Wix Results Presentation Deck

●

●

●

●

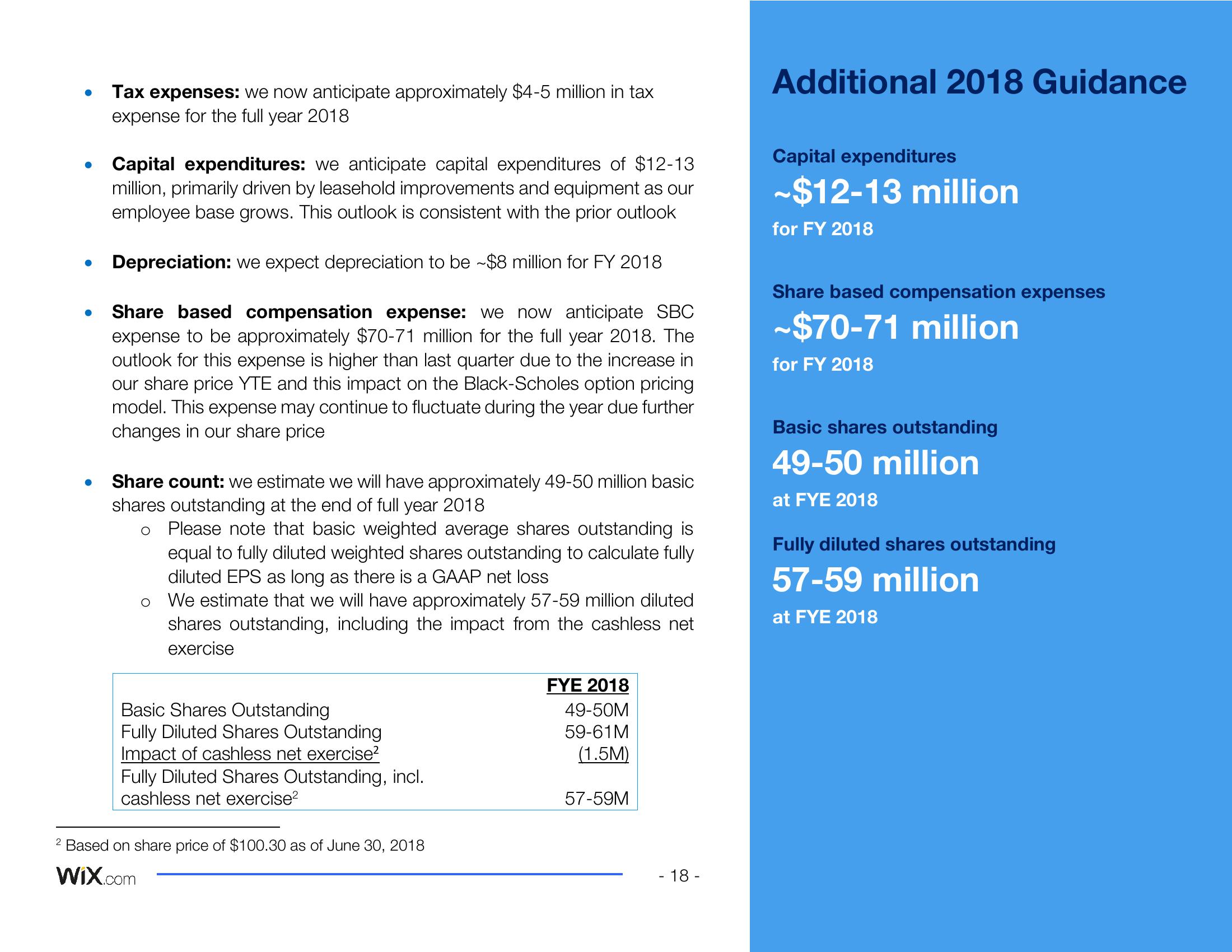

Tax expenses: we now anticipate approximately $4-5 million in tax

expense for the full year 2018

Capital expenditures: we anticipate capital expenditures of $12-13

million, primarily driven by leasehold improvements and equipment as our

employee base grows. This outlook is consistent with the prior outlook

Depreciation: we expect depreciation to be ~$8 million for FY 2018

Share based compensation expense: we now anticipate SBC

expense to be approximately $70-71 million for the full year 2018. The

outlook for this expense is higher than last quarter due to the increase in

our share price YTE and this impact on the Black-Scholes option pricing

model. This expense may continue to fluctuate during the year due further

changes in our share price

Share count: we estimate we will have approximately 49-50 million basic

shares outstanding at the end of full year 2018

O Please note that basic weighted average shares outstanding is

equal to fully diluted weighted shares outstanding to calculate fully

diluted EPS as long as there is a GAAP net loss

We estimate that we will have approximately 57-59 million diluted

shares outstanding, including the impact from the cashless net

exercise

O

Basic Shares Outstanding

Fully Diluted Shares Outstanding

Impact of cashless net exercise²

Fully Diluted Shares Outstanding, incl.

cashless net exercise²

2 Based on share price of $100.30 as of June 30, 2018

Wix.com

FYE 2018

49-50M

59-61M

(1.5M)

57-59M

- 18 -

Additional 2018 Guidance

Capital expenditures

~$12-13 million

for FY 2018

Share based compensation expenses

~$70-71 million

for FY 2018

Basic shares outstanding

49-50 million

at FYE 2018

Fully diluted shares outstanding

57-59 million

at FYE 2018View entire presentation