Melrose Mergers and Acquisitions Presentation Deck

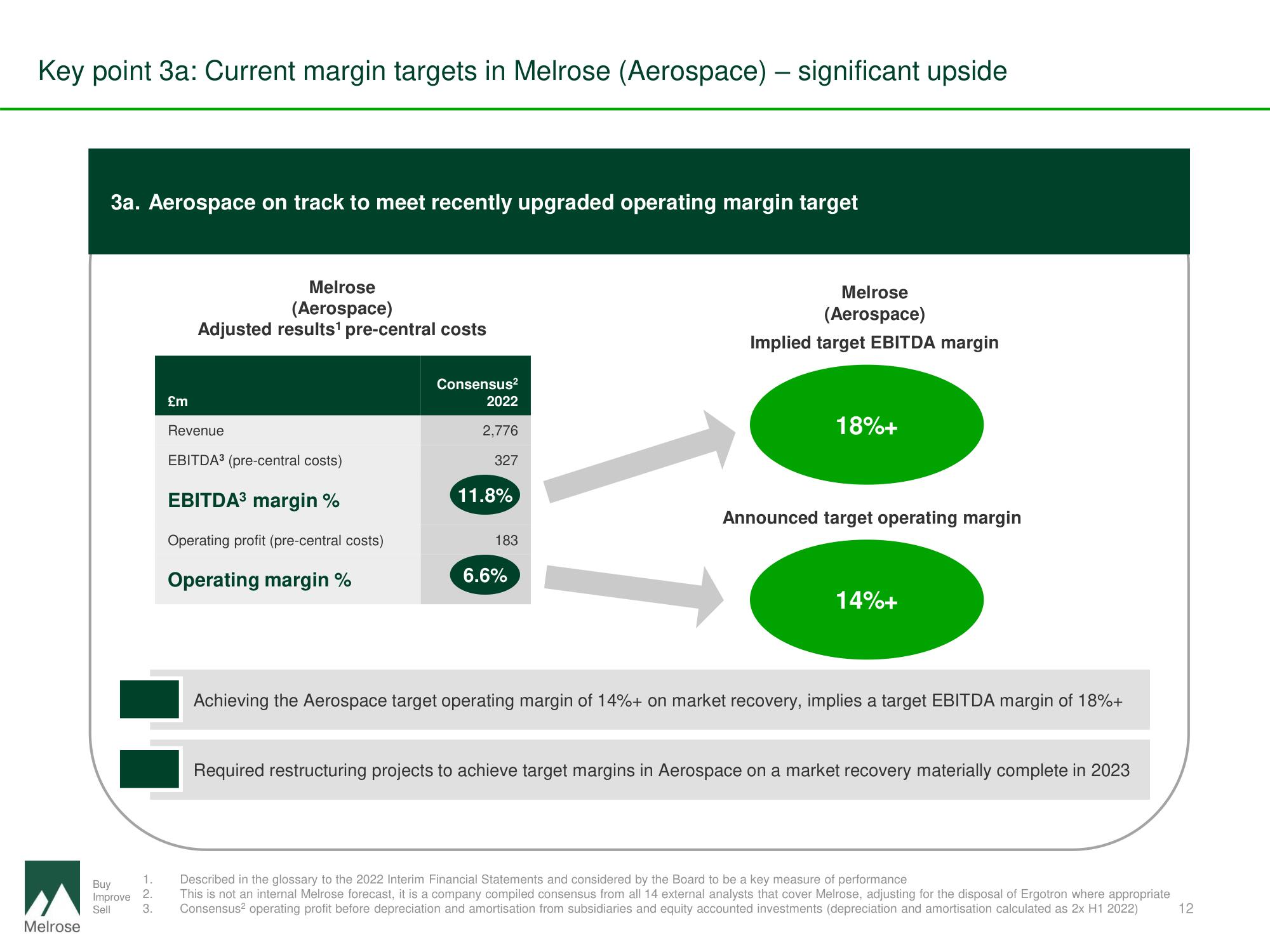

Key point 3a: Current margin targets in Melrose (Aerospace) - significant upside

Melrose

3a. Aerospace on track to meet recently upgraded operating margin target

Buy

Improve

Sell

1.

2.

3.

£m

Melrose

(Aerospace)

Adjusted results¹ pre-central costs

Revenue

EBITDA³ (pre-central costs)

EBITDA³ margin %

Operating profit (pre-central costs)

Operating margin %

Consensus²

2022

2,776

327

11.8%

183

6.6%

VI

Melrose

(Aerospace)

Implied target EBITDA margin

18%+

Announced target operating margin

14%+

Achieving the Aerospace target operating margin of 14%+ on market recovery, implies a target EBITDA margin of 18%+

Required restructuring projects to achieve target margins in Aerospace on a market recovery materially complete in 2023

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

This is not an internal Melrose forecast, it is a company compiled consensus from all 14 external analysts that cover Melrose, adjusting for the disposal of Ergotron where appropriate

Consensus² operating profit before depreciation and amortisation from subsidiaries and equity accounted investments (depreciation and amortisation calculated as 2x H1 2022)

12View entire presentation