Embracer Group Mergers and Acquisitions Presentation Deck

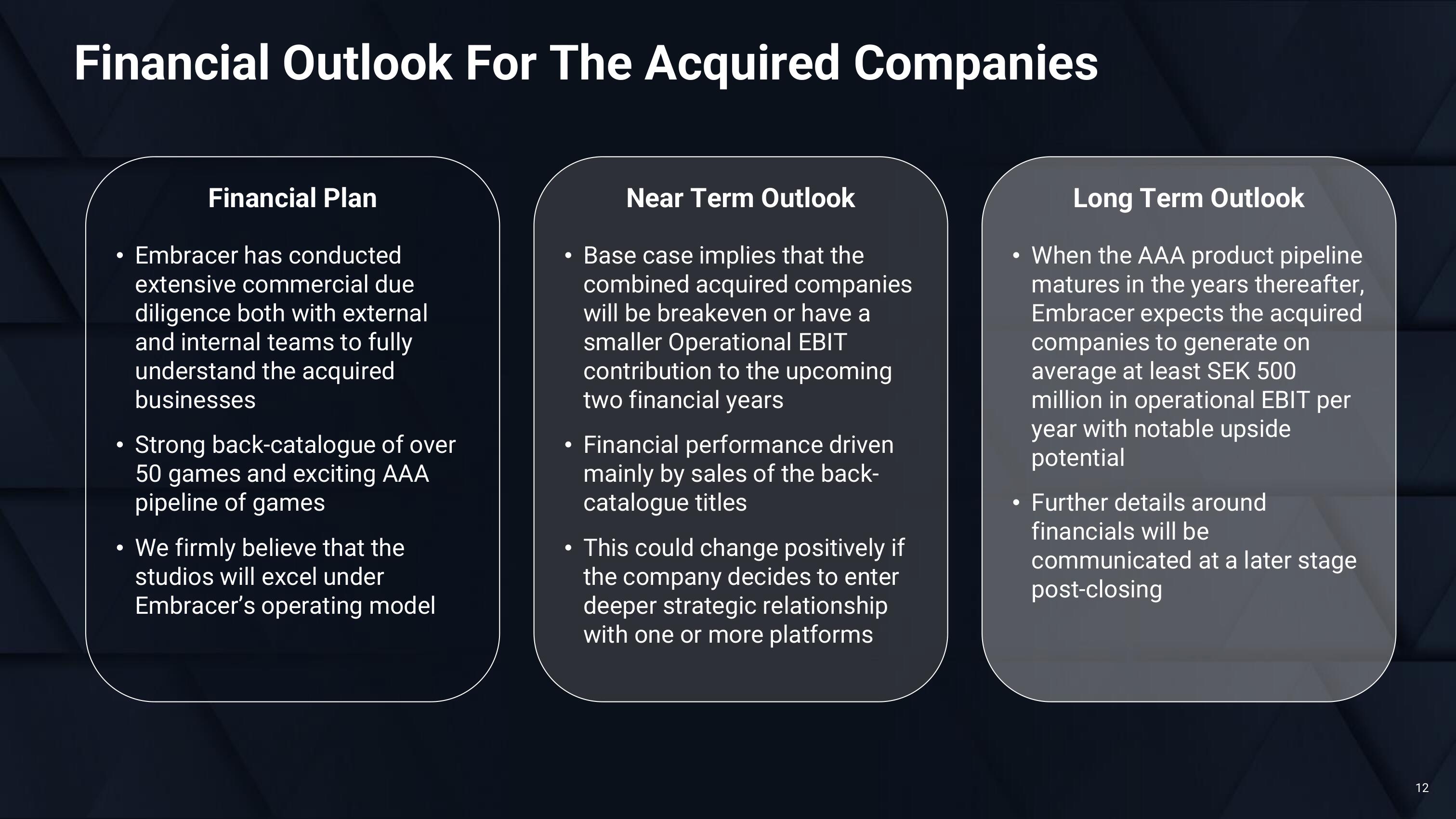

Financial Outlook For The Acquired Companies

●

Financial Plan

Embracer has conducted

extensive commercial due

diligence both with external

and internal teams to fully

understand the acquired

businesses

Strong back-catalogue of over

50 games and exciting AAA

pipeline of

games

We firmly believe that the

studios will excel under

Embracer's operating model

Near Term Outlook

• Base case implies that the

combined acquired companies

will be breakeven or have a

smaller Operational EBIT

contribution to the upcoming

two financial years

• Financial performance driven

mainly by sales of the back-

catalogue titles

●

This could change positively if

the company decides to enter

deeper strategic relationship

with one or more platforms

Long Term Outlook

When the AAA product pipeline

matures in the years thereafter,

Embracer expects the acquired

companies to generate on

average at least SEK 500

million in operational EBIT per

year with notable upside

potential

Further details around

financials will be

communicated at a later stage

post-closing

12View entire presentation