J.P.Morgan Investment Banking Pitch Book

APPENDIX

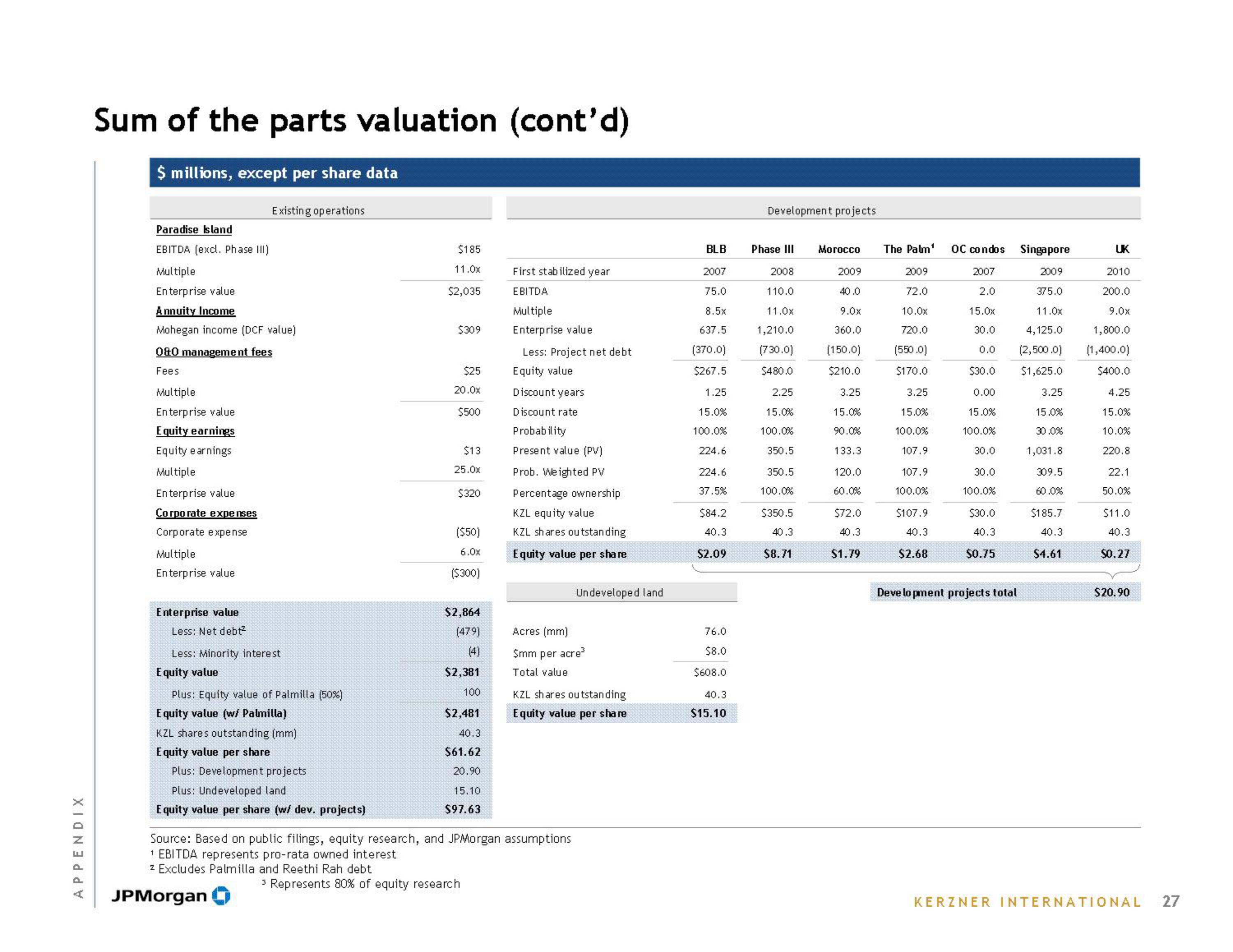

Sum of the parts valuation (cont'd)

$ millions, except per share data

Paradise Island

EBITDA (excl. Phase III)

Multiple

Enterprise value

Annuity Income

Mohegan income (DCF value)

080 management fees

Fees

Multiple

Enterprise value

Equity earnings

Equity earnings

Multiple

Enterprise value

Corporate expenses

Corporate expense

Multiple

Enterprise value

Existing operations

Enterprise value

Less: Net debt²

Less: Minority interest

Equity value

Plus: Equity value of Palmilla (50%)

Equity value (w/ Palmilla)

KZL shares outstanding (mm)

Equity value per share

Plus: Development projects

Plus: Undeveloped land

Equity value per share (w/ dev. projects)

JPMorgan

$185

11.0x

$2,035

$309

$25

20.0x

$500

$13

25.0x

$320

($50)

6.0x

($300)

$2,864

(479)

(4)

$2,381

100

$2,481

40.3

$61.62

20.90

15.10

$97.63

First stabilized year

EBITDA

Multiple

Enterprise value

3 Represents 80% of equity research

Less: Project net debt

Equity value

Discount years

Discount rate

Probability

Present value (PV)

Prob. Weighted PV

Percentage ownership

KZL equity value

KZL shares outstanding

Equity value per share

Source: Based on public filings, equity research, and JPMorgan assumptions

¹ EBITDA represents pro-rata owned interest

2 Excludes Palmilla and Reethi Rah debt

Undeveloped land

Acres (mm)

$mm per acre

Total value

KZL shares outstanding

Equity value per share

BLB

2007

75.0

8.5x

637.5

(370.0)

$267.5

1.25

15.0%

100.0%

224.6

224.6

37.5%

$84.2

40.3

$2.09

76.0

$8.0

$608.0

40.3

$15.10

Development projects

Phase III

2008

110.0

11.0x

1,210.0

(730.0)

$480.0

2.25

15.0%

100.0%

350.5

350.5

100.0%

$350.5

40.3

$8.71

Morocco

2009

40.0

9.0x

360.0

(150.0)

$210.0

3.25

15.0%

90.0%

133.3

120.0

60.0%

$72.0

40.3

$1.79

The Palm¹

2009

72.0

10.0x

720.0

(550.0)

$170.0

3.25

15.0%

100.0%

107.9

107.9

100.0%

$107.9

40.3

$2.68

OC condos Singapore

2007

2009

2.0

375.0

15.0x

11.0x

30.0

4,125.0

0.0 (2,500.0)

$30.0 $1,625.0

0.00

3.25

15.0%

15.0%

100.0%

30.0%

30.0 1,031.8

30.0

100.0%

$30.0

40.3

309.5

60.0%

$0.75

Development projects total

$185.7

40.3

$4.61

UK

2010

200.0

9.0x

1,800.0

(1,400.0)

$400.0

4.25

15.0%

10.0%

220.8

22.1

50.0%

$11.0

40.3

$0.27

$20.90

KERZNER INTERNATIONAL

27View entire presentation