Credit Suisse Investment Banking Pitch Book

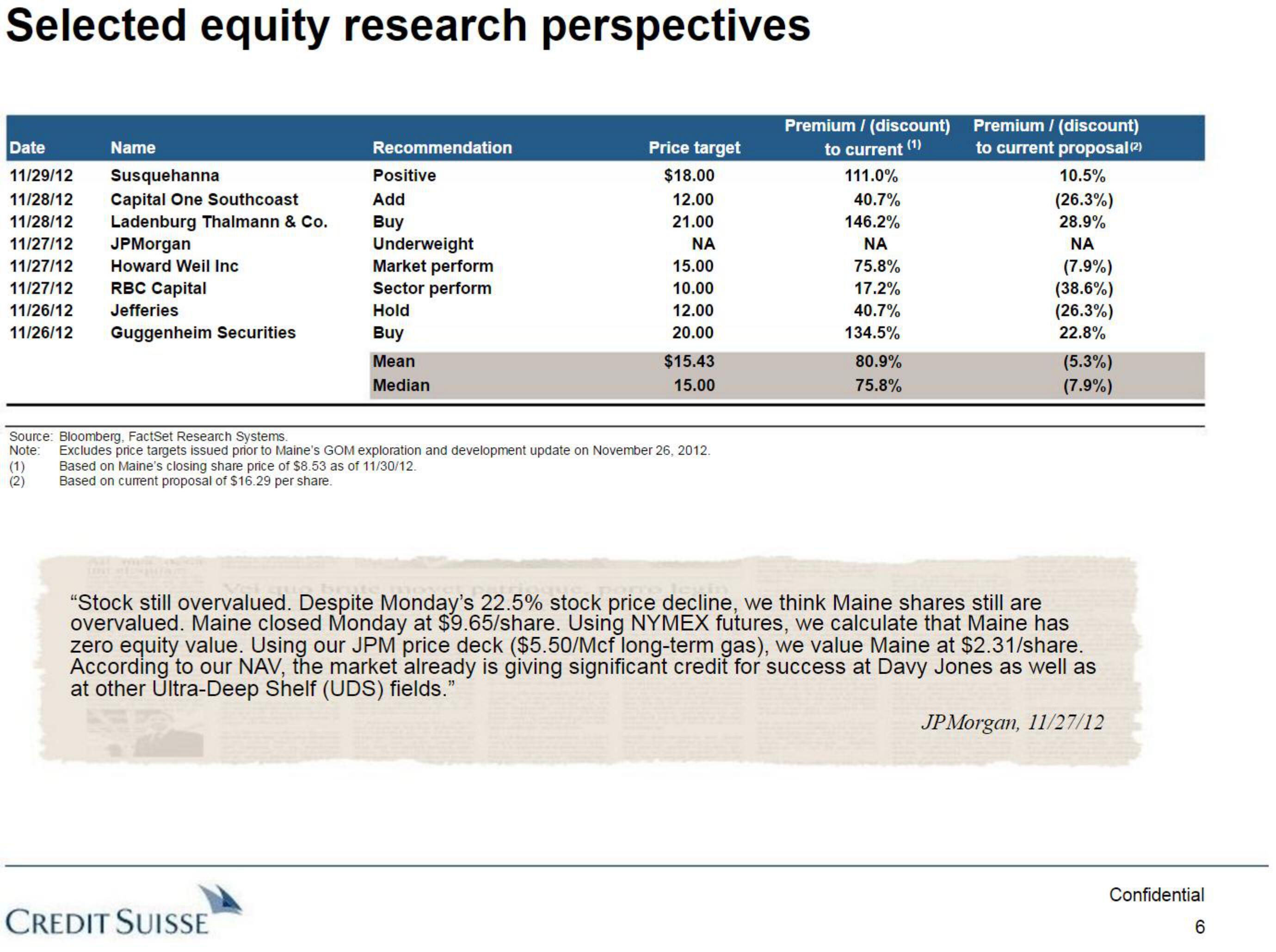

Selected equity research perspectives

Date

11/29/12 Susquehanna

11/28/12 Capital One Southcoast

11/28/12 Ladenburg Thalmann & Co.

11/27/12 JPMorgan

11/27/12 Howard Weil Inc

11/27/12 RBC Capital

11/26/12

Jefferies

11/26/12 Guggenheim Securities

Name

(1)

(2)

Recommendation

Positive

Add

Buy

Underweight

Market perform

Sector perform

Hold

Buy

Mean

Median

CREDIT SUISSE

Source: Bloomberg, FactSet Research Systems.

Note: Excludes price targets issued prior to Maine's GOM exploration and development update on November 26, 2012.

Based on Maine's closing share price of $8.53 as of 11/30/12.

Based on current proposal of $16.29 per share.

Price target

$18.00

12.00

21.00

ΝΑ

15.00

10.00

12.00

20.00

$15.43

15.00

Premium / (discount)

to current (1)

111.0%

40.7%

146.2%

ΝΑ

75.8%

17.2%

40.7%

134.5%

80.9%

75.8%

Premium / (discount)

to current

proposal (2)

10.5%

(26.3%)

28.9%

ΝΑ

(7.9%)

(38.6%)

(26.3%)

22.8%

(5.3%)

(7.9%)

S

"Stock still overvalued. Despite Monday's 22.5% stock price decline, we think Maine shares still are

overvalued. Maine closed Monday at $9.65/share. Using NYMEX futures, we calculate that Maine has

zero equity value. Using our JPM price deck ($5.50/Mcf long-term gas), we value Maine at $2.31/share.

According to our NAV, the market already is giving significant credit for success at Davy Jones as well as

at other Ultra-Deep Shelf (UDS) fields."

JPMorgan, 11/27/12

ConfidentialView entire presentation