Dutch Bros Results Presentation Deck

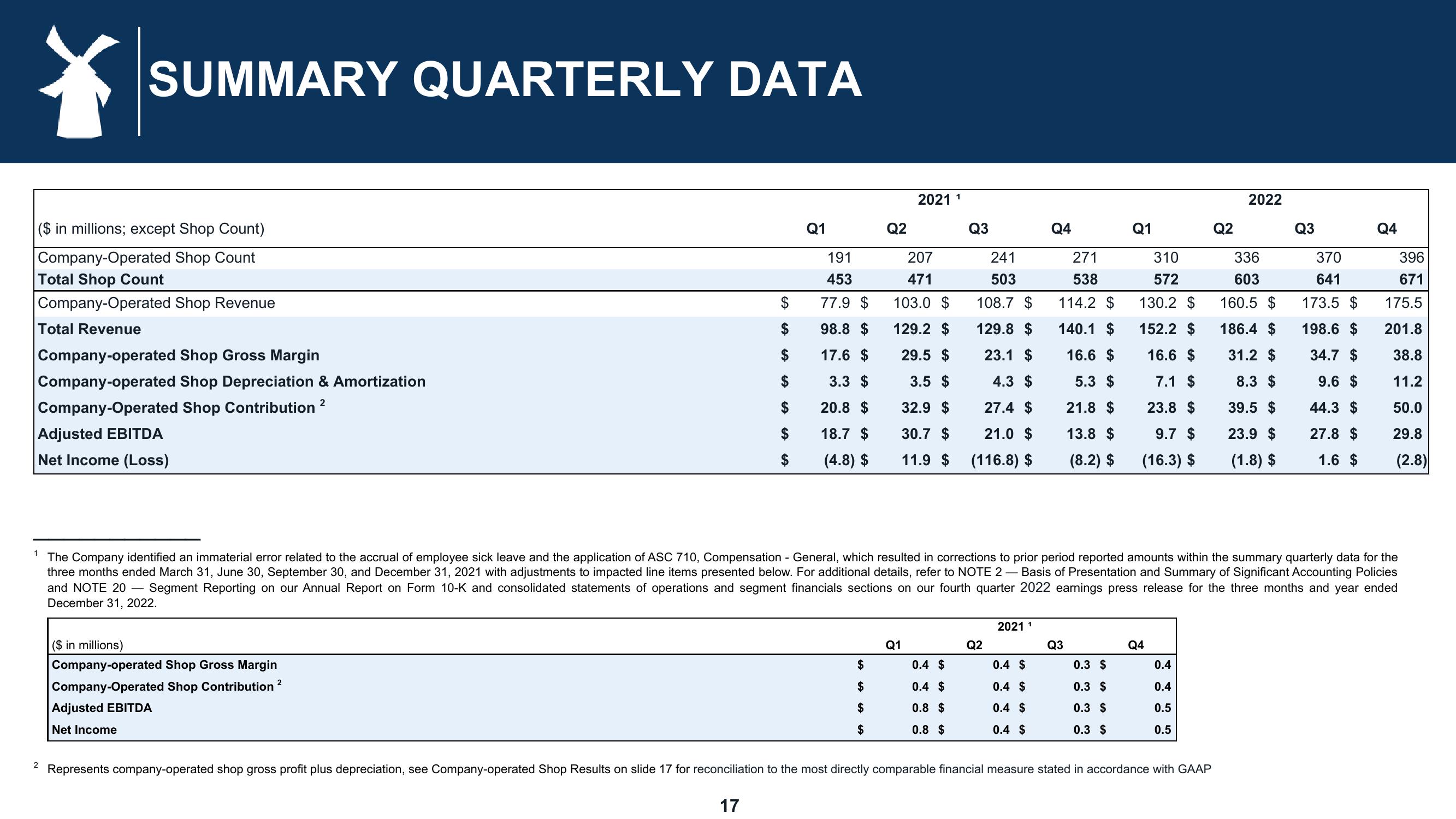

SUMMARY QUARTERLY DATA

($ in millions; except Shop Count)

Company-Operated Shop Count

Total Shop Count

Company-Operated Shop Revenue

Total Revenue

Company-operated Shop Gross Margin

Company-operated Shop Depreciation & Amortization

2

Company-Operated Shop Contribution ²

Adjusted EBITDA

Net Income (Loss)

2

($ in millions)

Company-operated Shop Gross Margin

Company-Operated Shop Contribution ²

$

$

$

$

$

Adjusted EBITDA

Net Income

Q1

191

453

77.9 $

98.8 $

17.6 $

3.3 $

20.8 $

18.7 $

(4.8) $

Q2

$

$

$

$

2021 1

207

471

103.0 $

129.2 $

29.5 $

3.5 $

32.9 $

30.7 $

11.9 $

Q1

Q3

0.4 $

0.4 $

0.8 $

0.8 $

241

503

108.7 $

129.8 $

23.1 $

4.3 $

27.4 $

21.0 $

(116.8) $

Q2

2021 1

Q4

0.4 $

0.4 $

0.4 $

0.4 $

271

538

114.2 $

140.1 $

16.6 $

5.3 $

21.8 $

13.8 $

(8.2) $

1 The Company identified an immaterial error related to the accrual of employee sick leave and the application of ASC 710, Compensation - General, which resulted in corrections to prior period reported amounts within the summary quarterly data for the

three months ended March 31, June 30, September 30, and December 31, 2021 with adjustments to impacted line items presented below. For additional details, refer to NOTE 2 - Basis of Presentation and Summary of Significant Accounting Policies

and NOTE 20 Segment Reporting on our Annual Report on Form 10-K and consolidated statements of operations and segment financials sections on our fourth quarter 2022 earnings press release for the three months and year ended

December 31, 2022.

Q3

Q1

0.3 $

0.3 $

0.3 $

0.3 $

310

572

130.2 $

152.2 $

16.6 $

7.1 $

23.8 $

9.7 $

(16.3) $

Q4

0.4

0.4

0.5

0.5

Q2

Represents company-operated shop gross profit plus depreciation, see Company-operated Shop Results on slide 17 for reconciliation to the most directly comparable financial measure stated in accordance with GAAP

17

2022

336

603

160.5 $

186.4 $

31.2 $

8.3 $

39.5 $

23.9 $

(1.8) $

Q3

370

641

173.5 $

198.6 $

34.7 $

9.6 $

44.3 $

27.8 $

1.6 $

Q4

396

671

175.5

201.8

38.8

11.2

50.0

29.8

(2.8)View entire presentation