WeWork Investor Presentation Deck

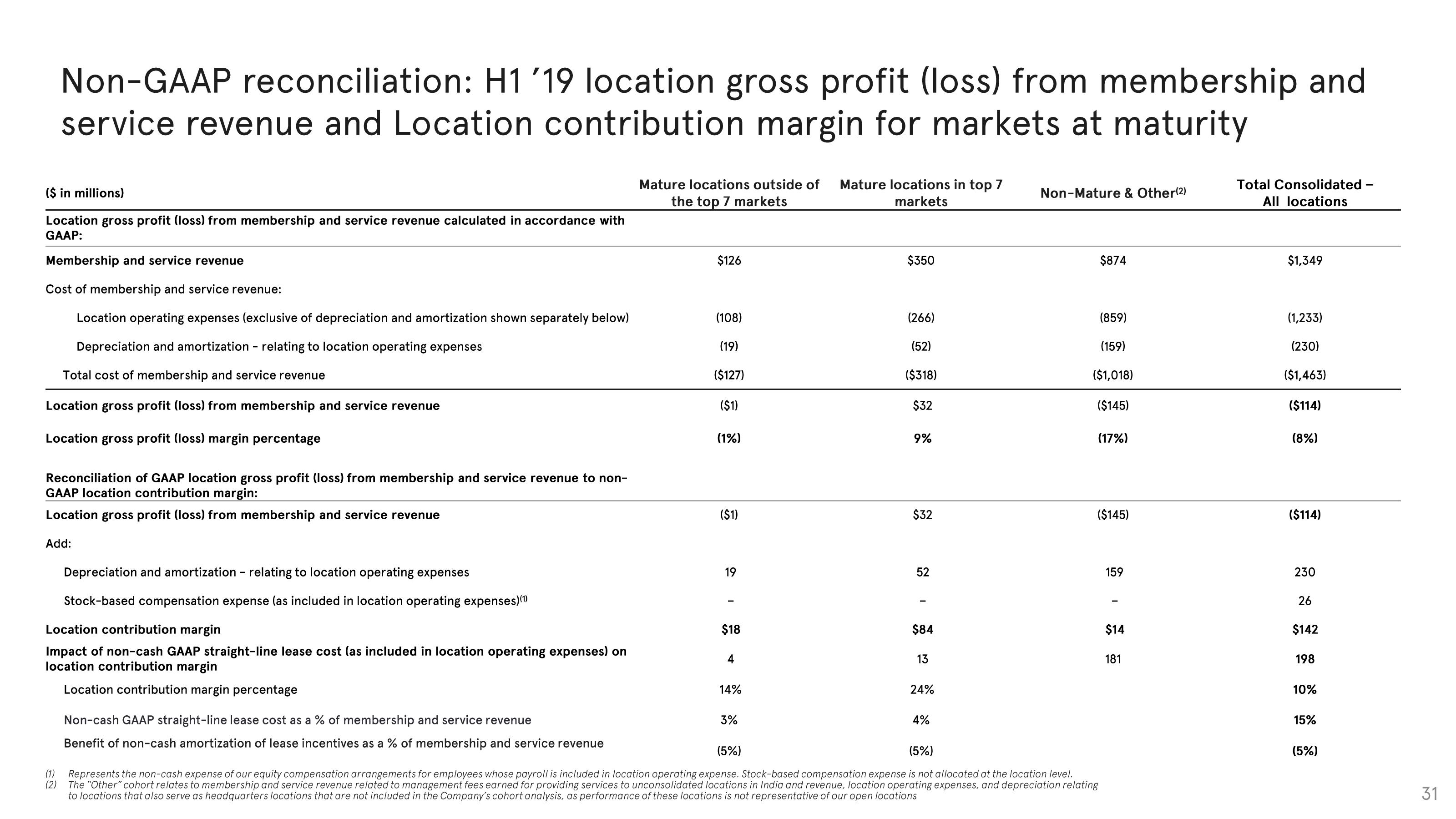

Non-GAAP reconciliation: H1 '19 location gross profit (loss) from membership and

service revenue and Location contribution margin for markets at maturity

($ in millions)

Location gross profit (loss) from membership and service revenue calculated in accordance with

GAAP:

Membership and service revenue

Cost of membership and service revenue:

Location operating expenses (exclusive of depreciation and amortization shown separately below)

Depreciation and amortization - relating to location operating expenses

Total cost of membership and service revenue

Location gross profit (loss) from membership and service revenue

Location gross profit (loss) margin percentage

Reconciliation of GAAP location gross profit (loss) from membership and service revenue to non-

GAAP location contribution margin:

Location gross profit (loss) from membership and service revenue

Add:

Depreciation and amortization - relating to location operating expenses

Stock-based compensation expense (as included in location operating expenses) (1)

Location contribution margin

Impact of non-cash GAAP straight-line lease cost (as included in location operating expenses) on

location contribution margin

Location contribution margin percentage

Mature locations outside of Mature locations in top 7

the top 7 markets

markets

$126

(108)

(19)

($127)

($1)

(1%)

($1)

19

$18

4

14%

$350

3%

(266)

(52)

($318)

$32

9%

$32

52

$84

13

24%

4%

Non-Mature & Other(2)

$874

(859)

(159)

($1,018)

($145)

Non-cash GAAP straight-line lease cost as a % of membership and service revenue

(5%)

(5%)

Benefit of non-cash amortization of lease incentives as a % of membership and service revenue

(1) Represents the non-cash expense of our equity compensation arrangements for employees whose payroll is included in location operating expense. Stock-based compensation expense is not allocated at the location level.

(2) The "Other" cohort relates to membership and service revenue related to management fees earned for providing services to unconsolidated locations in India and revenue, location operating expenses, and depreciation relating

to locations that also serve as headquarters locations that are not included in the Company's cohort analysis, as performance of these locations is not representative of our open locations

(17%)

($145)

159

$14

181

Total Consolidated -

All locations

$1,349

(1,233)

(230)

($1,463)

($114)

(8%)

($114)

230

26

$142

198

10%

15%

(5%)

31View entire presentation