Experian ESG Presentation Deck

Executive Summary

●

Improving Financial Health

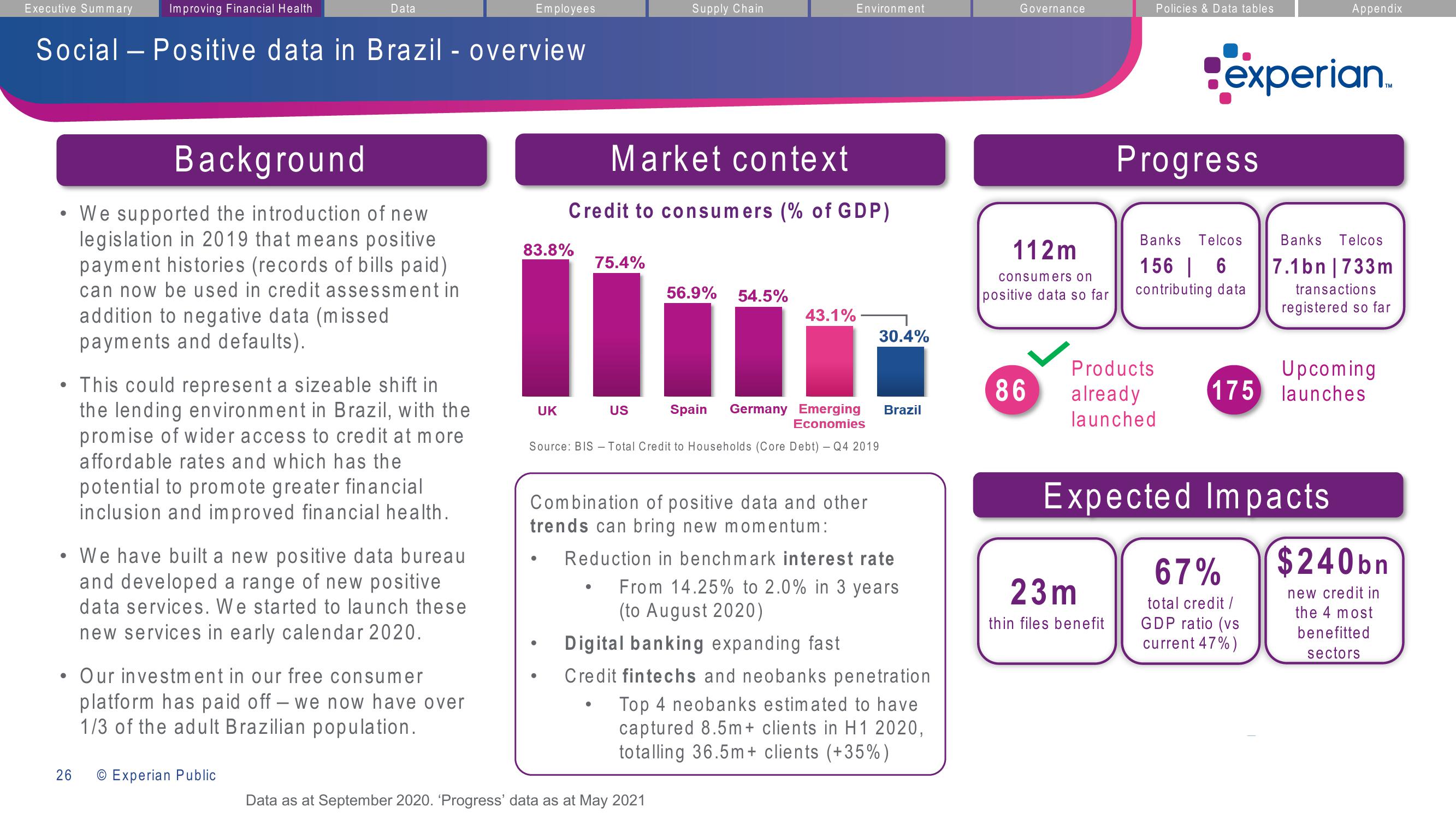

Social - Positive data in Brazil - overview

●

Data

●

• This could represent a sizeable shift in

the lending environment in Brazil, with the

promise of wider access to credit at more

affordable rates and which has the

potential to promote greater financial

inclusion and improved financial health.

26

Background

We supported the introduction of new

legislation in 2019 that means positive

payment histories (records of bills paid)

can now be used in credit assessment in

addition to negative data (missed

payments and defaults).

• We have built a new positive data bureau

and developed a range of new positive

data services. We started to launch these

new services in early calendar 2020.

Our investment in our free consumer

platform has paid off - we now have over

1/3 of the adult Brazilian population.

O Experian Public

Employees

83.8%

UK

●

Market context

Credit to consumers (% of GDP)

75.4%

Supply Chain

US

Germany Emerging

Economies

Source: BIS - Total Credit to Households (Core Debt) - Q4 2019

●

56.9% 54.5%

Spain

Environment

43.1%

Combination of positive data and other

trends can bring new momentum:

Data as at September 2020. 'Progress' data as at May 2021

30.4%

Reduction in benchmark interest rate

From 14.25% to 2.0% in 3 years

(to August 2020)

Brazil

Digital banking expanding fast

Credit fintechs and neobanks penetration

Top 4 neobanks estimated to have

captured 8.5m+ clients in H1 2020,

totalling 36.5m+ clients (+35%)

Governance

112m

consumers on

positive data so far

86

Policies & Data tables

23m

thin files benefit

Progress

Products

already

launched

experian.

Banks Telcos

156 | 6

contributing data

Appendix

Expected Impacts

Banks Telcos

7.1bn | 733m

transactions

registered so far

Upcoming

175 launches

67%

total credit /

GDP ratio (vs

current 47%)

$240bn

new credit in

the 4 most

benefitted

sectorsView entire presentation