Endeavour Mining Results Presentation Deck

NET EARNINGS FROM CONTINUING OPERATIONS

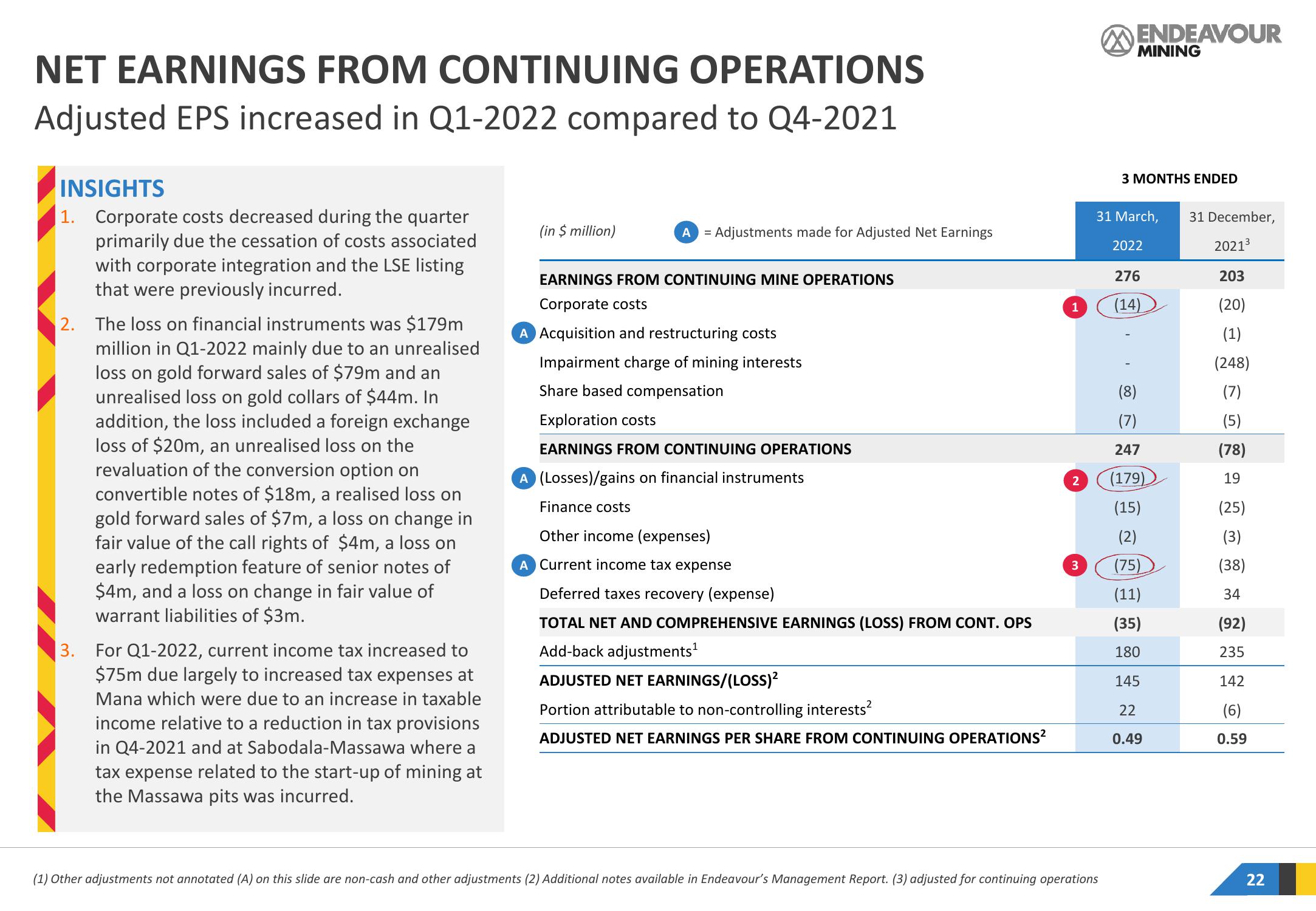

Adjusted EPS increased in Q1-2022 compared to Q4-2021

INSIGHTS

1. Corporate costs decreased during the quarter

primarily due the cessation of costs associated

with corporate integration and the LSE listing

that were previously incurred.

2. The loss on financial instruments was $179m

million in Q1-2022 mainly due to an unrealised

loss on gold forward sales of $79m and an

unrealised loss on gold collars of $44m. In

addition, the loss included a foreign exchange

loss of $20m, an unrealised loss on the

revaluation of the conversion option on

convertible notes of $18m, a realised loss on

gold forward sales of $7m, a loss on change in

fair value of the call rights of $4m, a loss on

early redemption feature of senior notes of

$4m, and a loss on change in fair value of

warrant liabilities of $3m.

3. For Q1-2022, current income tax increased to

$75m due largely to increased tax expenses at

Mana which were due to an increase in taxable

income relative to a reduction in tax provisions

in Q4-2021 and at Sabodala-Massawa where a

tax expense related to the start-up of mining at

the Massawa pits was incurred.

(in $ million)

A = Adjustments made for Adjusted Net Earnings

EARNINGS FROM CONTINUING MINE OPERATIONS

Corporate costs

A Acquisition and restructuring costs

Impairment charge of mining interests

Share based compensation

Exploration costs

EARNINGS FROM CONTINUING OPERATIONS

A (Losses)/gains on financial instruments

Finance costs

Other income (expenses)

A Current income tax expense

Deferred taxes recovery (expense)

TOTAL NET AND COMPREHENSIVE EARNINGS (LOSS) FROM CONT. OPS

Add-back adjustments¹

ADJUSTED NET EARNINGS/(LOSS)²

Portion attributable to non-controlling interests²

ADJUSTED NET EARNINGS PER SHARE FROM CONTINUING OPERATIONS²

1

2

3

ENDEAVOUR

(1) Other adjustments not annotated (A) on this slide are non-cash and other adjustments (2) Additional notes available in Endeavour's Management Report. (3) adjusted for continuing operations

MINING

3 MONTHS ENDED

31 March,

2022

276

(14)

(8)

(7)

247

(179)

(15)

(2)

(75)

(11)

(35)

180

145

22

0.49

31 December,

2021³

203

(20)

(1)

(248)

(7)

(5)

(78)

19

(25)

(3)

(38)

34

(92)

235

142

(6)

0.59

22View entire presentation