HBT Financial Results Presentation Deck

2... provides funding for loan growth opportunities

Leading Deposit Market Position

Top 2 deposit share rank in 6 of 7 largest Central Illinois markets in

which the Company operates¹

Deposit base is long tenured and granular across a variety of

product types dispersed across our geography

Proactive campaign to reach out to top 250 largest deposit

customers has been run to solidify these relationships

■ Detailed deposit pricing guidance is available to all consumer and

commercial staff to assist in pricing discussions with customers

As of 12/31/23

Noninterest-

bearing

Interest-bearing

demand

Money market

Savings

Time

Total deposits

HBT

Financial

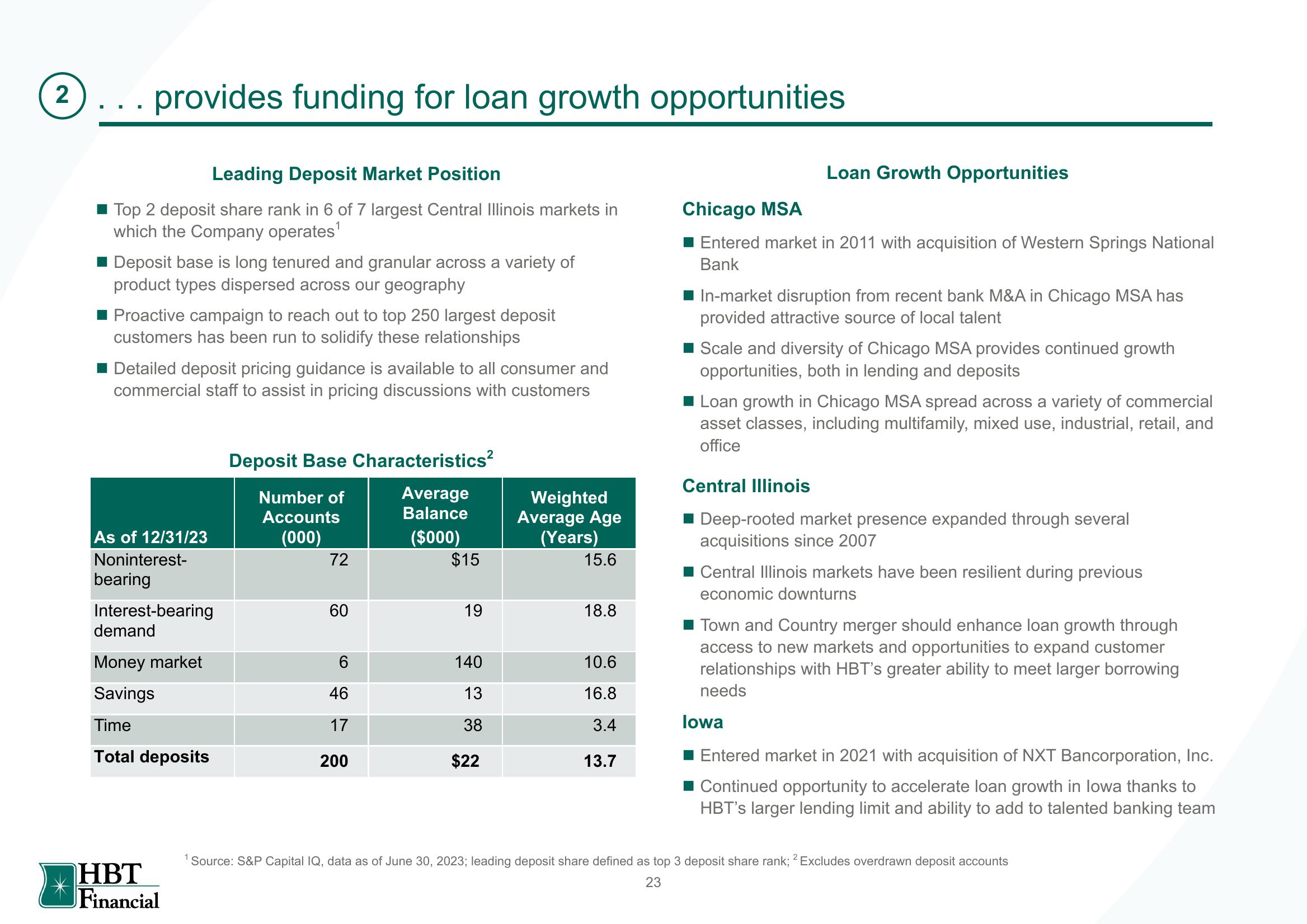

Deposit Base Characteristics²

Average

Balance

($000)

Number of

Accounts

(000)

72

60

6

46

17

200

$15

19

140

13

38

$22

Weighted

Average Age

(Years)

15.6

18.8

10.6

16.8

3.4

13.7

Loan Growth Opportunities

Chicago MSA

Entered market in 2011 with acquisition of Western Springs National

Bank

In-market disruption from recent bank M&A in Chicago MSA has

provided attractive source of local talent

■ Scale and diversity of Chicago MSA provides continued growth

opportunities, both in lending and deposits

Loan growth in Chicago MSA spread across a variety of commercial

asset classes, including multifamily, mixed use, industrial, retail, and

office

Central Illinois

Deep-rooted market presence expanded through several

acquisitions since 2007

■ Central Illinois markets have been resilient during previous

economic downturns

■ Town and Country merger should enhance loan growth through

access to new markets and opportunities to expand customer

relationships with HBT's greater ability to meet larger borrowing

needs

lowa

■ Entered market in 2021 with acquisition of NXT Bancorporation, Inc.

Continued opportunity to accelerate loan growth in lowa thanks to

HBT's larger lending limit and ability to add to talented banking team

¹Source: S&P Capital IQ, data as of June 30, 2023; leading deposit share defined as top 3 deposit share rank; 2 Excludes overdrawn deposit accounts

23View entire presentation