Ares US Real Estate Opportunity Fund III

Industrial Poised to Outperform

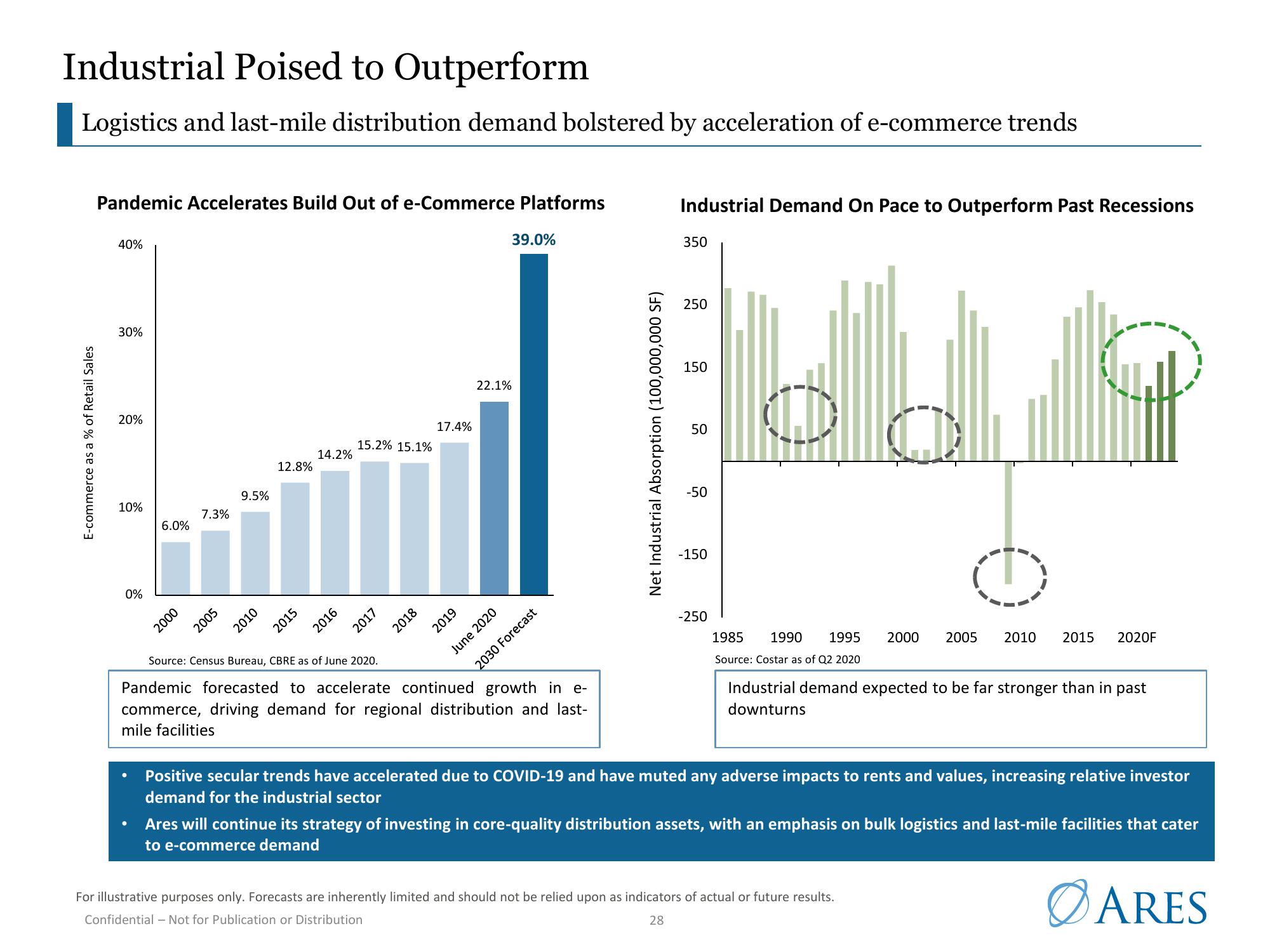

Logistics and last-mile distribution demand bolstered by acceleration of e-commerce trends

E-commerce as a % of Retail Sales

Pandemic Accelerates Build Out of e-Commerce Platforms

40%

30%

20%

10%

0%

6.0%

●

2000

7.3%

2005

9.5%

2010

12.8%

2015

14.2%

2016

15.2% 15.1%

2017

2018

17.4%

2019

22.1%

June 2020

39.0%

Source: Census Bureau, CBRE as of June 2020.

Pandemic forecasted to accelerate continued growth in e-

commerce, driving demand for regional distribution and last-

mile facilities

2030 Forecast

Net Industrial Absorption (100,000,000 SF)

Industrial Demand On Pace to Outperform Past Recessions

350

250

150

50

-50

-150

-250

1985 1990 1995

Source: Costar as of Q2 2020

2000 2005

2010

G

For illustrative purposes only. Forecasts are inherently limited and should not be relied upon as indicators of actual or future results.

Confidential - Not for Publication or Distribution

28

2015 2020F

Industrial demand expected to be far stronger than in past

downturns

Positive secular trends have accelerated due to COVID-19 and have muted any adverse impacts to rents and values, increasing relative investor

demand for the industrial sector

Ares will continue its strategy of investing in core-quality distribution assets, with an emphasis on bulk logistics and last-mile facilities that cater

to e-commerce demand

ARESView entire presentation