NVIDIA Investor Presentation Deck

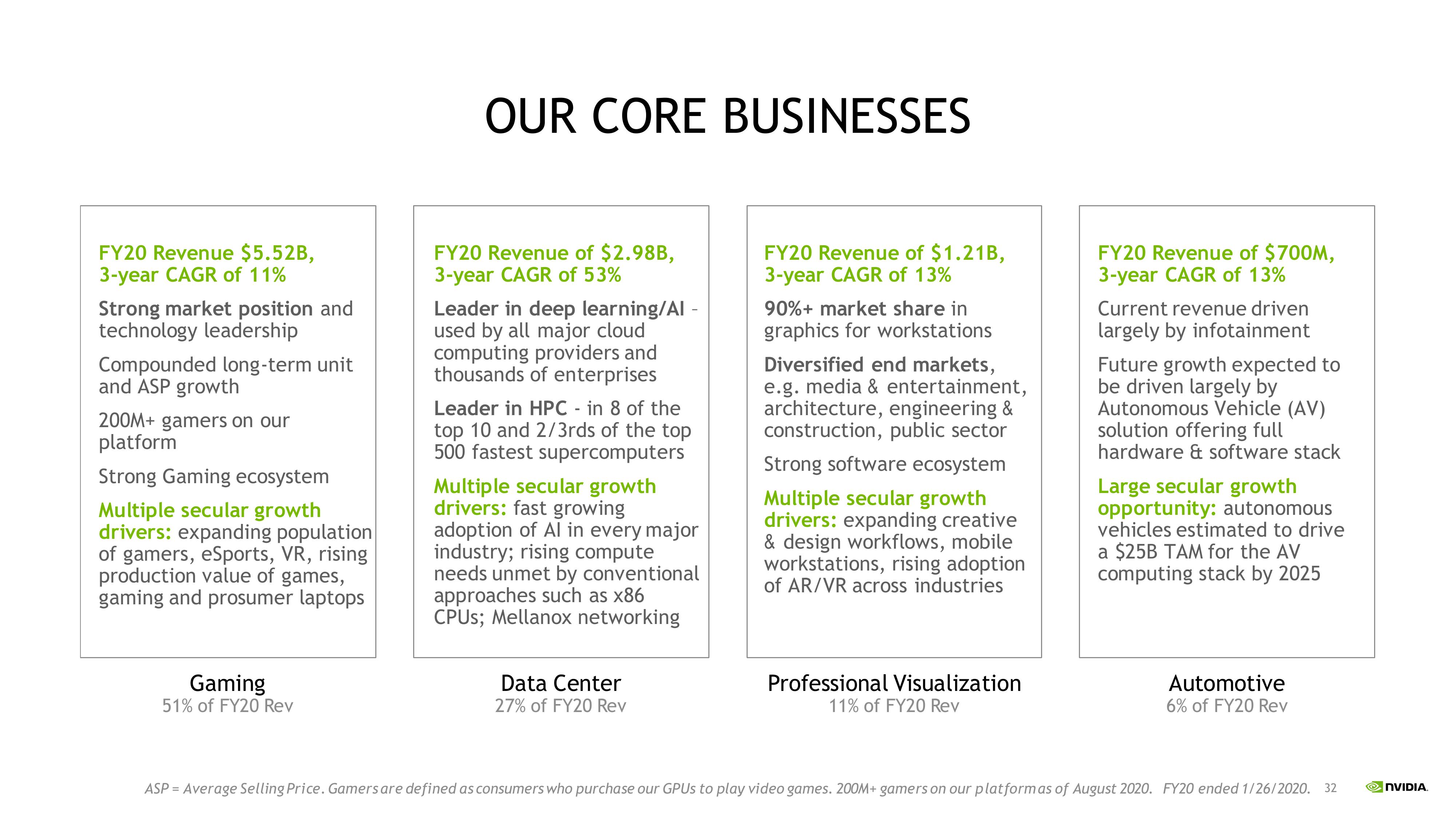

FY20 Revenue $5.52B,

3-year CAGR of 11%

Strong market position and

technology leadership

Compounded long-term unit

and ASP growth

200M+ gamers on our

platform

Strong Gaming ecosystem

Multiple secular growth

drivers: expanding population

of gamers, eSports, VR, rising

production value of games,

gaming and prosumer laptops

Gaming

51% of FY20 Rev

OUR CORE BUSINESSES

FY20 Revenue of $2.98B,

3-year CAGR of 53%

Leader in deep learning/Al -

used by all major cloud

computing providers and

thousands of enterprises

Leader in HPC - in 8 of the

top 10 and 2/3rds of the top

500 fastest supercomputers

Multiple secular growth

drivers: fast growing

adoption of Al in every major

industry; rising compute

needs unmet by conventional

approaches such as x86

CPUs; Mellanox networking

Data Center

27% of FY20 Rev

FY20 Revenue of $1.21B,

3-year CAGR of 13%

90%+ market share in

graphics for workstations

Diversified end markets,

e.g. media & entertainment,

architecture, engineering &

construction, public sector

Strong software ecosystem

Multiple secular growth

drivers: expanding creative

& design workflows, mobile

workstations, rising adoption

of AR/VR across industries

Professional Visualization

11% of FY20 Rev

FY20 Revenue of $700M,

3-year CAGR of 13%

Current revenue driven

largely by infotainment

Future growth expected to

be driven largely by

Autonomous Vehicle (AV)

solution offering full

hardware & software stack

Large secular growth

opportunity: autonomous

vehicles estimated to drive

a $25B TAM for the AV

computing stack by 2025

Automotive

6% of FY20 Rev

ASP Average Selling Price. Gamers are defined as consumers who purchase our GPUs to play video games. 200M+ gamers on our platform as of August 2020. FY20 ended 1/26/2020. 32

NVIDIAView entire presentation