Credit Suisse Investment Banking Pitch Book

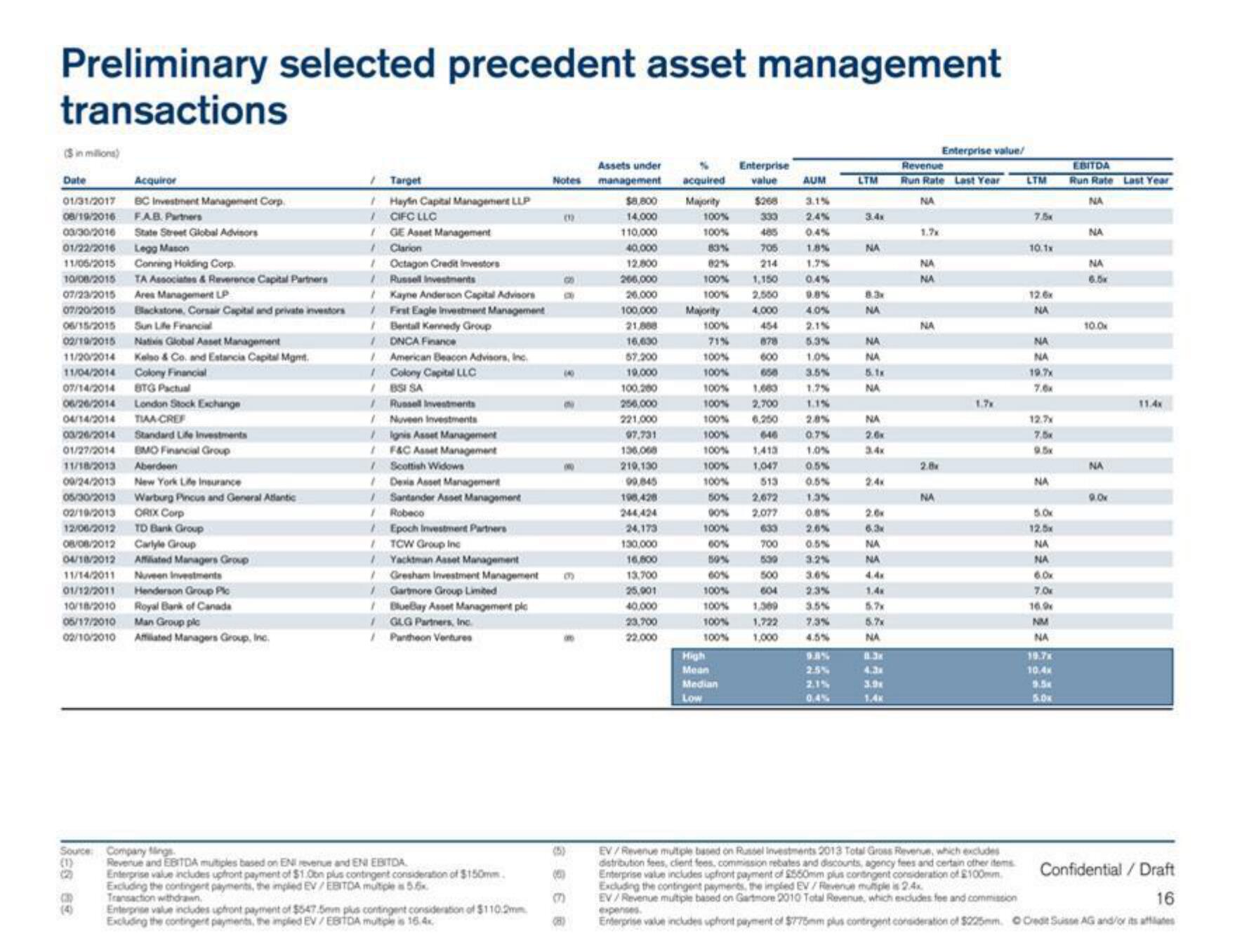

Preliminary selected precedent asset management

transactions

($ in millions)

Date

Acquiror

01/31/2017

BC Investment Management Corp

08/19/2016 FAB Partners

03/30/2016 State Street Global Advisors

01/22/2016 Legg Mason

11/06/2015 Conning Holding Corp.

