Commercial Metals Company Investor Presentation Deck

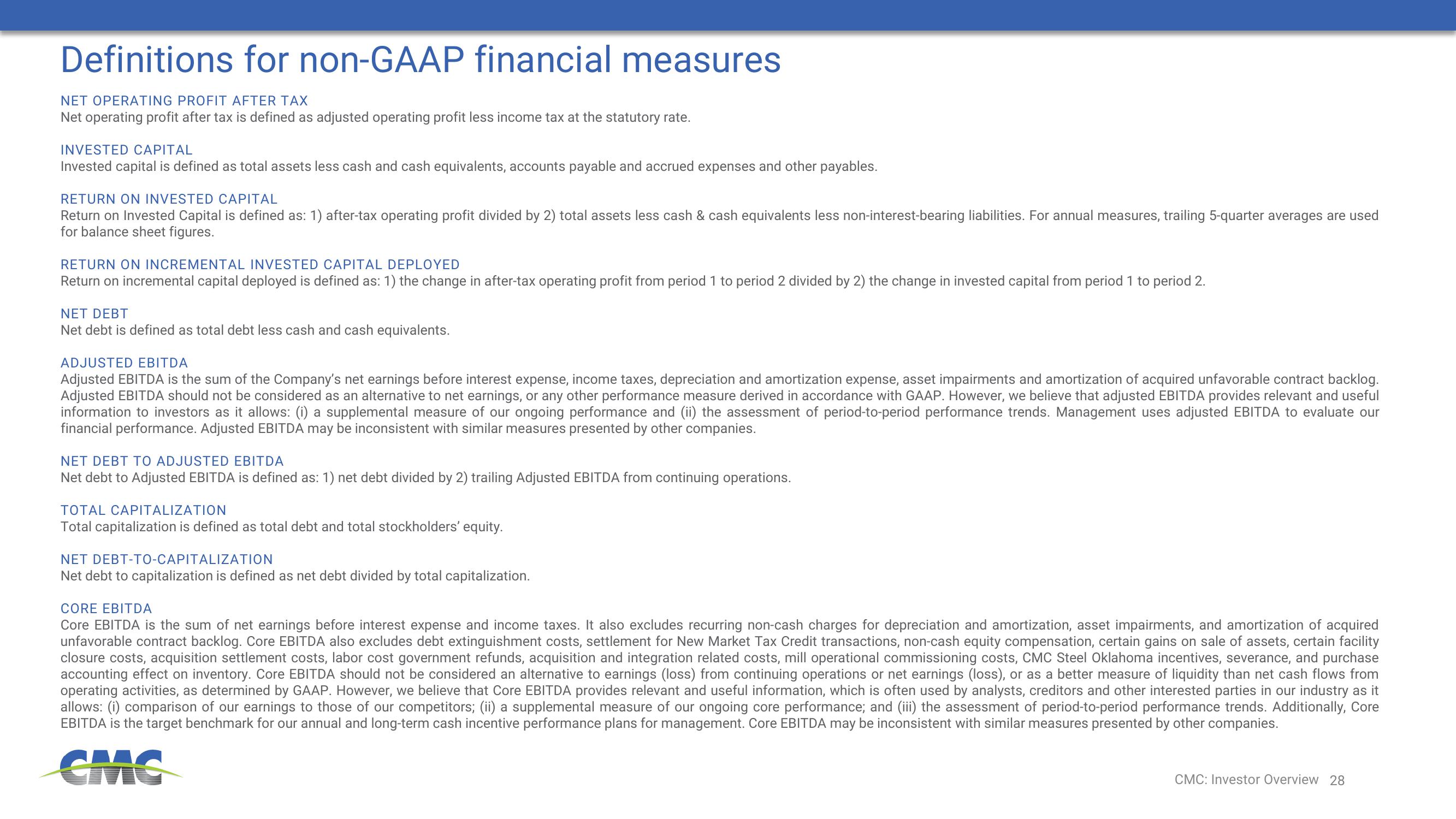

Definitions for non-GAAP financial measures

NET OPERATING PROFIT AFTER TAX

Net operating profit after tax is defined as adjusted operating profit less income tax at the statutory rate.

INVESTED CAPITAL

Invested capital is defined as total assets less cash and cash equivalents, accounts payable and accrued expenses and other payables.

RETURN ON INVESTED CAPITAL

Return on Invested Capital is defined as: 1) after-tax operating profit divided by 2) total assets less cash & cash equivalents less non-interest-bearing liabilities. For annual measures, trailing 5-quarter averages are used

for balance sheet figures.

RETURN ON INCREMENTAL INVESTED CAPITAL DEPLOYED

Return on incremental capital deployed is defined as: 1) the change in after-tax operating profit from period 1 to period 2 divided by 2) the change in invested capital from period 1 to period 2.

NET DEBT

Net debt is defined as total debt less cash and cash equivalents.

ADJUSTED EBITDA

Adjusted EBITDA is the sum of the Company's net earnings before interest expense, income taxes, depreciation and amortization expense, asset impairments and amortization of acquired unfavorable contract backlog.

Adjusted EBITDA should not be considered as an alternative to net earnings, or any other performance measure derived in accordance with GAAP. However, we believe that adjusted EBITDA provides relevant and useful

information to investors as it allows: (i) a supplemental measure of our ongoing performance and (ii) the assessment of period-to-period performance trends. Management uses adjusted EBITDA to evaluate our

financial performance. Adjusted EBITDA may be inconsistent with similar measures presented by other companies.

NET DEBT TO ADJUSTED EBITDA

Net debt to Adjusted EBITDA is defined as: 1) net debt divided by 2) trailing Adjusted EBITDA from continuing operations.

TOTAL CAPITALIZATION

Total capitalization is defined as total debt and total stockholders' equity.

NET DEBT-TO-CAPITALIZATION

Net debt to capitalization is defined as net debt divided by total capitalization.

CORE EBITDA

Core EBITDA is the sum of net earnings before interest expense and income taxes. It also excludes recurring non-cash charges for depreciation and amortization, asset impairments, and amortization of acquired

unfavorable contract backlog. Core EBITDA also excludes debt extinguishment costs, settlement for New Market Tax Credit transactions, non-cash equity compensation, certain gains on sale of assets, certain facility

closure costs, acquisition settlement costs, labor cost government refunds, acquisition and integration related costs, mill operational commissioning costs, CMC Steel Oklahoma incentives, severance, and purchase

accounting effect on inventory. Core EBITDA should not be considered an alternative to earnings (loss) from continuing operations or net earnings (loss), or as a better measure of liquidity than net cash flows from

operating activities, as determined by GAAP. However, we believe that Core EBITDA provides relevant and useful information, which is often used by analysts, creditors and other interested parties in our industry as it

allows: (i) comparison of our earnings to those of our competitors; (ii) a supplemental measure of our ongoing core performance; and (iii) the assessment of period-to-period performance trends. Additionally, Core

EBITDA is the target benchmark for our annual and long-term cash incentive performance plans for management. Core EBITDA may be inconsistent with similar measures presented by other companies.

CMC

CMC: Investor Overview 28View entire presentation