JD Sports Results Presentation Deck

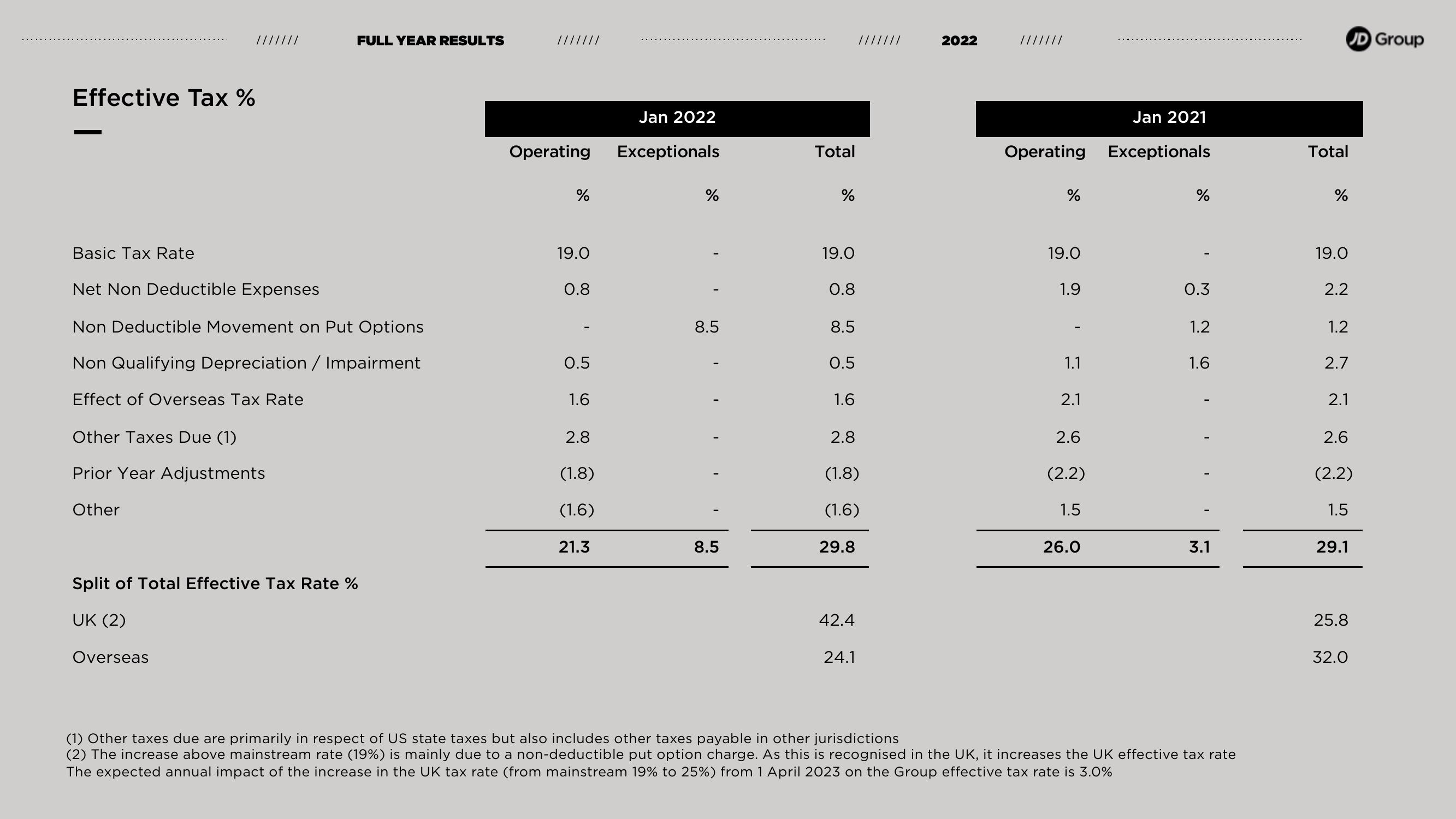

Effective Tax %

Basic Tax Rate

Net Non Deductible Expenses

Non Deductible Movement on Put Options

Non Qualifying Depreciation / Impairment

Effect of Overseas Tax Rate

Other Taxes Due (1)

Prior Year Adjustments

Other

FULL YEAR RESULTS

Split of Total Effective Tax Rate %

UK (2)

Overseas

Operating

%

19.0

0.8

0.5

1.6

2.8

(1.8)

(1.6)

21.3

Jan 2022

Exceptionals

%

8.5

I

I

8.5

Total

%

19.0

0.8

8.5

0.5

1.6

2.8

(1.8)

(1.6)

29.8

42.4

///////

24.1

2022

///////

Jan 2021

Operating Exceptionals

%

19.0

1.9

1.1

2.1

2.6

(2.2)

1.5

26.0

%

0.3

1.2

1.6

3.1

(1) Other taxes due are primarily in respect of US state taxes but also includes other taxes payable in other jurisdictions

(2) The increase above mainstream rate (19%) is mainly due to a non-deductible put option charge. As this is recognised in the UK, it increases the UK effective tax rate

The expected annual impact of the increase in the UK tax rate (from mainstream 19% to 25%) from 1 April 2023 on the Group effective tax rate is 3.0%

JD Group

Total

%

19.0

2.2

1.2

2.7

2.1

2.6

(2.2)

1.5

29.1

25.8

32.0View entire presentation