Apollo Global Management Investor Presentation Deck

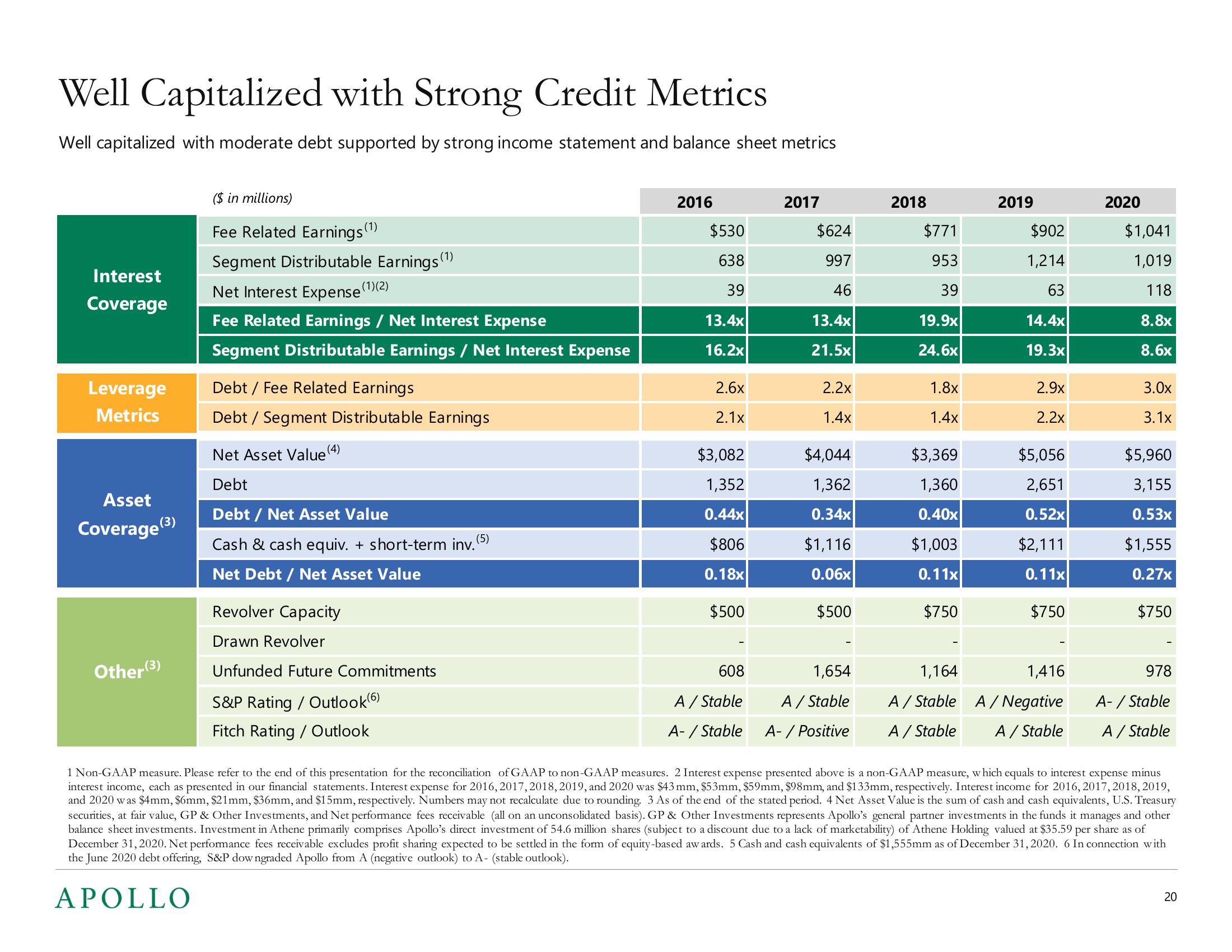

Well Capitalized with Strong Credit Metrics

Well capitalized with moderate debt supported by strong income statement and balance sheet metrics

Interest

Coverage

Leverage

Metrics

Asset

Coverage (3)

Other (3)

($ in millions)

Fee Related Earnings (¹)

Segment Distributable Earnings (¹)

Net Interest Expense

Fee Related Earnings / Net Interest Expense

Segment Distributable Earnings / Net Interest Expense

Debt / Fee Related Earnings

Debt / Segment Distributable Earnings

(4)

(1)(2)

Net Asset Value

Debt

Debt / Net Asset Value

Cash & cash equiv. + short-term inv. (5)

Net Debt / Net Asset Value

Revolver Capacity

Drawn Revolver

Unfunded Future Commitments

S&P Rating / Outlook (6)

Fitch Rating / Outlook

2016

$530

638

39

13.4x

16.2x

2.6x

2.1x

$3,082

1,352

0.44x

$806

0.18x

$500

608

A / Stable

A-/Stable

2017

$624

997

46

13.4x

21.5x

2.2x

1.4x

$4,044

1,362

0.34x

$1,116

0.06x

$500

1,654

A / Stable

A- / Positive

2018

$771

953

39

19.9x

24.6x

1.8x

1.4x

$3,369

1,360

0.40x

$1,003

0.11x

$750

2019

$902

1,214

63

14.4x

19.3x

2.9x

2.2x

$5,056

2,651

0.52x

$2,111

0.11x

$750

1,164

1,416

A/Stable A / Negative

A / Stable

A / Stable

2020

$1,041

1,019

118

8.8x

8.6x

3.0x

3.1x

$5,960

3,155

0.53x

$1,555

0.27x

$750

978

A-/Stable

A / Stable

1 Non-GAAP measure. Please refer to the end of this presentation for the reconciliation of GAAP to non-GAAP measures. 2 Interest expense presented above is a non-GAAP measure, which equals to interest expense minus

interest income, each as presented in our financial statements. Interest expense for 2016, 2017, 2018, 2019, and 2020 was $43 mm, $53mm, $59mm, $98mm, and $133mm, respectively. Interest income for 2016, 2017, 2018, 2019,

and 2020 was $4mm, $6mm, $21mm, $36mm, and $15mm, respectively. Numbers may not recalculate due to rounding. 3 As of the end of the stated period. 4 Net Asset Value is the sum of cash and cash equivalents, U.S. Treasury

securities, at fair value, GP & Other Investments, and Net performance fees receivable (all on an unconsolidated basis). GP & Other Investments represents Apollo's general partner investments in the funds it manages and other

balance sheet investments. Investment in Athene primarily comprises Apollo's direct investment of 54.6 million shares (subject to a discount due to a lack of marketability) of Athene Holding valued at $35.59 per share as of

December 31, 2020. Net performance fees receivable excludes profit sharing expected to be settled in the form of equity-based awards. 5 Cash and cash equivalents of $1,555mm as of December 31, 2020. 6 In connection with

the June 2020 debt offering, S&P downgraded Apollo from A (negative outlook) to A- (stable outlook).

APOLLO

20View entire presentation