Silicon Valley Bank Results Presentation Deck

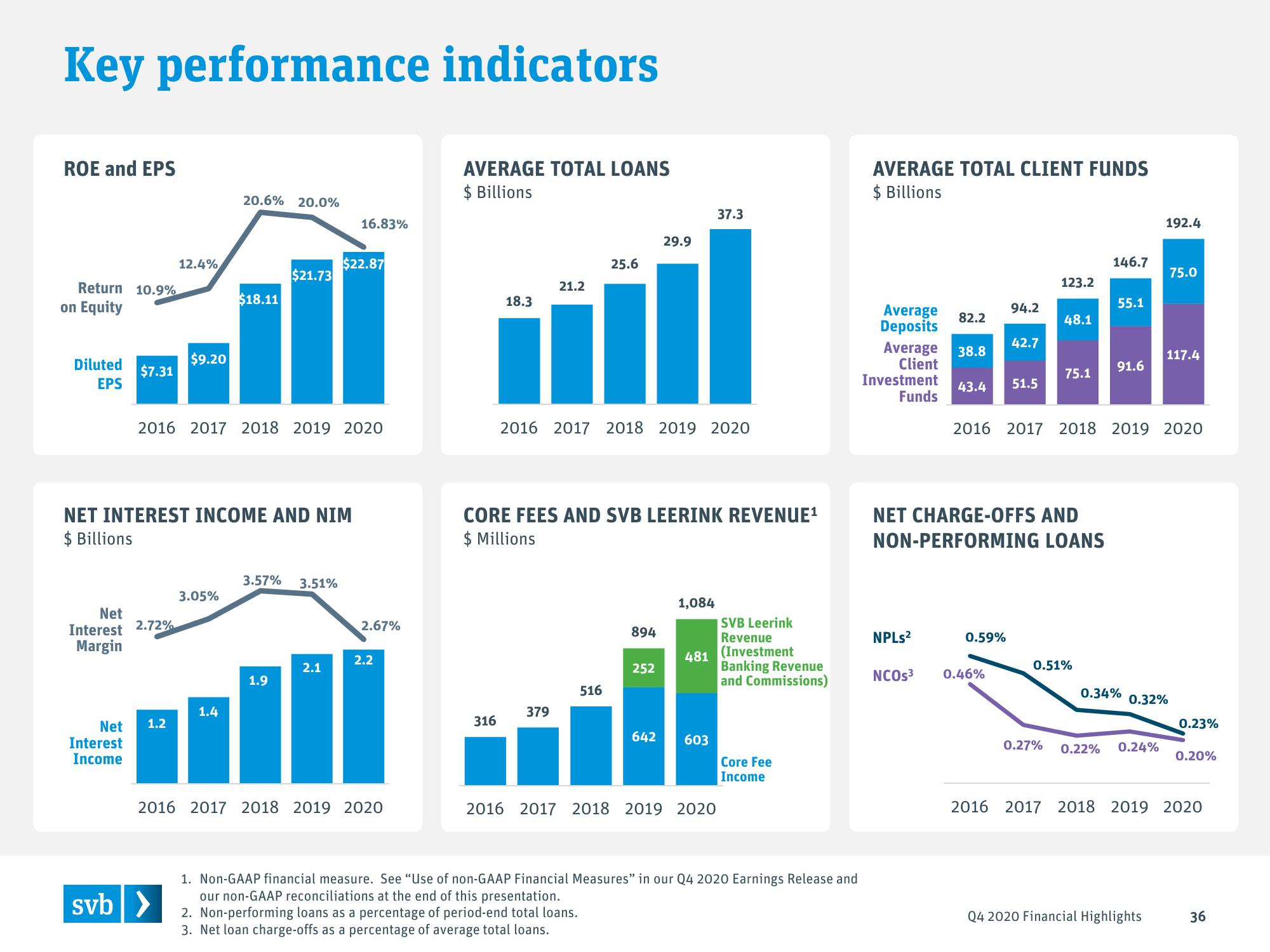

Key performance indicators

ROE and EPS

Return 10.9%

on Equity

Diluted

EPS

Net

Interest

Margin

$7.31

Interest

Income

2.72%

Net 1.2

12.4%

$9.20

NET INTEREST INCOME AND NIM

$ Billions

svb >

20.6% 20.0%

2016 2017 2018 2019 2020

3.05%

$18.11

1.4

$21.73

3.57% 3.51%

1.9

16.83%

$22.87

2.1

2.67%

2.2

2016 2017 2018 2019 2020

AVERAGE TOTAL LOANS

$ Billions

18.3

316

21.2

379

25.6

2016 2017 2018 2019 2020

CORE FEES AND SVB LEERINK REVENUE¹

$ Millions

516

894

29.9

252

642

1,084

481

37.3

603

2016 2017 2018 2019 2020

SVB Leerink

Revenue

(Investment

Banking Revenue

and Commissions)

Core Fee

Income

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2020 Earnings Release and

our non-GAAP reconciliations at the end of this presentation.

2. Non-performing loans as a percentage of period-end total loans.

3. Net loan charge-offs as a percentage of average total loans.

AVERAGE TOTAL CLIENT FUNDS

$ Billions

Average

Deposits

Average 38.8

Client

Investment

Funds

NPLs²

82.2

NCOs³

94.2

43.4 51.5

42.7

0.59%

0.46%

123.2

NET CHARGE-OFFS AND

NON-PERFORMING LOANS

48.1

75.1

146.7

0.51%

55.1

91.6

2016 2017 2018 2019 2020

192.4

0.27% 0.22% 0.24%

0.34% 0.32%

75.0

117.4

Q4 2020 Financial Highlights

0.23%

0.20%

2016 2017 2018 2019 2020

36View entire presentation