Rocket Lab SPAC Presentation Deck

FINANCIAL MODEL SUMMARY

36

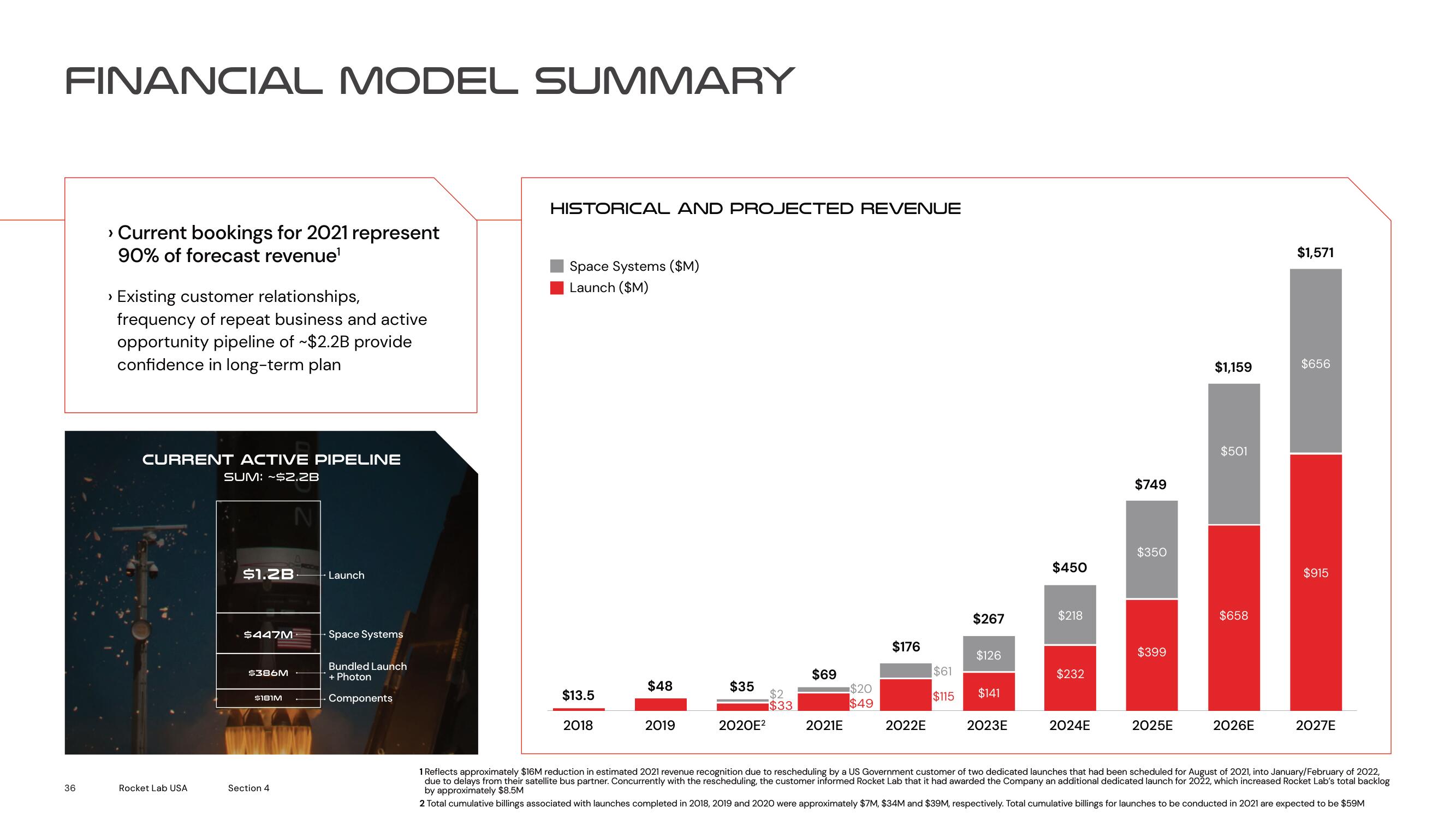

› Current bookings for 2021 represent

90% of forecast revenue¹

› Existing customer relationships,

frequency of repeat business and active

opportunity pipeline of ~$2.2B provide

confidence in long-term plan

CURRENT ACTIVE PIPELINE

SUM: -$2.2B

N

Rocket Lab USA

$1.2B

$447M

$386M

$181M

Section 4

+Launch

Space Systems

Bundled Launch

+ Photon

Components

HISTORICAL AND PROJECTED REVENUE

Space Systems ($M)

Launch ($M)

$13.5

2018

$48

2019

$35

2020E²

$2

$33

$69

2021E

$20

$49

$176

2022E

$61

$115

$267

$126

$141

2023E

$450

$218

$232

2024E

$749

$350

$399

2025E

$1,159

$501

$658

2026E

$1,571

$656

$915

2027E

1 Reflects approximately $16M reduction in estimated 2021 revenue recognition due to rescheduling by a US Government customer of two dedicated launches that had been scheduled for August of 2021, into January/February of 2022,

due to delays from their satellite bus partner. Concurrently with the rescheduling, the customer informed Rocket Lab that it had awarded the Company an additional dedicated launch for 2022, which increased Rocket Lab's total backlog

by approximately $8.5M

2 Total cumulative billings associated with launches completed in 2018, 2019 and 2020 were approximately $7M, $34M and $39M, respectively. Total cumulative billings for launches to be conducted in 2021 are expected to be $59MView entire presentation