Evercore Investment Banking Pitch Book

Appendix

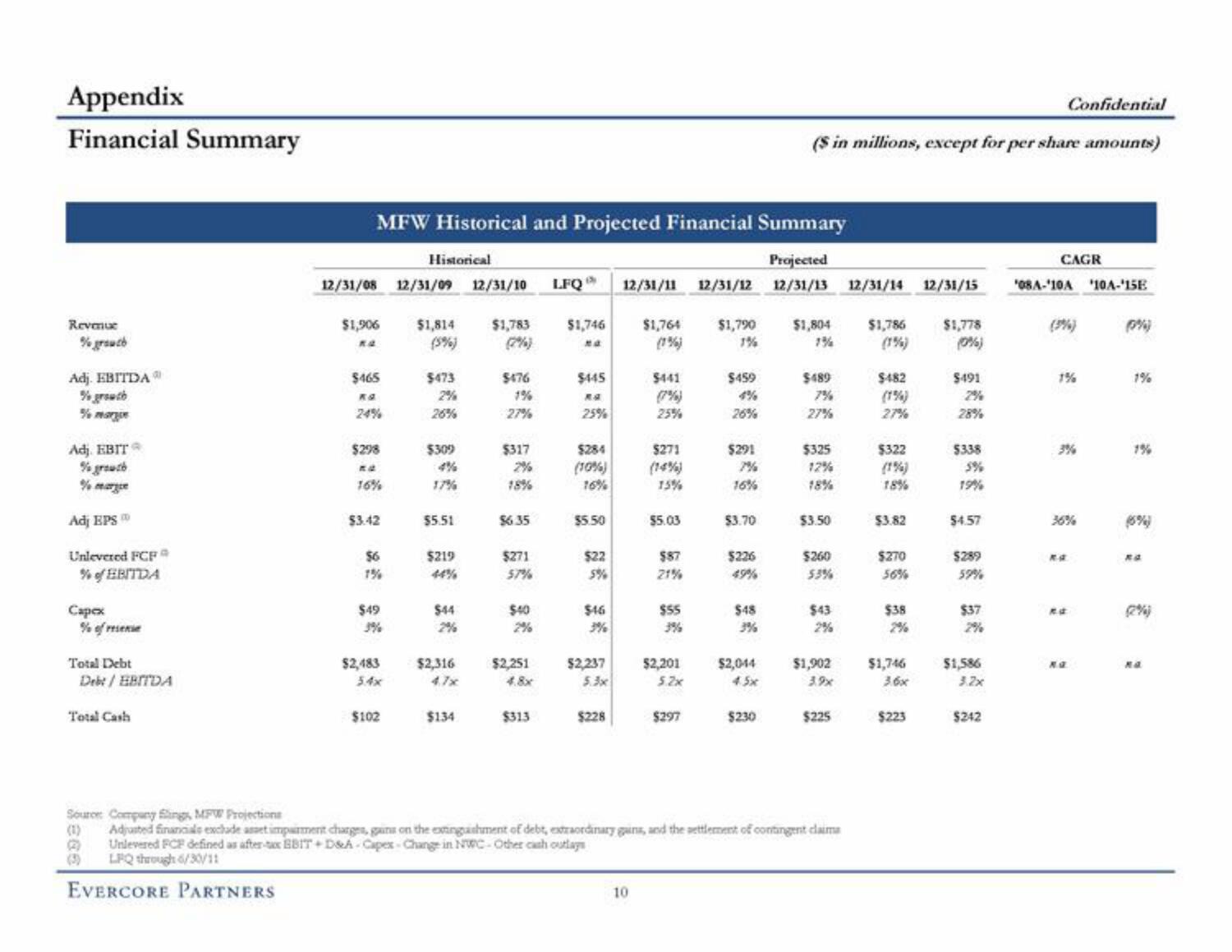

Financial Summary

Revenue

% grauch

Adj. EBITDA

% growch

% margue

Adj. EBITⓇ

% growth

% marge

Adj EPS

Unlevered FCF

% of EBITDA

Capex

% of resense

Total Debt

Debt/EBITDA

Total Cash

MFW Historical and Projected Financial Summary

Projected

LFQ 12/31/11 12/31/12 12/31/13 12/31/14 12/31/15

12/31/08 12/31/09 12/31/10

$1,906

Ka

$465

24%

$298

na

76%

$3.42

$6

1%

$49

3%

$2,483

5.4x

Historical

$102

$1,814 $1,783

(5%)

(2%)

$473

2%

26%

$309

17%

$5.51

$219

$44

$2,316

$134

$476

1%

27%

$317

2%

$6.35

$271

57%

$40

$2,251

4.8x

$313

$1,746

na

$445

R.A.

25%

$284

(10%)

16%

$5.50

$22

5%

$46

3%

$2,237

5.3x

$228

$1,764

(1%)

10

$441

(7%)

25%

$271

(14%)

75%

$5.03

$87

21%

$55

3%

$2,201

5.2x

$297

$1,790

1%

$459

26%

$291

16%

$3.70

$226

49%

$48

$2,044

4.5x

$230

($ in millions, except for per share amounts)

$1,804

$489

7%

27%

$325

12%

18%

$3.50

$260

53%

$43

2%

$1,902

$225

Source Company Slings, MPW Projections

Adjusted financials exclude asset impairment charges, gains on the extinguishment of debt, extraordinary gains, and the settlement of contingent claims

Unlevered FCF defined as after-tax BBIT+D&A Capex-Change in NWC-Other cash outlays

LPQ through 6/30/11

EVERCORE PARTNERS

$1,786

(1%)

$482

27%

$322

(1%)

18%

$3.82

$270

56%

$38

$1,746

3.6x

$223

$1,778

(0%)

$491

2%

28%

$338

5%

19%

$4.57

$289

59%

$37

2%

$1,586

3.2x

$242

Confidential

CAGR

'08A-'10A '10-'15E

(9%)

1%

36%

nd

Ra

(0%)

1%

(6%)

Ra

naView entire presentation