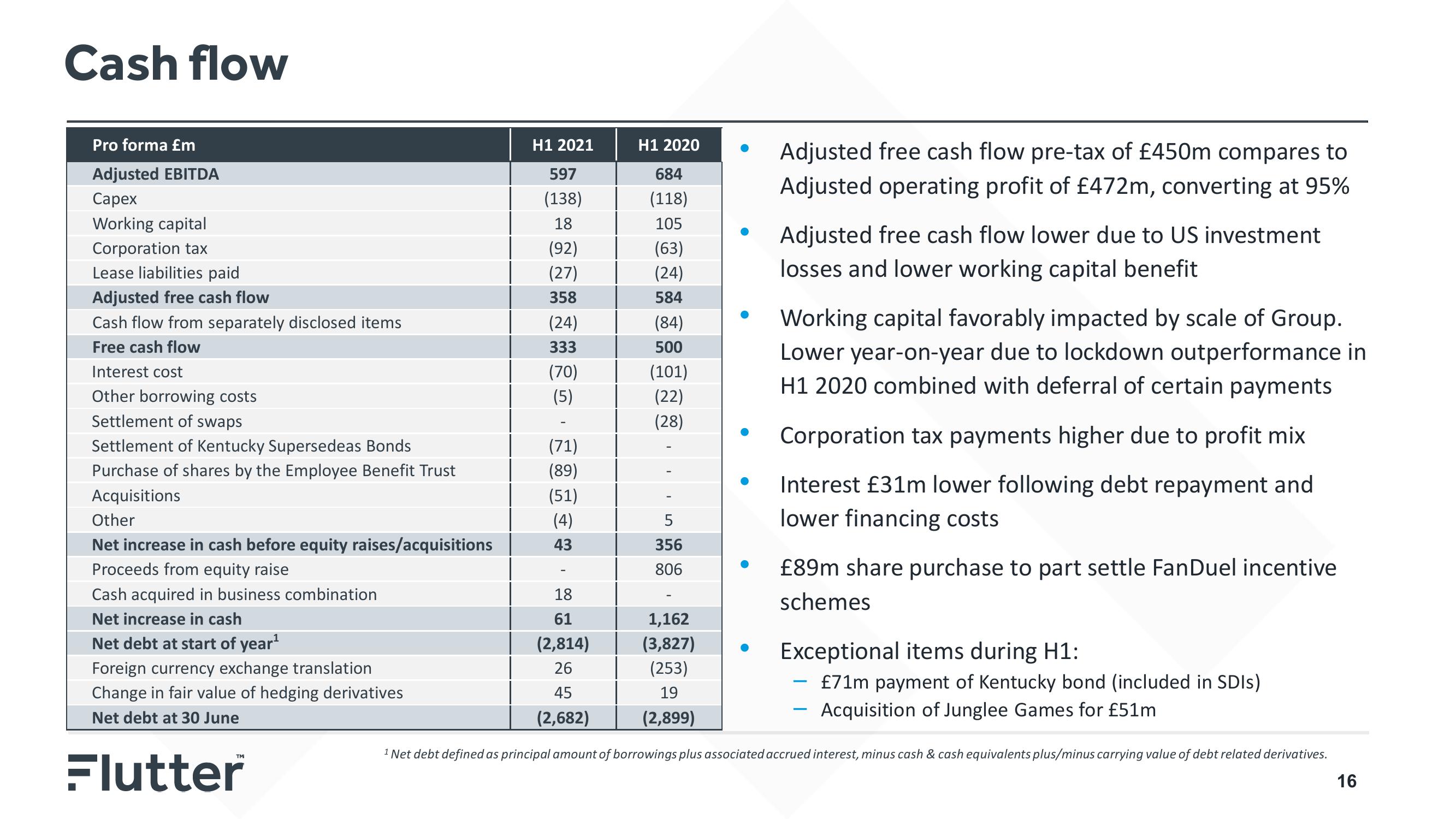

Pro forma £m

Adjusted EBITDA

Capex

Working capital

Corporation tax

Lease liabilities paid

Adjusted free cash flow

Cash flow from separately disclosed items

Free cash flow

Interest cost

Other borrowing costs

Settlement of swaps

Settlement of Kentucky Supersedeas Bonds

Purchase of shares by the Employee Benefit Trust

Acquisitions

Other

Net increase in cash before equity raises/acquisitions

Proceeds from equity raise

Cash acquired in business combination

Net increase in cash

Net debt at start of year¹

Foreign currency exchange translation

Change in fair value of hedging derivatives

Net debt at 30 June

Flutter

H1 2021

597

(138)

18

(92)

(27)

358

(24)

333

(70)

(5)

(71)

(89)

(51)

(4)

43

-

18

61

(2,814)

26

45

(2,682)

H1 2020

684

(118)

105

(63)

(24)

584

(84)

500

(101)

(22)

(28)

356

806

1,162

(3,827)

(253)

19

(2,899)

Adjusted free cash flow pre-tax of £450m compares to

Adjusted operating profit of £472m, converting at 95%

Adjusted free cash flow lower due to US investment

losses and lower working capital benefit

Working capital favorably impacted by scale of Group.

Lower year-on-year due to lockdown outperformance in

H1 2020 combined with deferral of certain payments

Corporation tax payments higher due to profit mix

Interest £31m lower following debt repayment and

lower financing costs

£89m share purchase to part settle FanDuel incentive

schemes

Exceptional items during H1:

£71m payment of Kentucky bond (included in SDIs)

Acquisition of Junglee Games for £51m

¹ Net debt defined as principal amount of borrowings plus associated accrued interest, minus cash & cash equivalents plus/minus carrying value of debt related derivatives.

16View entire presentation