OSP Value Fund IV LP Q4 2022

OSP

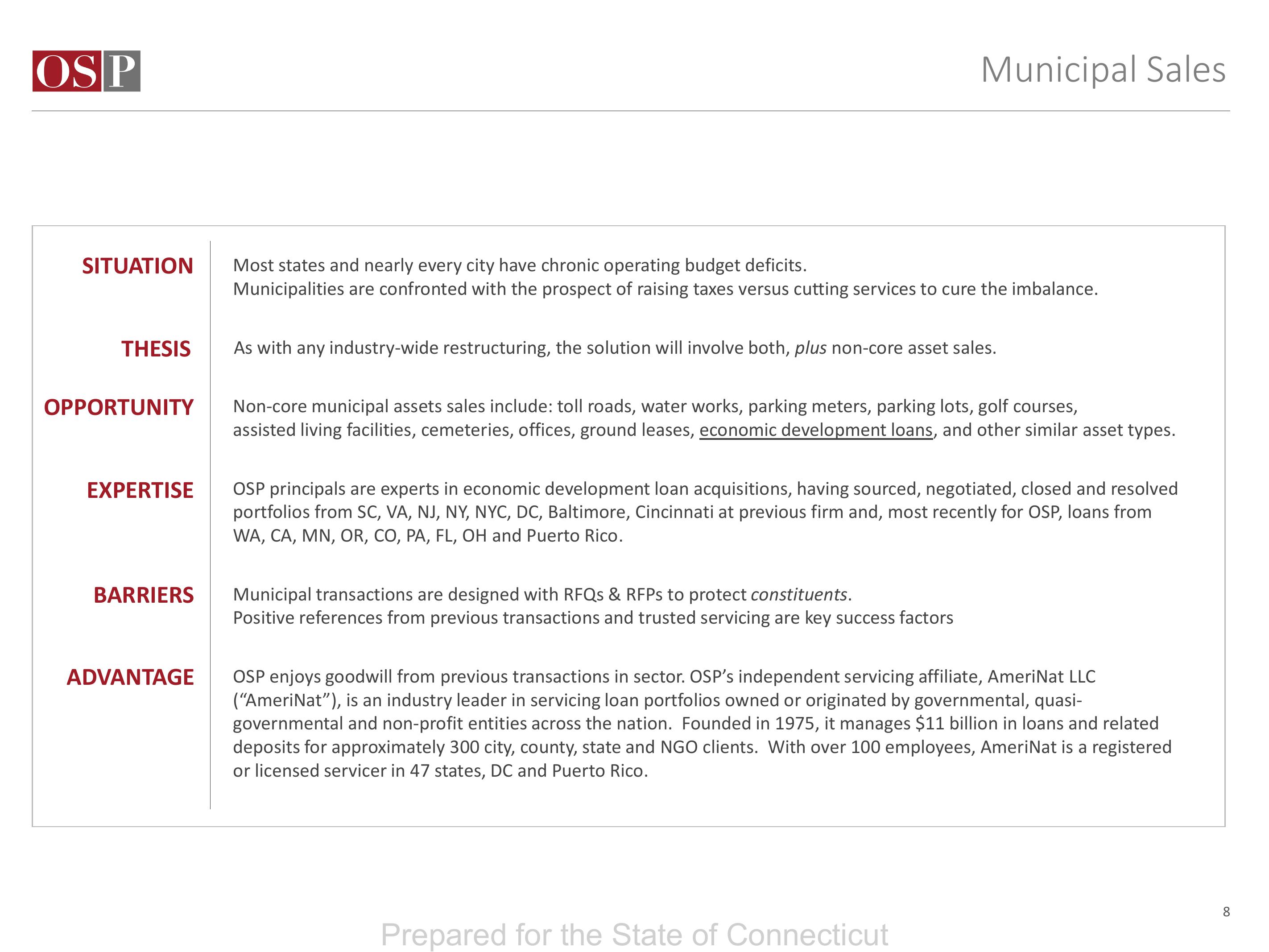

SITUATION

THESIS

OPPORTUNITY

EXPERTISE

BARRIERS

ADVANTAGE

Most states and nearly every city have chronic operating budget deficits.

Municipalities are confronted with the prospect of raising taxes versus cutting services to cure the imbalance.

Municipal Sales

As with any industry-wide restructuring, the solution will involve both, plus non-core asset sales.

Non-core municipal assets sales include: toll roads, water works, parking meters, parking lots, golf courses,

assisted living facilities, cemeteries, offices, ground leases, economic development loans, and other similar asset types.

OSP principals are experts in economic development loan acquisitions, having sourced, negotiated, closed and resolved

portfolios from SC, VA, NJ, NY, NYC, DC, Baltimore, Cincinnati at previous firm and, most recently for OSP, loans from

WA, CA, MN, OR, CO, PA, FL, OH and Puerto Rico.

Municipal transactions are designed with RFQs & RFPs to protect constituents.

Positive references from previous transactions and trusted servicing are key success factors

OSP enjoys goodwill from previous transactions in sector. OSP's independent servicing affiliate, AmeriNat LLC

("AmeriNat"), is an industry leader in servicing loan portfolios owned or originated by governmental, quasi-

governmental and non-profit entities across the nation. Founded in 1975, it manages $11 billion in loans and related

deposits for approximately 300 city, county, state and NGO clients. With over 100 employees, AmeriNat is a registered

or licensed servicer in 47 states, DC and Puerto Rico.

Prepared for the State of Connecticut

8View entire presentation