Apollo Global Management Mergers and Acquisitions Presentation Deck

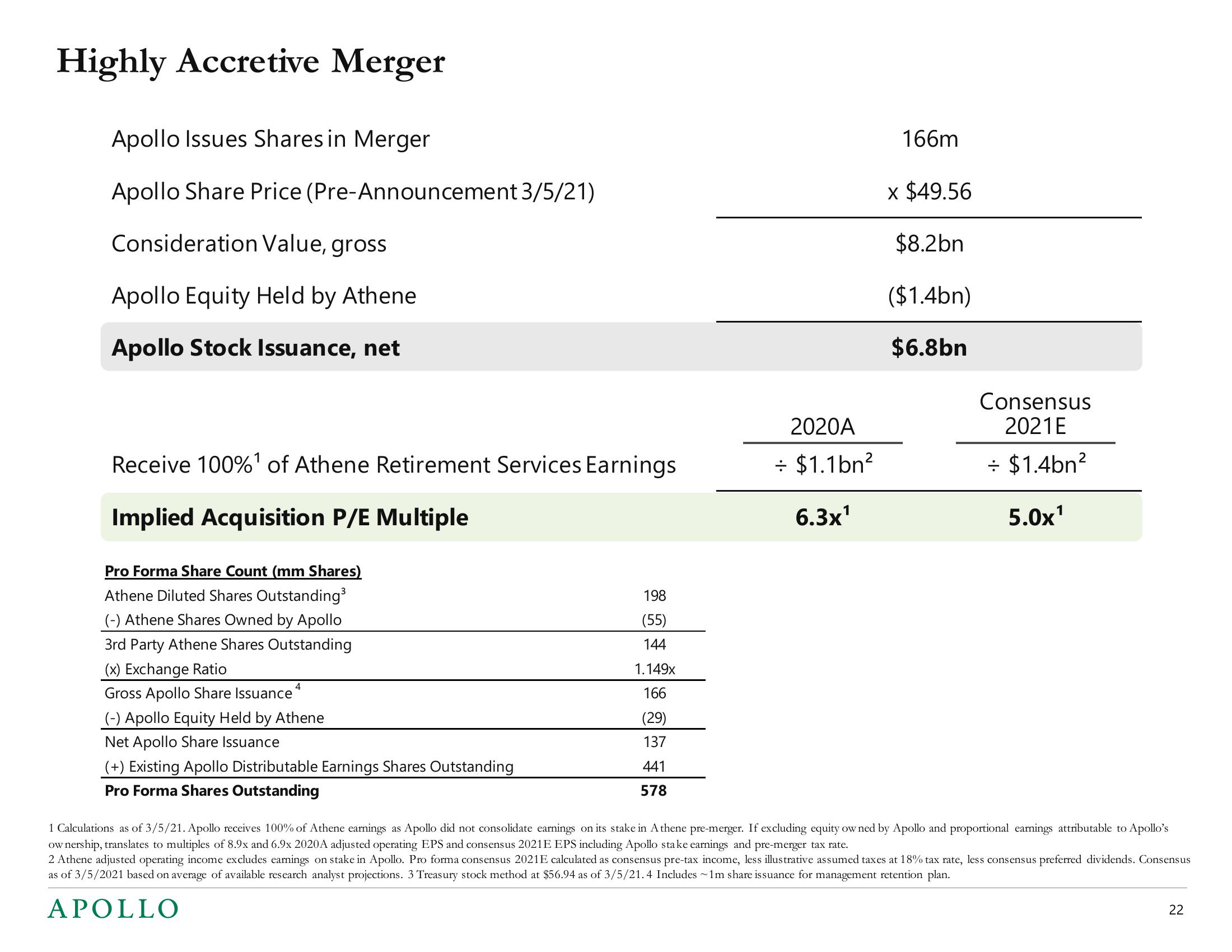

Highly Accretive Merger

Apollo Issues Shares in Merger

Apollo Share Price (Pre-Announcement 3/5/21)

Consideration Value, gross

Apollo Equity Held by Athene

Apollo Stock Issuance, net

Receive 100%¹ of Athene Retirement Services Earnings

Implied Acquisition P/E Multiple

Pro Forma Share Count (mm Shares)

Athene Diluted Shares Outstanding³

(-) Athene Shares Owned by Apollo

3rd Party Athene Shares Outstanding

(x) Exchange Ratio

Gross Apollo Share Issuance

(-) Apollo Equity Held by Athene

Net Apollo Share Issuance

4

(+) Existing Apollo Distributable Earnings Shares Outstanding

Pro Forma Shares Outstanding

198

(55)

144

1.149x

166

(29)

137

441

578

2020A

= $1.1bn²

6.3x¹

166m

x $49.56

$8.2bn

($1.4bn)

$6.8bn

Consensus

2021E

= $1.4bn²

5.0x¹

1 Calculations as of 3/5/21. Apollo receives 100% of Athene earnings as Apollo did not consolidate earnings on its stake in Athene pre-merger. If excluding equity owned by Apollo and proportional earnings attributable to Apollo's

ownership, translates to multiples of 8.9x and 6.9x 2020A adjusted operating EPS and consensus 2021E EPS including Apollo stake earnings and pre-merger tax rate.

2 Athene adjusted operating income excludes earnings on stake in Apollo. Pro forma consensus 2021E calculated as consensus pre-tax income, less illustrative assumed taxes at 18% tax rate, less consensus preferred dividends. Consensus

as of 3/5/2021 based on average of available research analyst projections. 3 Treasury stock method at $56.94 as of 3/5/21.4 Includes ~1m share issuance for management retention plan.

APOLLO

22View entire presentation