AngloAmerican Investor Day Presentation Deck

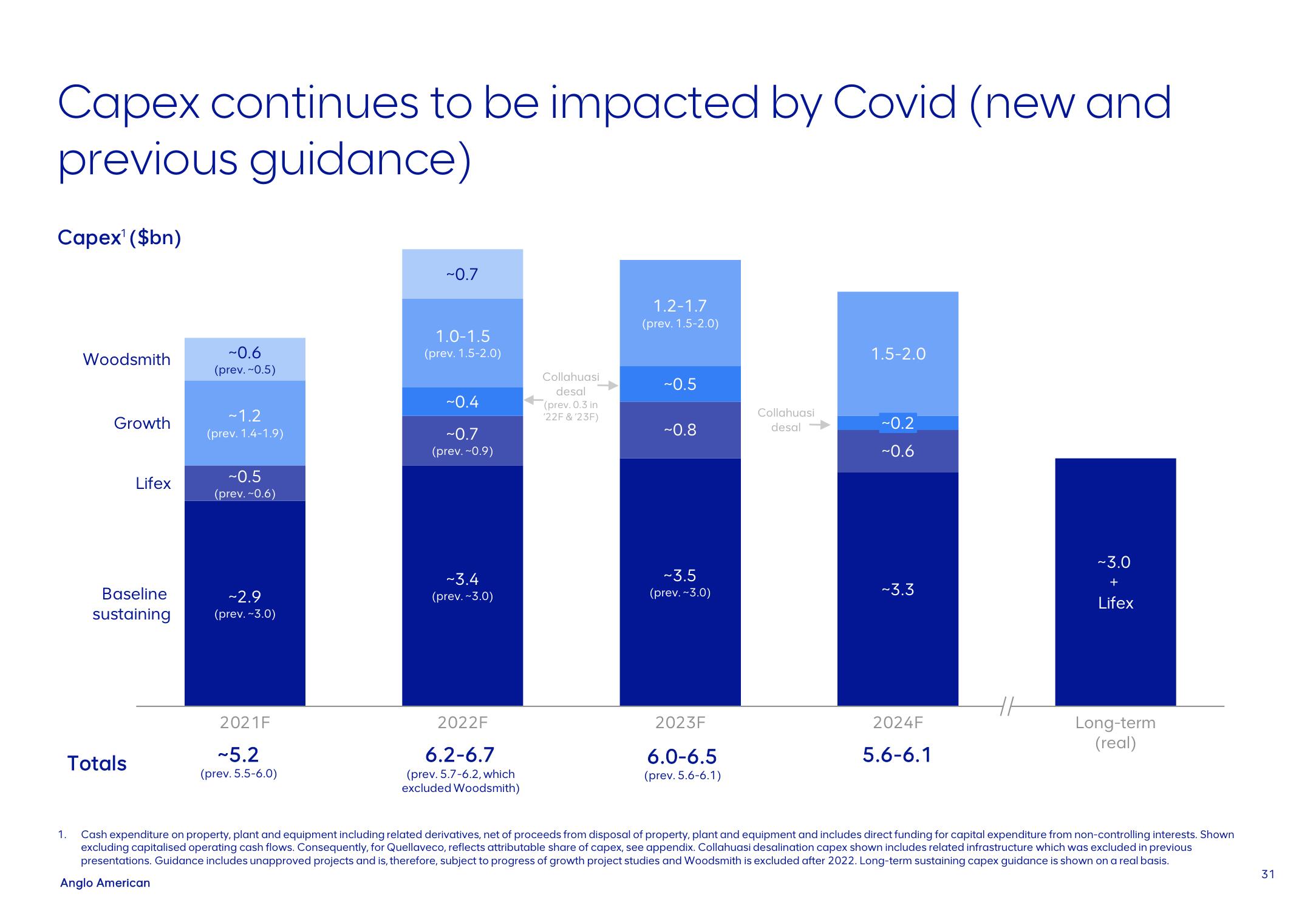

Capex continues to be impacted by Covid (new and

previous guidance)

Capex¹ ($bn)

Woodsmith

Growth

Lifex

Baseline

sustaining

Totals

~0.6

(prev. ~0.5)

~1.2

(prev. 1.4-1.9)

~0.5

(prev. ~0.6)

~2.9

(prev.-3.0)

2021F

~5.2

(prev. 5.5-6.0)

~0.7

1.0-1.5

(prev. 1.5-2.0)

~0.4

~0.7

(prev. ~0.9)

~3.4

(prev.-3.0)

2022F

6.2-6.7

(prev. 5.7-6.2, which

excluded Woodsmith)

Collahuasi

desal

(prev. 0.3 in

'22F & '23F)

1.2-1.7

(prev. 1.5-2.0)

~0.5

~0.8

~3.5

(prev. ~3.0)

2023F

6.0-6.5

(prev. 5.6-6.1)

Collahuasi

desal

1.5-2.0

-0.2

~0.6

~3.3

2024F

5.6-6.1

~3.0

+

Lifex

Long-term

(real)

1. Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital expenditure from non-controlling interests. Shown

excluding capitalised operating cash flows. Consequently, for Quellaveco, reflects attributable share of capex, see appendix. Collahuasi desalination capex shown includes related infrastructure which was excluded in previous

presentations. Guidance includes unapproved projects and is, therefore, subject to progress of growth project studies and Woodsmith is excluded after 2022. Long-term sustaining capex guidance is shown on a real basis.

Anglo American

31View entire presentation