Investor Day

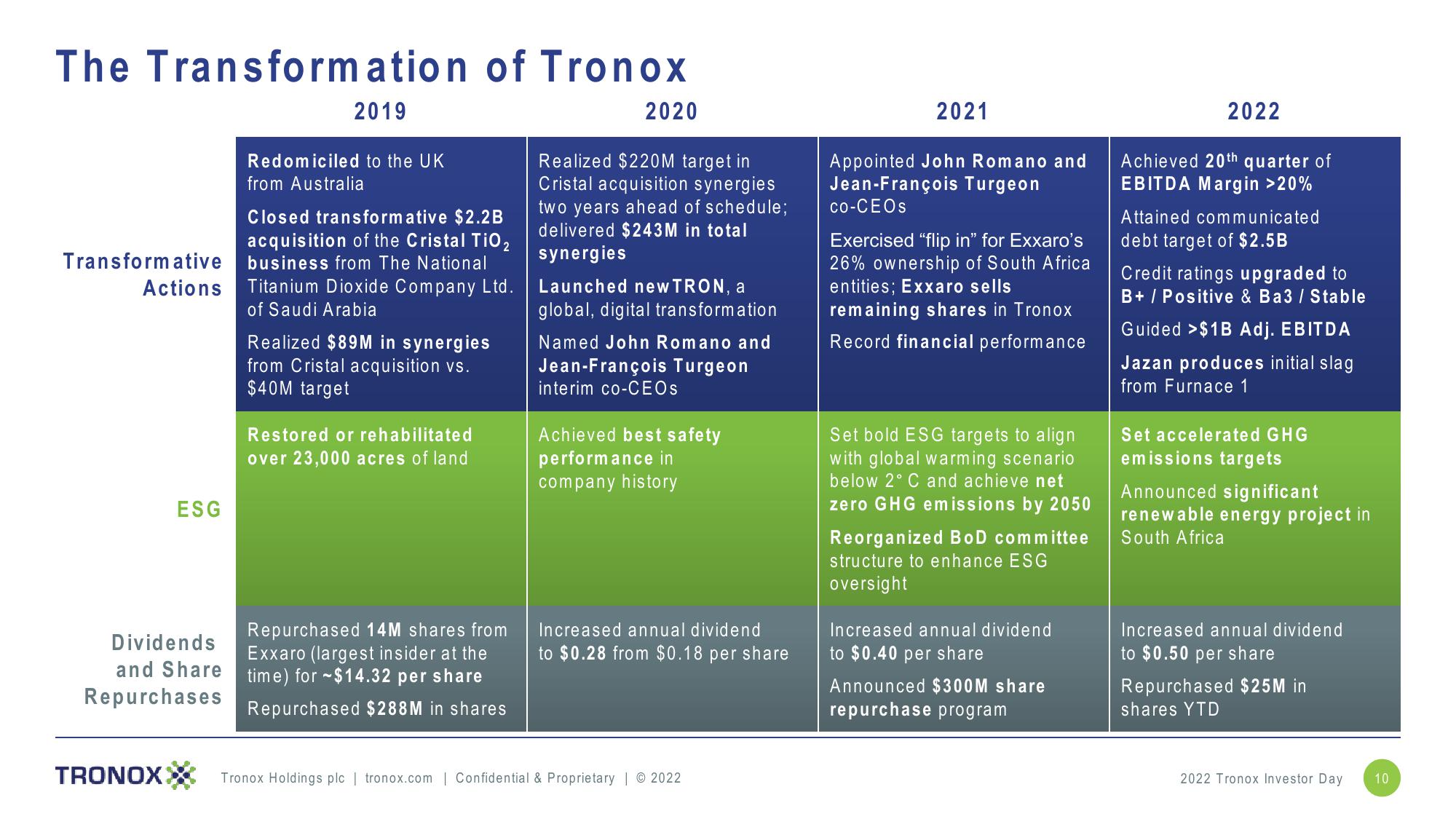

The Transformation of Tronox

Transformative

Actions

ESG

Dividends

and Share

Repurchases

TRONOX

2019

Redomiciled to the UK

from Australia

Closed transformative $2.2B

acquisition of the Cristal TiO₂

business from The National

Titanium Dioxide Company Ltd.

of Saudi Arabia

Realized $89M in synergies

from Cristal acquisition vs.

$40M target

Restored or rehabilitated

over 23,000 acres of land

Repurchased 14M shares from

Exxaro (largest insider at the

time) for $14.32 per share

Repurchased $288M in shares

2020

Realized $220M target in

Cristal acquisition synergies

two years ahead of schedule;

delivered $243M in total

synergies

Launched new TRON, a

global, digital transformation

Named John Romano and

Jean-François Turgeon

interim co-CEOs

Achieved best safety

performance in

company history

Increased annual dividend

to $0.28 from $0.18 per share

Tronox Holdings plc | tronox.com | Confidential & Proprietary | © 2022

2021

Appointed John Romano and

Jean-François Turgeon

co-CEOs

Exercised "flip in" for Exxaro's

26% ownership of South Africa

entities; Exxaro sells

remaining shares in Tronox

Record financial performance

Set bold ESG targets to align

with global warming scenario

below 2° C and achieve net

zero GHG emissions by 2050

Reorganized BoD committee

structure to enhance ESG

oversight

Increased annual dividend

to $0.40 per share

Announced $300M share

repurchase program

2022

Achieved 20th quarter of

EBITDA Margin >20%

Attained communicated

debt target of $2.5B

Credit ratings upgraded to

B+ / Positive & Ba3 / Stable

Guided >$1B Adj. EBITDA

Jazan produces initial slag

from Furnace 1

Set accelerated GHG

emissions targets

Announced significant

renewable energy project in

South Africa

Increased annual dividend

to $0.50 per share

Repurchased $25M in

shares YTD

2022 Tronox Investor Day

10View entire presentation