Olaplex Investor Presentation Deck

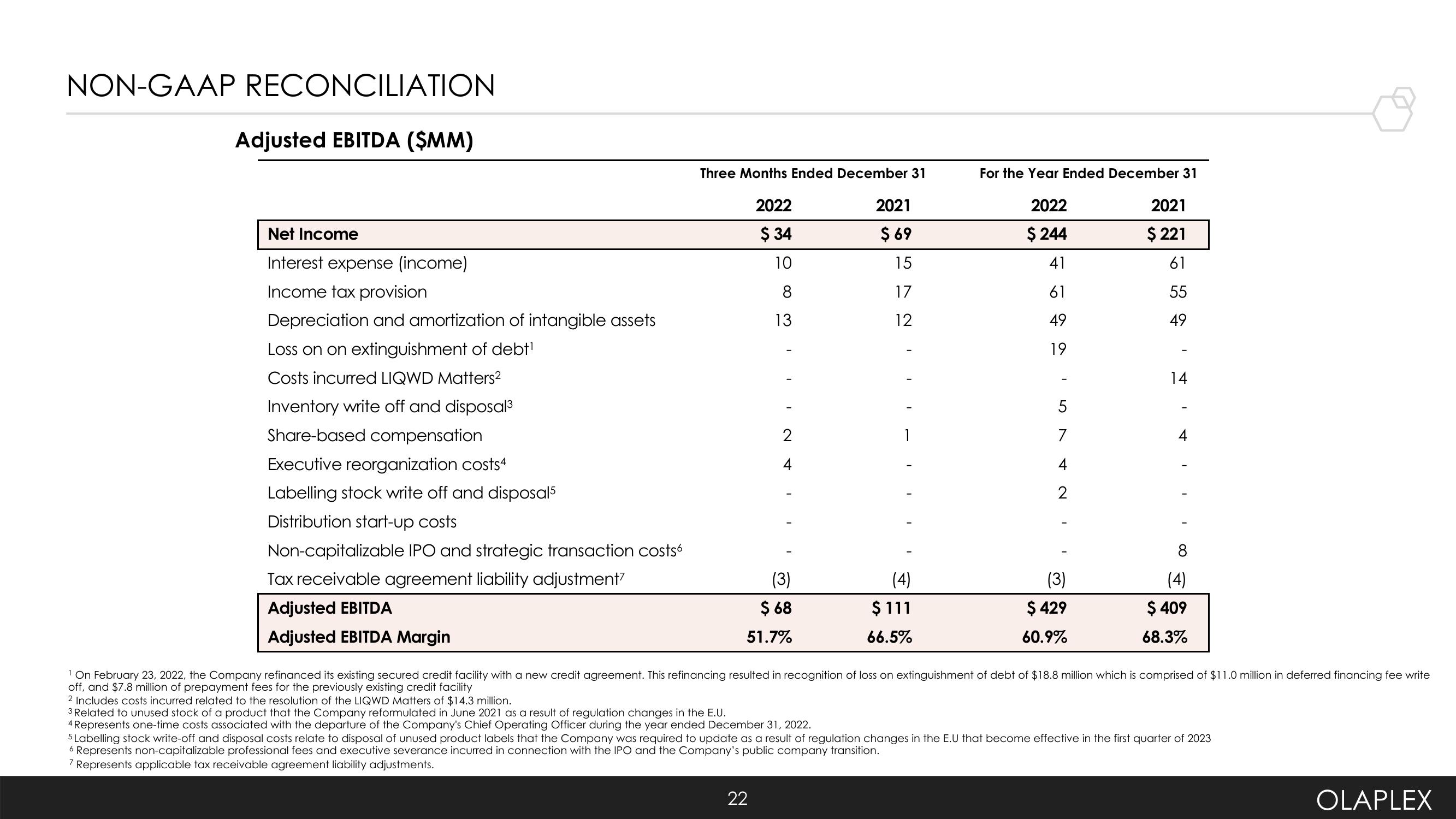

NON-GAAP RECONCILIATION

Adjusted EBITDA ($MM)

Net Income

Interest expense (income)

Income tax provision

Depreciation and amortization of intangible assets

Loss on on extinguishment of debt¹

Costs incurred LIQWD Matters²

Inventory write off and disposal³

Share-based compensation

Executive reorganization costs4

Labelling stock write off and disposal 5

Distribution start-up costs

Non-capitalizable IPO and strategic transaction costs

Tax receivable agreement liability adjustment'

Adjusted EBITDA

Adjusted EBITDA Margin

Three Months Ended December 31

2022

$ 34

10

8

13

INT

2

(3)

$ 68

51.7%

22

2021

$ 69

15

17

12

1

(4)

$111

66.5%

For the Year Ended December 31

2022

$ 244

41

61

49

19

I

5

7

4

2

(3)

$ 429

60.9%

2021

$ 221

61

55

49

14

4

8

(4)

$ 409

68.3%

¹ On February 23, 2022, the Company refinanced its existing secured credit facility with a new credit agreement. This refinancing resulted in recognition of loss on extinguishment of debt of $18.8 million which is comprised of $11.0 million in deferred financing fee write

off, and $7.8 million of prepayment fees for the previously existing credit facility

2 Includes costs incurred related to the resolution of the LIQWD Matters of $14.3 million.

3 Related to unused stock of a product that the Company reformulated in June 2021 as a result of regulation changes in the E.U.

4 Represents one-time costs associated with the departure of the Company's Chief Operating Officer during the year ended December 31, 2022.

5 Labelling stock write-off and disposal costs relate to disposal of unused product labels that the Company was required to update as a result of regulation changes in the E.U that become effective in the first quarter of 2023

6 Represents non-capitalizable professional fees and executive severance incurred in connection with the IPO and the Company's public company transition.

7 Represents applicable tax receivable agreement liability adjustments.

OLAPLEXView entire presentation