Credit Suisse Investment Banking Pitch Book

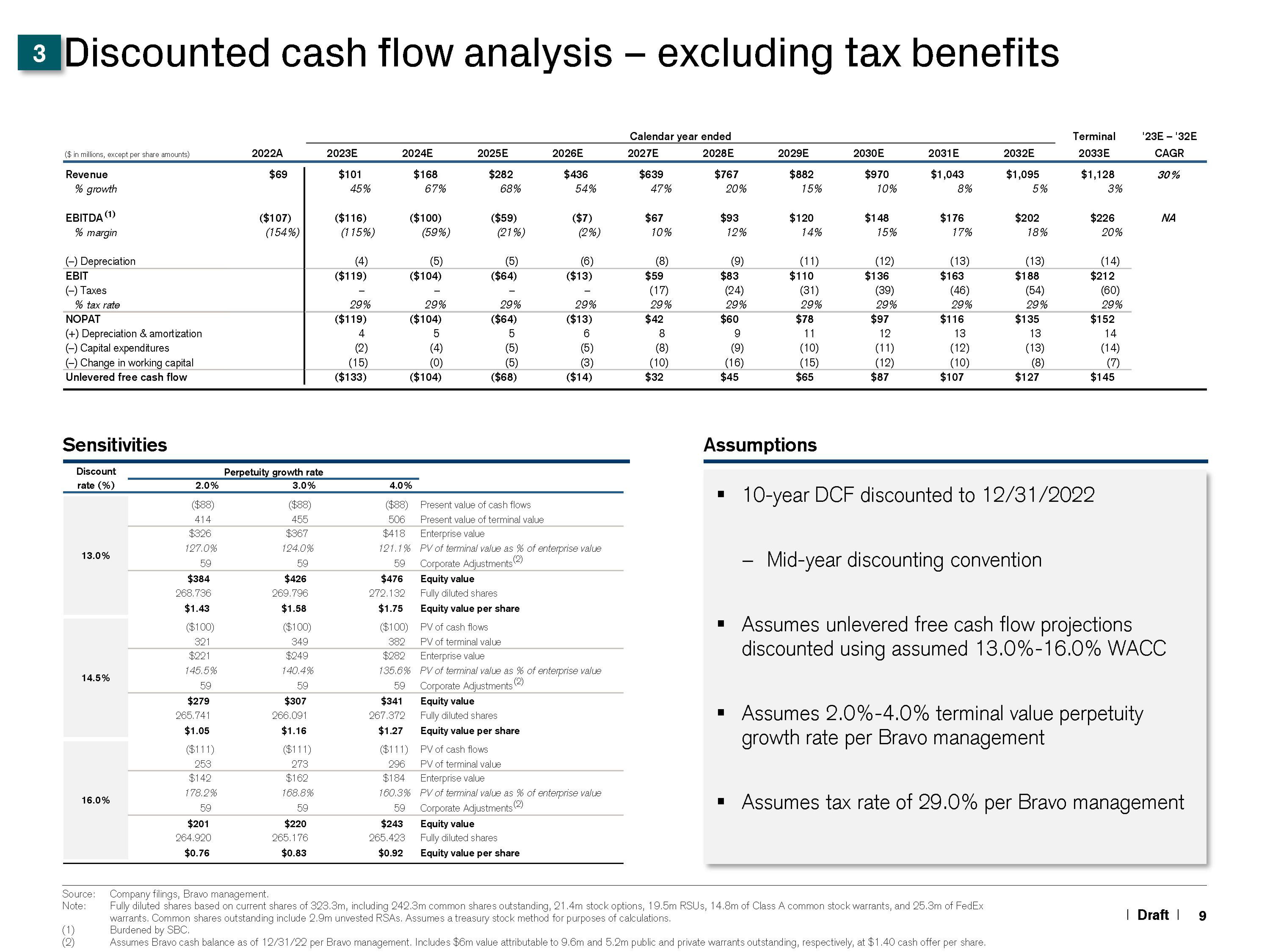

3 Discounted cash flow analysis - excluding tax benefits

($ in millions, except per share amounts)

