Apollo Global Management Investor Presentation Deck

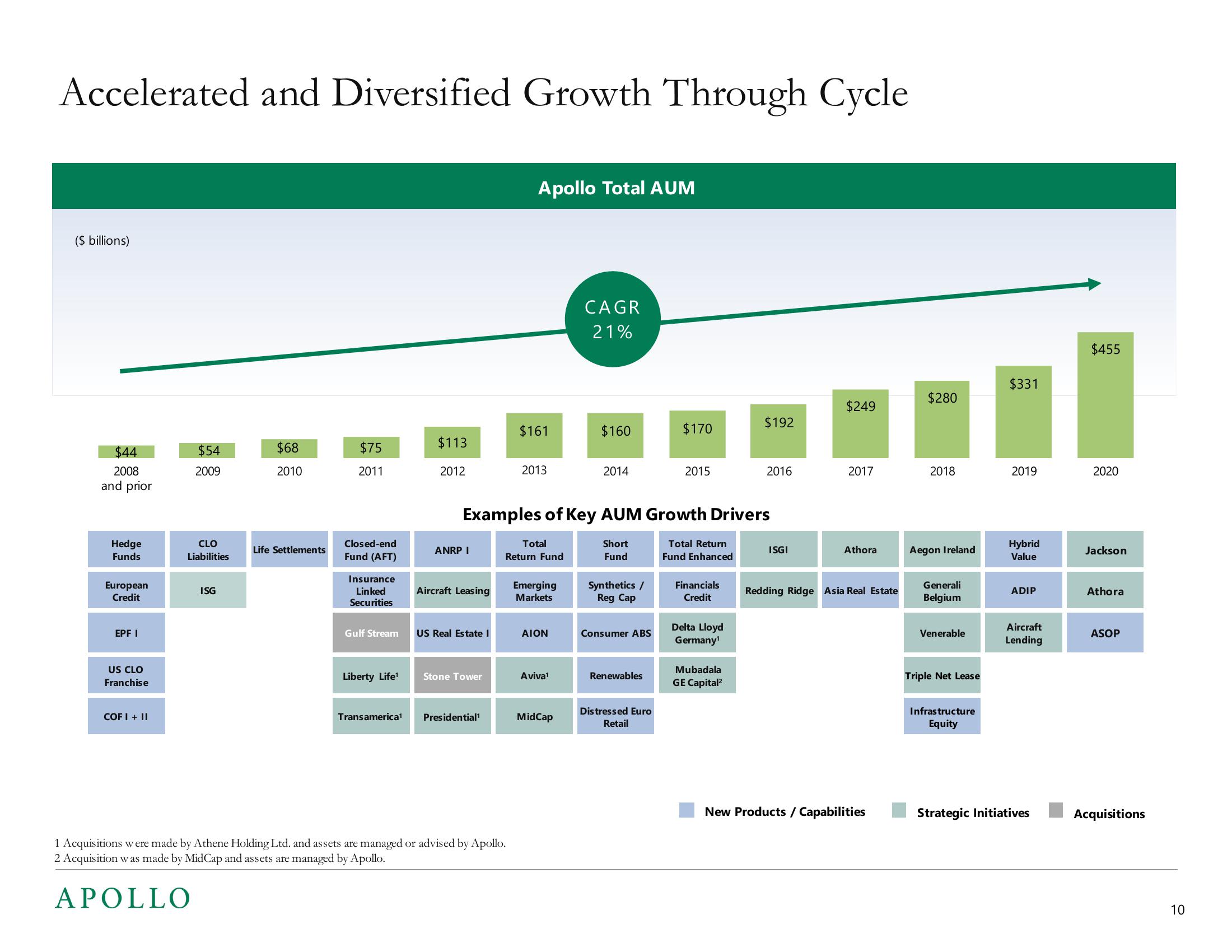

Accelerated and Diversified Growth Through Cycle

($ billions)

$44

2008

and prior

Hedge

Funds

European

Credit

EPF I

US CLO

Franchise

COF I + II

$54

2009

APOLLO

CLO

Liabilities

ISG

$68

2010

Life Settlements

$75

2011

Closed-end

Fund (AFT)

Insurance

Linked

Securities

Gulf Stream

Liberty Life¹

$113

2012

ANRP I

Aircraft Leasing

US Real Estate I

Stone Tower

Transamerica1¹ Presidential¹

Apollo Total AUM

1 Acquisitions were made by Athene Holding Ltd. and assets are managed or advised by Apollo.

2 Acquisition was made by MidCap and assets are managed by Apollo.

$161

2013

Total

Return Fund

Examples of Key AUM Growth Drivers

Short

Fund

Total Return

Fund Enhanced

Emerging

Markets

AION

Aviva¹

CAGR

21%

MidCap

$160

2014

Synthetics /

Reg Cap

Consumer ABS

Renewables

$170

Distressed Euro

Retail

2015

Financials

Credit

Delta Lloyd

Germany¹

$192

Mubadala

GE Capital²

2016

ISGI

$249

2017

Athora

Redding Ridge Asia Real Estate

New Products / Capabilities

$280

2018

Aegon Ireland

Generali

Belgium

Venerable

Triple Net Lease

Infrastructure

Equity

$331

2019

Hybrid

Value

ADIP

Aircraft

Lending

Strategic Initiatives

$455

2020

Jackson

Athora

ASOP

Acquisitions

10View entire presentation