Affirm Results Presentation Deck

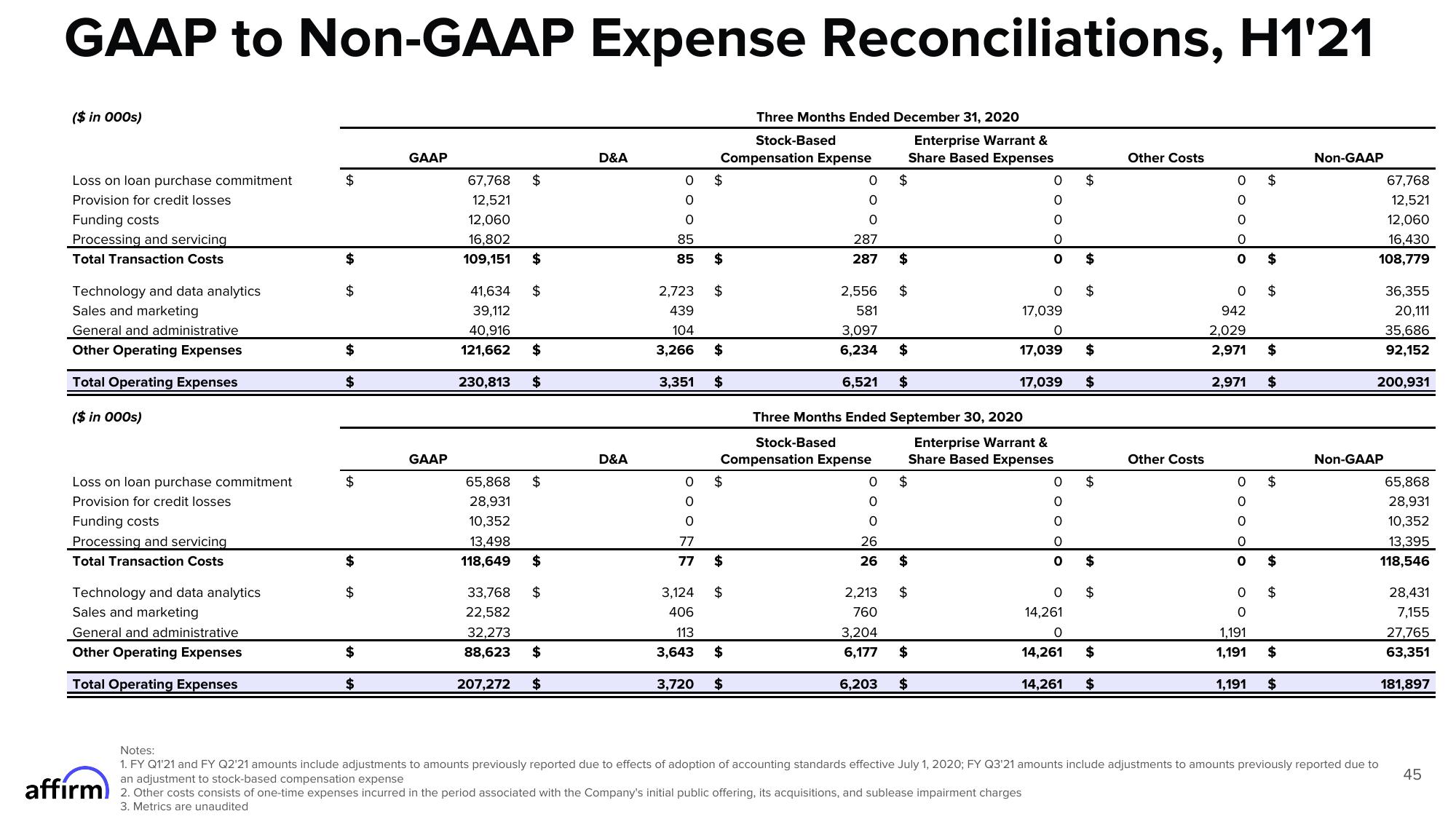

GAAP to Non-GAAP Expense Reconciliations, H1'21

Three Months Ended December 31, 2020

Stock-Based

($ in 000s)

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Other Operating Expenses

Total Operating Expenses

($ in 000s)

Loss on loan purchase commitment

Provision for credit losses

Funding costs

Processing and servicing

Total Transaction Costs

Technology and data analytics

Sales and marketing

General and administrative

Other Operating Expenses

Total Operating Expenses

affirm

$

$

$

$

$

$

$

$

$

$

GAAP

GAAP

67,768 $

12,521

12,060

16,802

109,151

41,634

39,112

40,916

121,662

230,813

$

$

207,272

$

$

65,868 $

28,931

10,352

13,498

118,649

$

33,768 $

22,582

32,273

88,623

$

$

D&A

D&A

O

O

O

85

85

OOONE

77

Compensation Expense

2,723

439

104

3,266

3,351 $

$

$

3,720

$

$

$

77 $

$

3,124

406

113

3,643 $

Compensation Expense

0

O

0

287

287

$

Enterprise Warrant &

Share Based Expenses

$

2,556

581

3,097

6,234

$

6,521 $

$

$

0

0

0

26

26

Three Months Ended September 30, 2020

Stock-Based

0

$

2,213 $

760

3,204

6,177 $

6,203 $

0

0

O

17,039

0

17,039

17,039

Enterprise Warrant &

Share Based Expenses

$

000

lo

$

$

$

$

$

$

$

0 $

14,261

0

14,261

14,261

$

$

Other Costs

Other Costs

0

0

0

0

942

2,029

2,971

olo o o o

0

O

$

$

2,971 $

1,191

$

$

$

$

$

1,191

1,191 $

$

Non-GAAP

67,768

12,521

12,060

16,430

108,779

Non-GAAP

36,355

20,111

200,931

Notes:

1. FY Q1'21 and FY Q2'21 amounts include adjustments to amounts previously reported due to effects of adoption of accounting standards effective July 1, 2020; FY Q3'21 amounts include adjustments to amounts previously reported due to

an adjustment to stock-based compensation expense

2. Other costs consists of one-time expenses incurred in the period associated with the Company's initial public offering, its acquisitions, and sublease impairment charges

3. Metrics are unaudited

35,686

92,152

65,868

28,931

10,352

13,395

118,546

28,431

7,155

27,765

63,351

181,897

45View entire presentation