Revenue

% growth

EBITDA (1)

% margin

(-) Depreciation

EBIT

(-) Taxes

% tax rate

NOPAT

(+) Depreciation & amortization

(-) Capital expenditures

(-) Change in working capital

Unlevered free cash flow

Sensitivities

Discount

rate (%)

(1)

(2)

13.0%

14.5%

16.0%

Source:

Note:

2.0%

($88)

414

$326

127.0%

59

$384

268.736

$1.43

($100)

321

$221

145.5%

59

$279

265.741

$1.05

($111)

253

$142

178.2%

59

$201

264.920

$0.76

2022A

$69

($107)

(154%)

Perpetuity growth rate

3.0%

($88)

455

$367

124.0%

59

$426

269.796

$1.58

($100)

349

$249

140.4%

59

$307

266.091

$1.16

($111)

273

$162

168.8%

59

$220

265.176

$0.83

2023E

$101

45%

($116)

(115%)

(4)

($119)

29%

($119)

4

(2)

(15)

($133)

2024E

$168

67%

($100)

(59%)

($111)

296

$184

(5)

($104)

29%

($104)

5

(4)

(0)

($104)

2025E

$282

68%

($59)

(21%)

(5)

($64)

29%

($64)

5

(5)

(5)

($68)

Equity value per share

2026E

$436

54%

($7)

$243 Equity value

265.423 Fully diluted shares

$0.92 Equity value per share

(2%)

(6)

($13)

4.0%

($88) Present value of cash flows

506

Present value of terminal value

$418

Enterprise value

121.1%

PV of terminal value as % of enterprise value

Corporate Adjustments (2)

59

$476

Equity value

272.132 Fully diluted shares

$1.75

29%

($13)

6

(5)

(3)

($14)

($100)

PV of cash flows

382

PV of terminal value

$282

Enterprise value

135.6% PV of terminal value as % of enterprise value

(2)

59 Corporate Adjustments

$341

Equity value

267.372 Fully diluted shares

$1.27 Equity value per share

PV of cash flows

PV of terminal value

Enterprise value

160.3% PV of terminal value as % of enterprise value

59 Corporate Adjustments (2)

Calendar year ended

2027E

2028E

$639

47%

$67

10%

(8)

$59

(17)

29%

$42

8

(8)

(10)

$32

$767

20%

$93

12%

$83

(9)

(24)

29%

$60

9

(9)

(16)

$45

■

■

2029E

$882

15%

$120

-

14%

(11)

$110

(31)

29%

Assumptions

$78

11

(10)

(15)

$65

2030E

$970

10%

$148

15%

(12)

$136

(39)

29%

$97

12

(11)

(12)

$87

2031E

$1,043

8%

$176

17%

(13)

$163

(46)

29%

$116

13

(12)

(10)

$107

2032E

$1,095

5%

$202

18%

(13)

$188

Company filings, Bravo management.

Fully diluted shares based on current shares of 323.3m, including 242.3m common shares outstanding, 21.4m stock options, 19.5m RSUS, 14.8m of Class A common stock warrants, and 25.3m of FedEx

warrants. Common shares outstanding include 2.9m unvested RSAS. Assumes a treasury stock method for purposes of calculations.

Burdened by SBC.

Assumes Bravo cash balance as of 12/31/22 per Bravo management. Includes $6m value attributable to 9.6m and 5.2m public and private warrants outstanding, respectively, at $1.40 cash offer per share.

(54)

29%

$135

13

(13)

(8)

$127

Mid-year discounting convention

Terminal

2033E

$1,128

3%

$226

10-year DCF discounted to 12/31/2022

20%

(14)

$212

(60)

29%

$152

14

(14)

(7)

$145

'23E-¹32E

CAGR

30%

Assumes unlevered free cash flow projections

discounted using assumed 13.0%-16.0% WACC

▪ Assumes 2.0% -4.0% terminal value perpetuity

growth rate per Bravo management

ΝΑ

▪ Assumes tax rate of 29.0% per Bravo management

| Draft |

9View entire presentation