10/08/2015 TA Associates & Reverence Capital Partners

07/23/2015 Ares Management LP

07/20/2015 Blackstone, Corsair Capital and private investors

06/15/2015

Sun Life Financial

02/19/2015

11/20/2014

11/04/2014 Colony Financial

07/14/2014

BTG Pactual

06/26/2014 London Stock Exchange

04/14/2014 TIAA CREF

03/26/2014

01/27/2014 BMO Financial Group

11/18/2013 Aberdeen

09/24/2013 New York Life Insurance

05/30/2013 Warburg Pincus and General Atlantic

02/10/2013

ORIX Corp

12/06/2012

TD Bank Group

08/08/2012

Carlyle Group

04/10/2012 Affiliated Managers Group

Natixis Global Asset Management

Kelso & Co. and Estancia Capital Mgmt.

05/17/2010

02/10/2010

11/14/2011 Nuveen Investments

01/12/2011

Henderson Group Plc

10/18/2010

Standard Life Investments

89

Royal Bank of Canada

Man Group plc

Affiliated Managers Group, Inc.

Source: Company Mings

(1)

/Target

Haylin Capital Management LLP

1

CIFC LLC

/GE Asset Management

Clarion

Octagon Credit Investors

Russell Investments

Kayne Anderson Capital Advisors

/ First Eagle Investment Management

/Bentall Kennedy Group

DNCA Finance

American Beacon Advisors, Inc.

Colony Capital LLC

1

BSI SA

/Russell Investments

1 Nuveen Investments

Ignis Asset Management

F&C Asset Management

Scottish Widows

Dexia Asset Management

Santander Asset Management

Robeco

/ Epoch Investment Partners

/TCW Group Inc

Yacktman Asset Management

Revenue and EBITDA multiples based on ENI revenue and ENI EBITDA.

Enterprise value includes upfront payment of $1.0bn plus contingent consideration of $150mm.

Excluding the contingent payments, the implied EV / EBITDA multiple is 5.5x

Transaction withdrawn

Assets under

Notes management

/Gresham Investment Management B

/ Garbmore Group Limited

/BlueBay Asset Management plc

GLG Partners, Inc.

Pantheon Ventures

Enterprise value includes upfront payment of $547.5mm plus contingent consideration of $110.2mm

Excluding the contingert payments, the implied EV/EBITDA multiple is 16.4

(4)

8

(5)

B

$8,800 Majority

14,000

110,000

40,000

12,800

200,000

20.000

100,000

21,808

16,630

57.200

19,000

100,200

250,000

221,000

97,731

136,008

219,130

99,845

Enterprise

acquired value AUM

198,428

244,424

24,173

130,000

16,800

13,700

25,901

40,000

23,700

22,000

100%

100%

83%

82%

100%

100%

$268

333

705

214

2,550

Majority 4,000

454

878

600

100%

71%

100%

100%

100%

100% 2,700

100% 0,250

100%

100% 1.415

646

1,047

High

Mean

Median

Low

100%

100%

50%

2,672

90% 2.077

100%

60%

50%

60%

100%

100%

100%

1.7%

1.1%

2.8%

0.7%

1.0%

0.5%

513 0.5%

700

500

604

1.369

1,722

100% 1,000

3.1%

2.4%

0.4%

1.8%

1.7%

0.4%

9.8%

4.0%

2.1%

5.3%

1.0%

3.5%

0.8%

2.0%

0.5%

3.2%

3.6%

2.3%

3.5%

7.3%

4.5%

2.1%

0.4%

LTM

3.4x

NA

8.3x

NA

NA

NA

5.1x

NA

NA

2.6x

3.4x

2.4x

2.0x

6.3

NA

NA

4.4x

1.4x

5.7x

5.7x

NA

4.3x

3.9

1.4x

Revenue

Run Rate Last Year

NA

NA

NA

NA

2.8

Enterprise value/

NA

1.7x

LTM

7.5x

10.1x

12.6x

NA

NA

NA

19.7x

7.6x

12.7x

7.5x

9.5x

NA

5.0x

NA

NA

6.0x

7.0x

16.9x

NM

NA

10.4x

9.5x

5.0x

EBITDA

Run Rate Last Year

NA

NA

NA

6.5

10.0x

NA

9.0x

11.4x

EV/Revenue multple based on Russel Investments 2013 Total Gross Revenue, which excludes

distribution fees, client fees, commission rebates and discounts, agency fees and certain other items

Enterprise value includes upfront payment of £550mm plus contingent consideration of £100mm

Excluding the contingent payments, the implied EV/Revenue mutiple is 2.4x

Confidential / Draft

16

EV/Revenue multiple based on Gartmore 2010 Total Revenue, which excludes fee and commission

expenses.

Enterprise value includes upfront payment of $775mm plus contingent consideration of $225mm. Credit Suisse AG and/or its affiliatesView entire presentation