KKR Real Estate Finance Trust Investor Presentation Deck

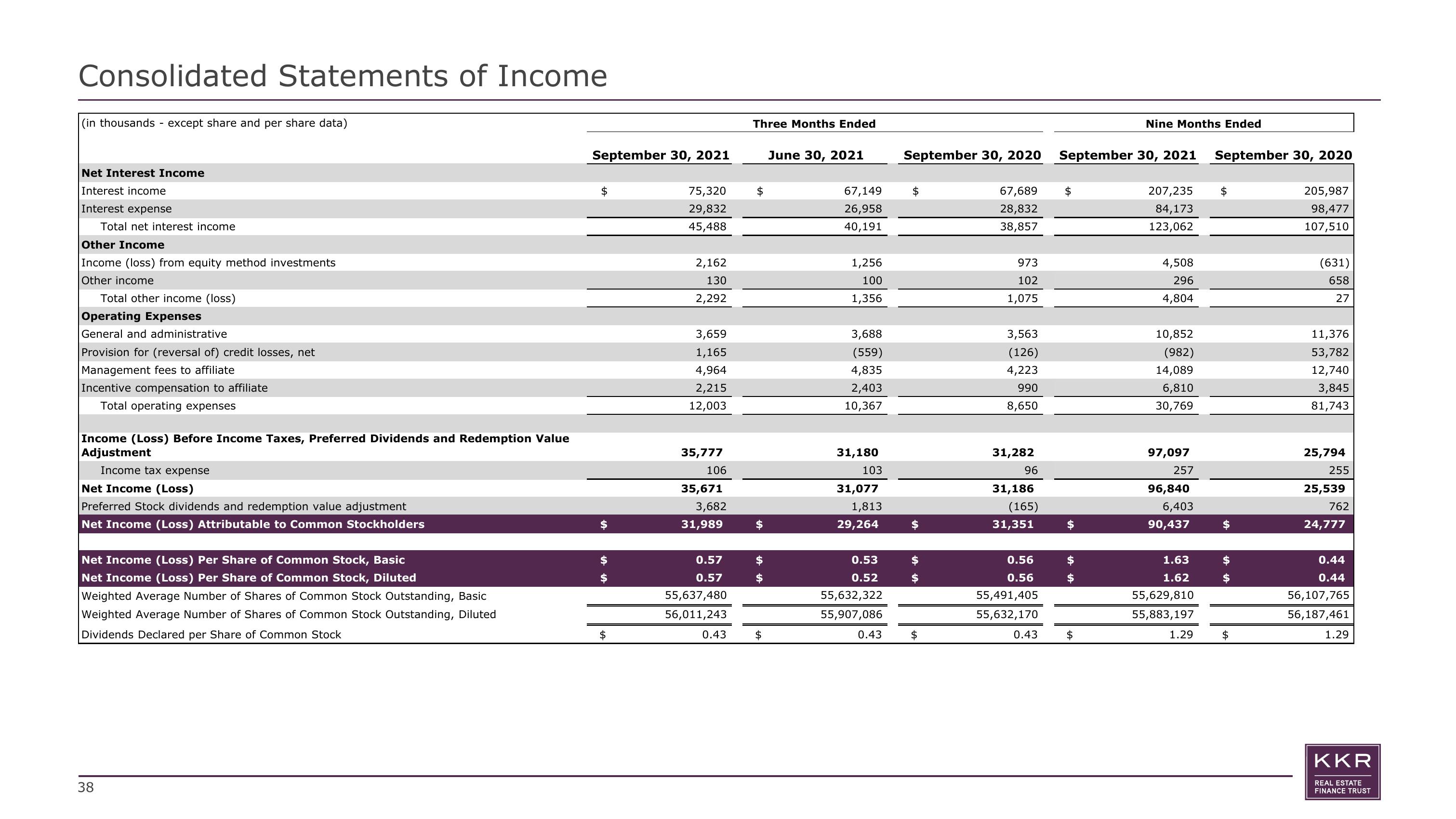

Consolidated Statements of Income

(in thousands - except share and per share data)

Net Interest Income

Interest income

Interest expense

Total net interest income

Other Income

Income (loss) from equity method investments

Other income

Total other income (loss)

Operating Expenses

General and administrative

Provision for (reversal of) credit losses, net

Management fees to affiliate

Incentive compensation to affiliate

Total operating expenses

Income (Loss) Before Income Taxes, Preferred Dividends and Redemption Value

Adjustment

Income tax expense

Net Income (Loss)

Preferred Stock dividends and redemption value adjustment

Net Income (Loss) Attributable to Common Stockholders

38

Net Income (Loss) Per Share of Common Stock, Basic

Net Income (Loss) Per Share of Common Stock, Diluted

Weighted Average Number of Shares of Common Stock Outstanding, Basic

Weighted Average Number of Shares of Common Stock Outstanding, Diluted

Dividends Declared per Share of Common Stock

September 30, 2021

$

$

A A

$

75,320

29,832

45,488

2,162

130

2,292

3,659

1,165

4,964

2,215

12,003

35,777

106

35,671

3,682

31,989

0.57

0.57

55,637,480

56,011,243

0.43

Three Months Ended

$

$

June 30, 2021

67,149

26,958

40,191

1,256

100

1,356

3,688

(559)

4,835

2,403

10,367

31,180

103

31,077

1,813

29,264

0.53

0.52

55,632,322

55,907,086

0.43

September 30, 2020

$

$

$

$

67,689

28,832

38,857

973

102

1,075

3,563

(126)

4,223

990

8,650

31,282

96

31,186

(165)

31,351

0.56

0.56

55,491,405

55,632,170

0.43

September 30, 2021 September 30, 2020

$

A

Nine Months Ended

$

207,235

84,173

123,062

4,508

296

4,804

10,852

(982)

14,089

6,810

30,769

97,097

257

96,840

6,403

90,437

1.63

1.62

55,629,810

55,883,197

1.29

$

$

205,987

98,477

107,510

(631)

658

27

11,376

53,782

12,740

3,845

81,743

25,794

255

25,539

762

24,777

0.44

0.44

56,107,765

56,187,461

1.29

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation