Silicon Valley Bank Results Presentation Deck

Focus Area: Leveraging client liquidity

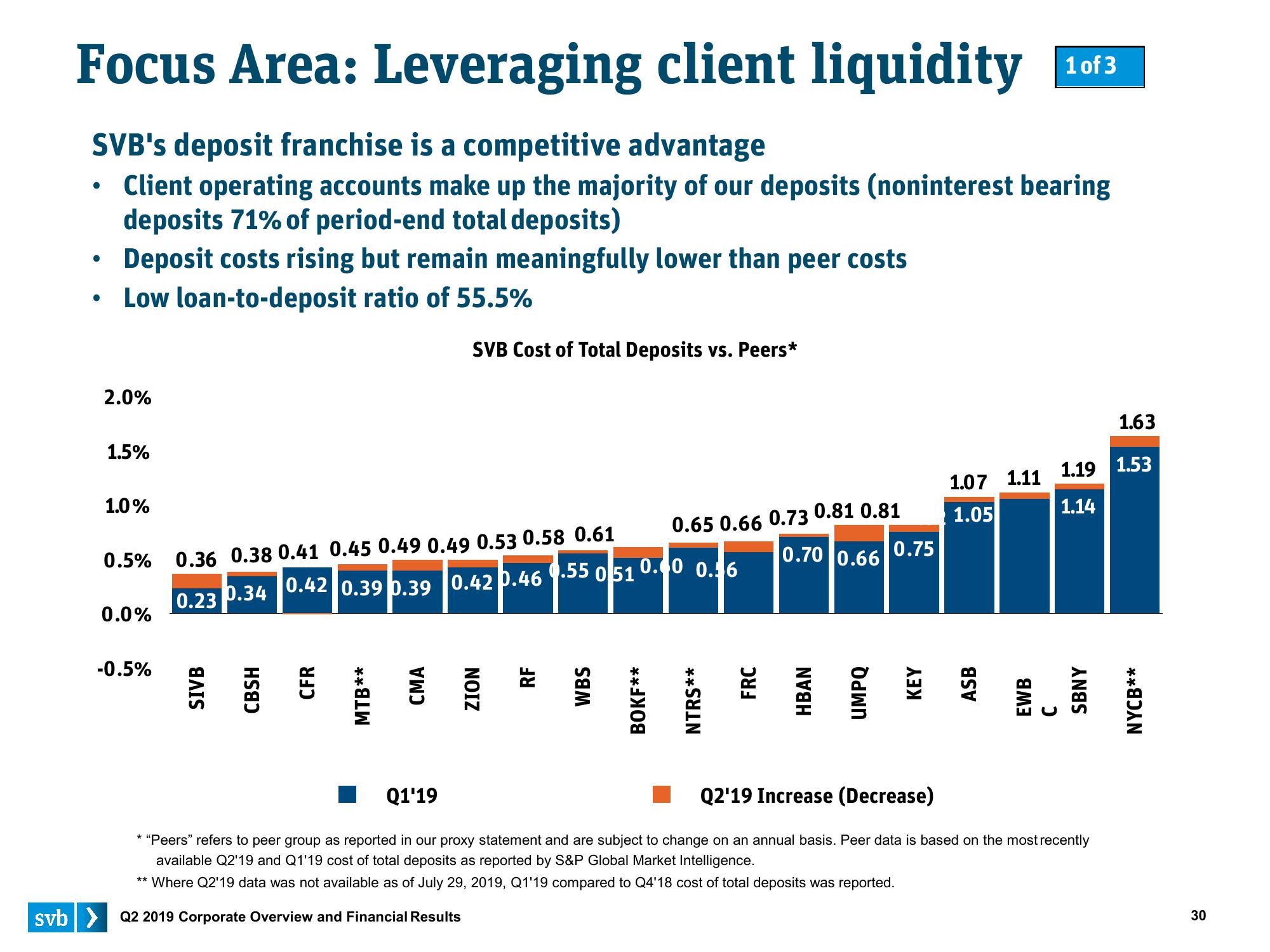

SVB's deposit franchise is a competitive advantage

Client operating accounts make up the majority of our deposits (noninterest bearing

deposits 71% of period-end total deposits)

Deposit costs rising but remain meaningfully lower than peer costs

Low loan-to-deposit ratio of 55.5%

●

●

2.0%

1.5%

1.0%

0.5%

0.0%

-0.5%

**

0.36 0.38 0.41 0.45 0.49 0.49 0.53 0.58 0.61

0.55 051

0.42 0.39 0.39

0.42 0.46

0.23

0.34

SIVB

CBSH

CFR

MTB**

CMA

SVB Cost of Total Deposits vs. Peers*

svb> Q2 2019 Corporate Overview and Financial Results

ZION

RF

WBS

0.65 0.66 0.73 0.81 0.81

0.70 0.66

0.60 0.56

BOKF**

NTRS**

FRC

HBAN

UMPQ

0.75

KEY

1.07 1.11

1.05

ASB

1 of 3

1.63

1.19 1.53

1.14

Q1'19

Q2'19 Increase (Decrease)

* "Peers" refers to peer group as reported in our proxy statement and are subject to change on an annual basis. Peer data is based on the most recently

available Q2'19 and Q1'19 cost of total deposits as reported by S&P Global Market Intelligence.

Where Q2'19 data was not available as of July 29, 2019, Q1'19 compared to Q4'18 cost of total deposits was reported.

EWB

SBNY

C

NYCB**

30View entire presentation