HSBC Results Presentation Deck

Mainland China commercial real estate update

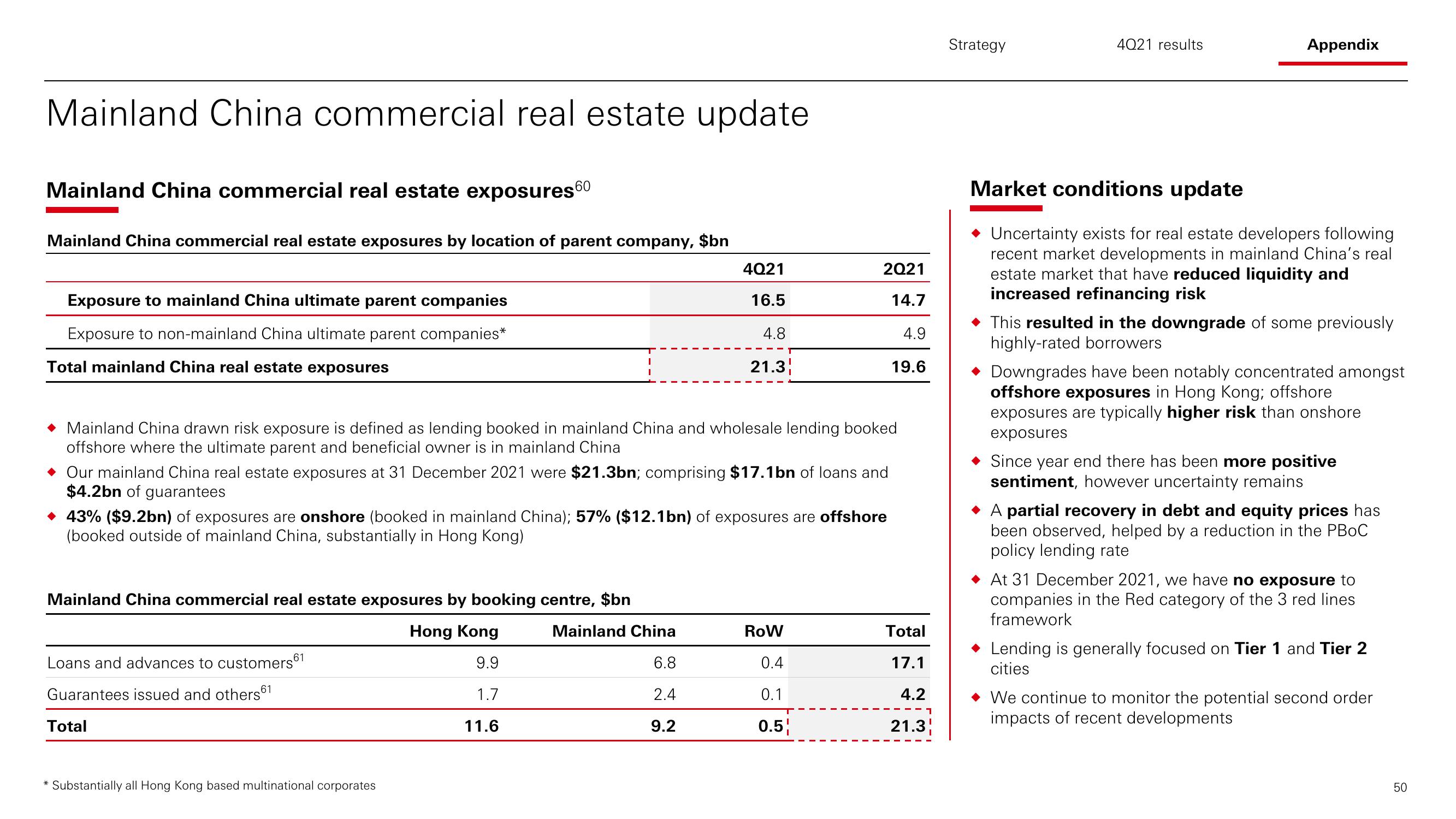

Mainland China commercial real estate exposures 60

Mainland China commercial real estate exposures by location of parent company, $bn

Exposure to mainland China ultimate parent companies

Exposure to non-mainland China ultimate parent companies*

Total mainland China real estate exposures

Mainland China drawn risk exposure is defined as lending booked in mainland China and wholesale lending booked

offshore where the ultimate parent and beneficial owner is in mainland China

Our mainland China real estate exposures at 31 December 2021 were $21.3bn; comprising $17.1bn of loans and

$4.2bn of guarantees

Mainland China commercial real estate exposures by booking centre, $bn

Mainland China

Hong Kong

9.9

1.7

6.8

2.4

11.6

9.2

4Q21

16.5

4.8

21.3

◆ 43% ($9.2bn) of exposures are onshore (booked in mainland China); 57% ($12.1bn) of exposures are offshore

(booked outside of mainland China, substantially in Hong Kong)

Loans and advances to customers61

Guarantees issued and others61

Total

2Q21

14.7

4.9

19.6

* Substantially all Hong Kong based multinational corporates

RoW

0.4

0.1

0.5

Total

17.1

4.2

21.3

Strategy

4021 results

Appendix

Market conditions update

Uncertainty exists for real estate developers following

recent market developments in mainland China's real

estate market that have reduced liquidity and

increased refinancing risk

◆ This resulted in the downgrade of some previously

highly-rated borrowers

Downgrades have been notably concentrated amongst

offshore exposures in Hong Kong; offshore

exposures are typically higher risk than onshore

exposures

◆ Since year end there has been more positive

sentiment, however uncertainty remains

◆ A partial recovery in debt and equity prices has

been observed, helped by a reduction in the PBOC

policy lending rate

◆ At 31 December 2021, we have no exposure to

companies in the Red category of the 3 red lines

framework

Lending is generally focused on Tier 1 and Tier 2

cities

◆ We continue to monitor the potential second order

impacts of recent developments

50View entire presentation