AngloAmerican Results Presentation Deck

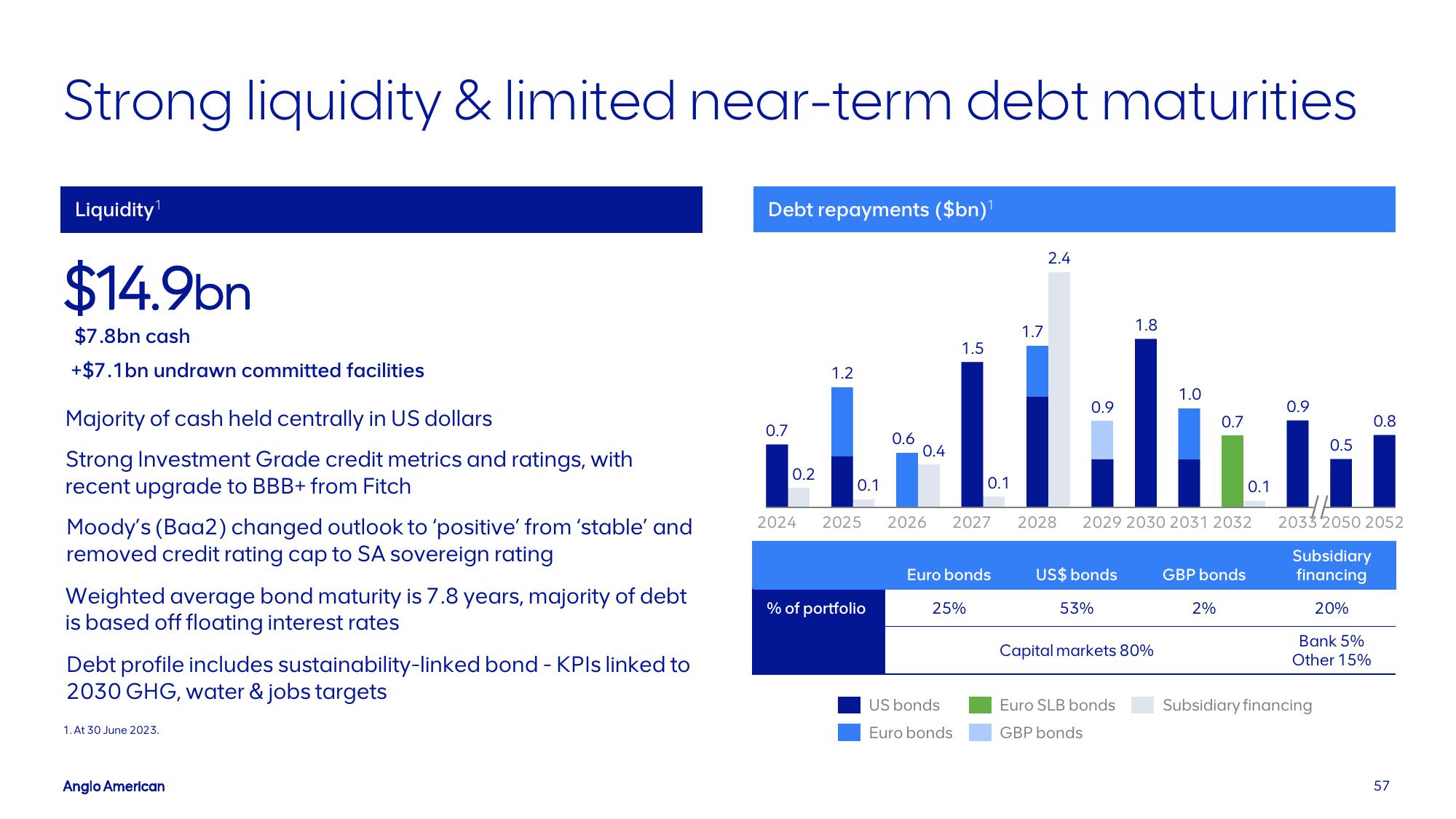

Strong liquidity & limited near-term debt maturities

Liquidity¹

$14.9bn

$7.8bn cash

+$7.1bn undrawn committed facilities

Majority of cash held centrally in US dollars

Strong Investment Grade credit metrics and ratings, with

recent upgrade to BBB+ from Fitch

Moody's (Baa2) changed outlook to 'positive' from 'stable' and

removed credit rating cap to SA sovereign rating

Weighted average bond maturity is 7.8 years, majority of debt

is based off floating interest rates

Debt profile includes sustainability-linked bond - KPIs linked to

2030 GHG, water & jobs targets

1. At 30 June 2023.

Anglo American

Debt repayments ($bn)¹

0.7

0.2

1.2

0.1

2024 2025

% of portfolio

0.6

0.4

1.5

2026 2027

0.1

Euro bonds

25%

US bonds

Euro bonds

1.7

2.4

2028

0.9

US$ bonds

53%

1.8

2029 2030 2031 2032

Capital markets 80%

Euro SLB bonds

GBP bonds

1.0

0.7

GBP bonds

2%

0.1

0.9

0.5

HE

2033 2050 2052

Subsidiary

financing

20%

Bank 5%

Other 15%

Subsidiary financing

0.8

57View entire presentation