W3BCLOUD SPAC

Overview of W3BCloud / SLAC Business Combination

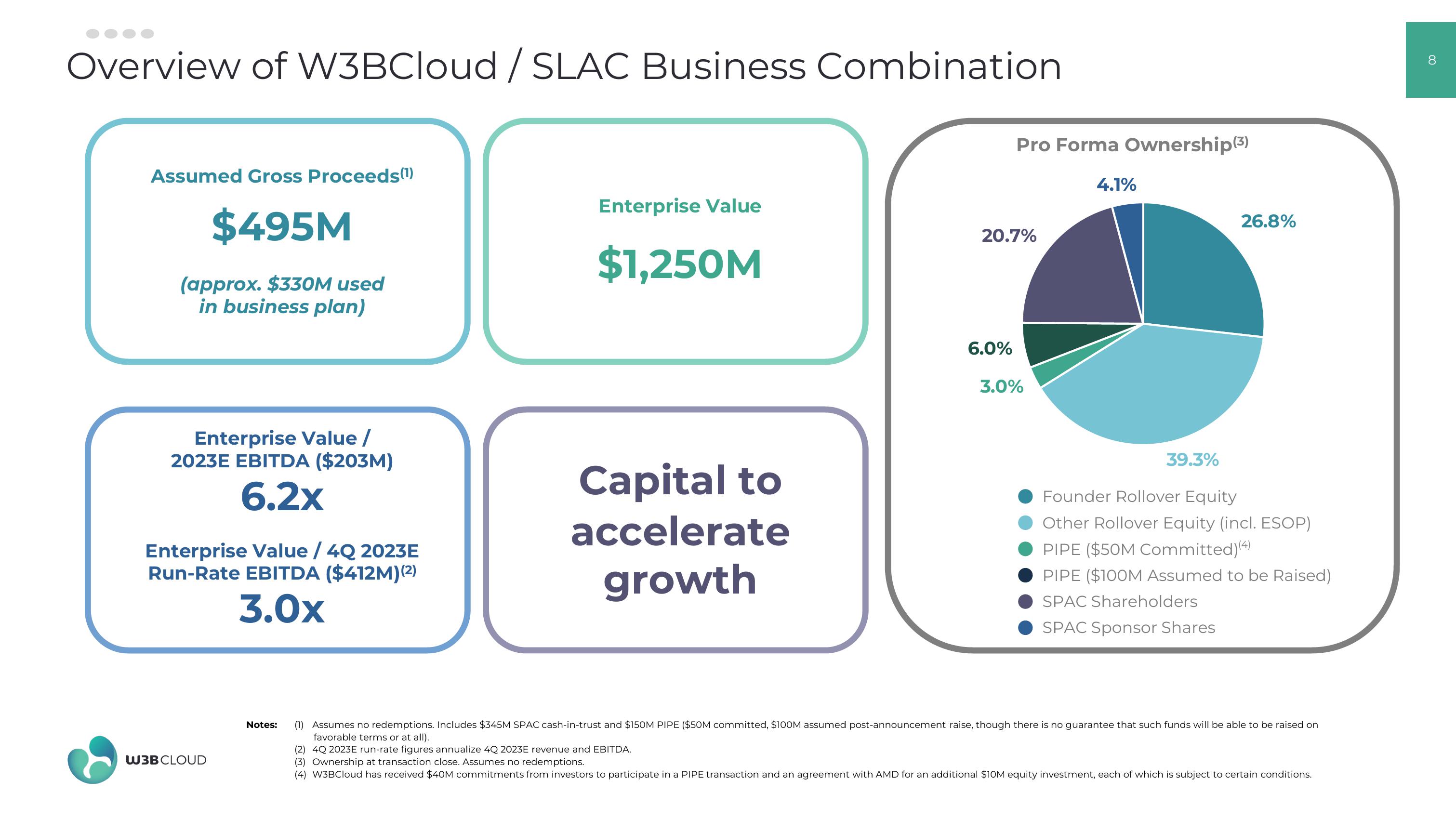

Assumed Gross Proceeds(¹)

$495M

(approx. $330M used

in business plan)

Enterprise Value /

2023E EBITDA ($203M)

6.2x

Enterprise Value / 4Q 2023E

Run-Rate EBITDA ($412M) (2)

3.0x

W3B CLOUD

Notes:

Enterprise Value

$1,250M

Capital to

accelerate

growth

Pro Forma Ownership(³)

20.7%

6.0%

3.0%

4.1%

39.3%

26.8%

Founder Rollover Equity

Other Rollover Equity (incl. ESOP)

PIPE ($50M Committed)(4)

PIPE ($100M Assumed to be Raised)

SPAC Shareholders

SPAC Sponsor Shares

(1) Assumes no redemptions. Includes $345M SPAC cash-in-trust and $150M PIPE ($50M committed, $100M assumed post-announcement raise, though there is no guarantee that such funds will be able to be raised on

favorable terms or at all).

(2) 4Q 2023E run-rate figures annualize 4Q 2023E revenue and EBITDA.

(3) Ownership at transaction close. Assumes no redemptions.

(4) W3BCloud has received $40M commitments from investors to participate in a PIPE transaction and an agreement with AMD for an additional $10M equity investment, each of which is subject to certain conditions.

8View entire presentation