Lockheed Martin Projections

Definitions of Non-GAAP Measures

Measures

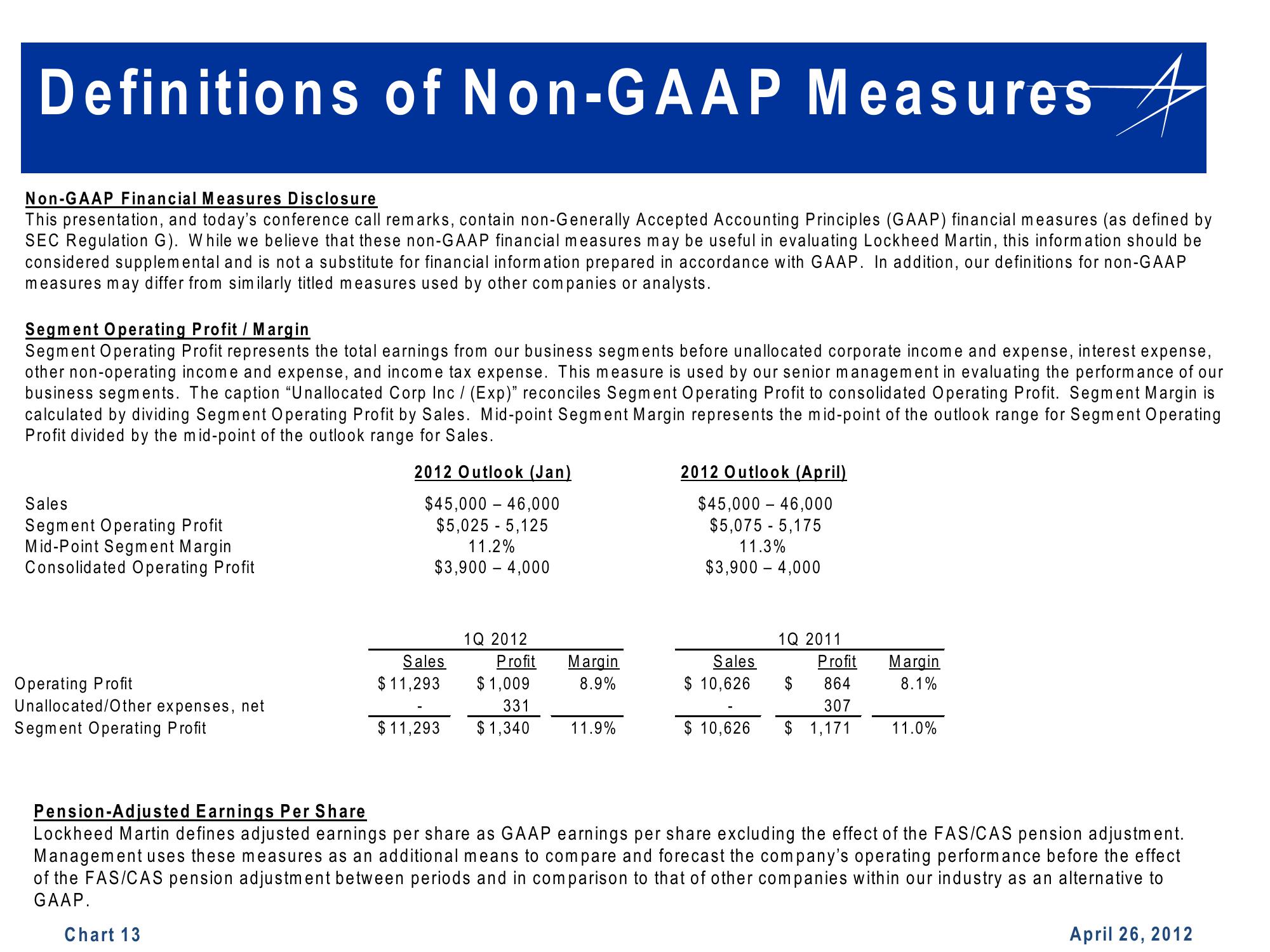

Non-GAAP Financial Measures Disclosure

This presentation, and today's conference call remarks, contain non-Generally Accepted Accounting Principles (GAAP) financial measures (as defined by

SEC Regulation G). While we believe that these non-GAAP financial measures may be useful in evaluating Lockheed Martin, this information should be

considered supplemental and is not a substitute for financial information prepared in accordance with GAAP. In addition, our definitions for non-GAAP

measures may differ from similarly titled measures used by other companies or analysts.

Segment Operating Profit / Margin

Segment Operating Profit represents the total earnings from our business segments before unallocated corporate income and expense, interest expense,

other non-operating income and expense, and income tax expense. This measure is used by our senior management in evaluating the performance of our

business segments. The caption "Unallocated Corp Inc / (Exp)" reconciles Segment Operating Profit to consolidated Operating Profit. Segment Margin is

calculated by dividing Segment Operating Profit by Sales. Mid-point Segment Margin represents the mid-point of the outlook range for Segment Operating

Profit divided by the mid-point of the outlook range for Sales.

2012 Outlook (Jan)

$45,000 46,000

$5,025 - 5,125

11.2%

$3,900 - 4,000

Sales

Segment Operating Profit

Mid-Point Segment Margin

Consolidated Operating Profit

Operating Profit

Unallocated/Other expenses, net

Segment Operating Profit

Sales

$11,293

Chart 13

$11,293

1Q 2012

Profit

$ 1,009

331

$1,340

Margin

8.9%

11.9%

2012 Outlook (April)

$45,000 46,000

$5,075 - 5,175

11.3%

$3,900 - 4,000

Sales

Profit

$ 864

307

$ 10,626 $ 1,171

1Q 2011

$ 10,626

Margin

8.1%

11.0%

Pension-Adjusted Earnings Per Share

Lockheed Martin defines adjusted earnings per share as GAAP earnings per share excluding the effect of the FAS/CAS pension adjustment.

Management uses these measures as an additional means to compare and forecast the company's operating performance before the effect

of the FAS/CAS pension adjustment between periods and in comparison to that of other companies within our industry as an alternative to

GAAP.

April 26, 2012View entire presentation