Zegna Investor Day Presentation Deck

2022 GUIDANCE

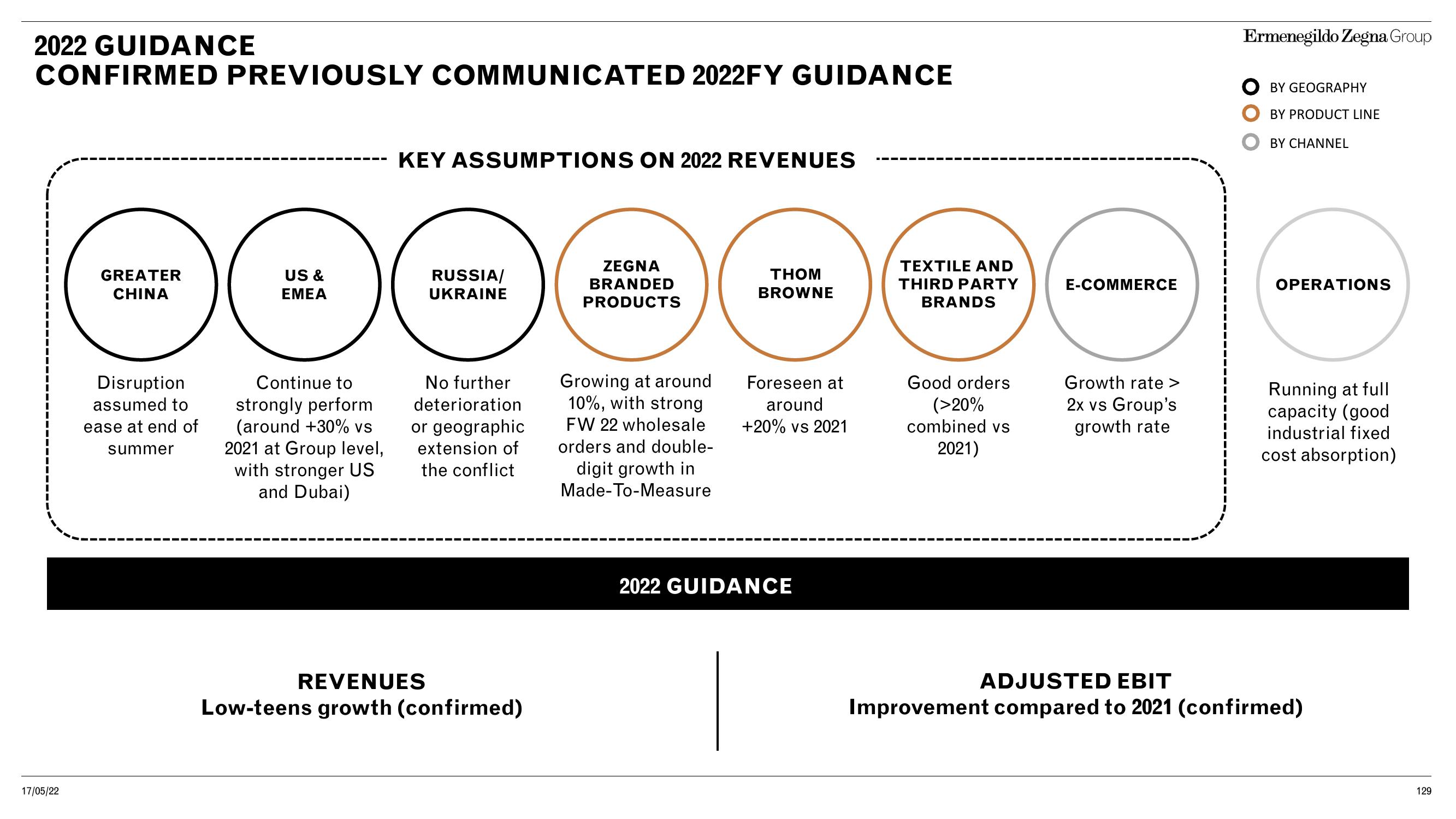

CONFIRMED PREVIOUSLY COMMUNICATED 2022FY GUIDANCE

17/05/22

GREATER

CHINA

Disruption

assumed to

ease at end of

summer

:)

US &

EMEA

Continue to

strongly perform

(around +30% vs

2021 at Group level,

with stronger US

and Dubai)

KEY ASSUMPTIONS ON 2022 REVENUES

RUSSIA/

UKRAINE

No further

deterioration

or geographic

extension of

the conflict

REVENUES

Low-teens growth (confirmed)

ZEGNA

BRANDED

PRODUCTS

Growing at around

10%, with strong

FW 22 wholesale

orders and double-

digit growth in

Made-To-Measure

THOM

BROWNE

Foreseen at

around

+20% vs 2021

2022 GUIDANCE

TEXTILE AND

THIRD PARTY

BRANDS

Good orders

(>20%

combined vs

2021)

E-COMMERCE

Growth rate >

2x vs Group's

growth rate

Ermenegildo Zegna Group

BY GEOGRAPHY

BY PRODUCT LINE

BY CHANNEL

OPERATIONS

Running at full

capacity (good

industrial fixed

cost absorption)

ADJUSTED EBIT

Improvement compared to 2021 (confirmed)

129View entire presentation