Kin SPAC Presentation Deck

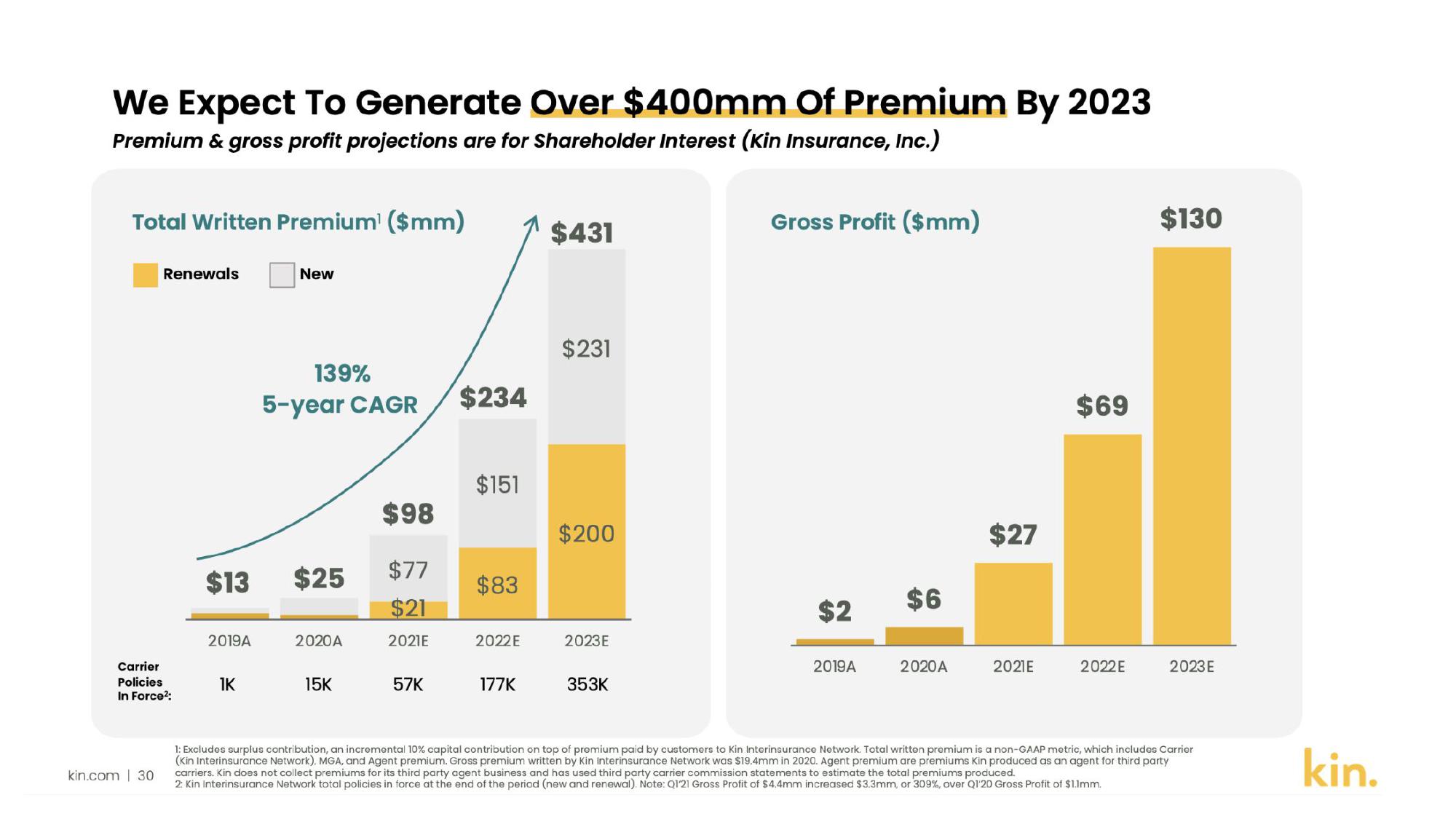

We Expect To Generate Over $400mm Of Premium By 2023

Premium & gross profit projections are for Shareholder Interest (Kin Insurance, Inc.)

Total Written Premium¹ ($mm)

Renewals

Carrier

Policies

In Force²:

kin.com | 30

$13

2019A

1K

New

139%

5-year CAGR $234

$98

$25 $77

$21

2021E

2020A

15K

57K

$151

$83

2022E

177K

$431

$231

$200

2023E

353K

Gross Profit ($mm)

$2 $6

2019A

2020A

$27

2021E

$69

2022E

$130

2023E

1: Excludes surplus contribution, an incremental 10% capital contribution on top of premium paid by customers to Kin Interinsurance Network. Total written premium is a non-GAAP metric, which includes Carrier

(Kin Interinsurance Network), MGA, and Agent premium. Gross premium written by Kin Interinsurance Network was $19.4mm in 2020. Agent premium are premiums Kin produced as an agent for third party

carriers. Kin does not collect premiums for its third party agent business and has used third party carrier commission statements to estimate the total premiums produced.

2: Kin Interinsurance Network total policies in force at the end of the period (new and renewal). Note: Q1'21 Gross Profit of $4.4mm increased $3.3mm, or 309%, over Q1'20 Gross Profit of $1.1mm.

kin.View entire presentation