GPI SPAC Presentation Deck

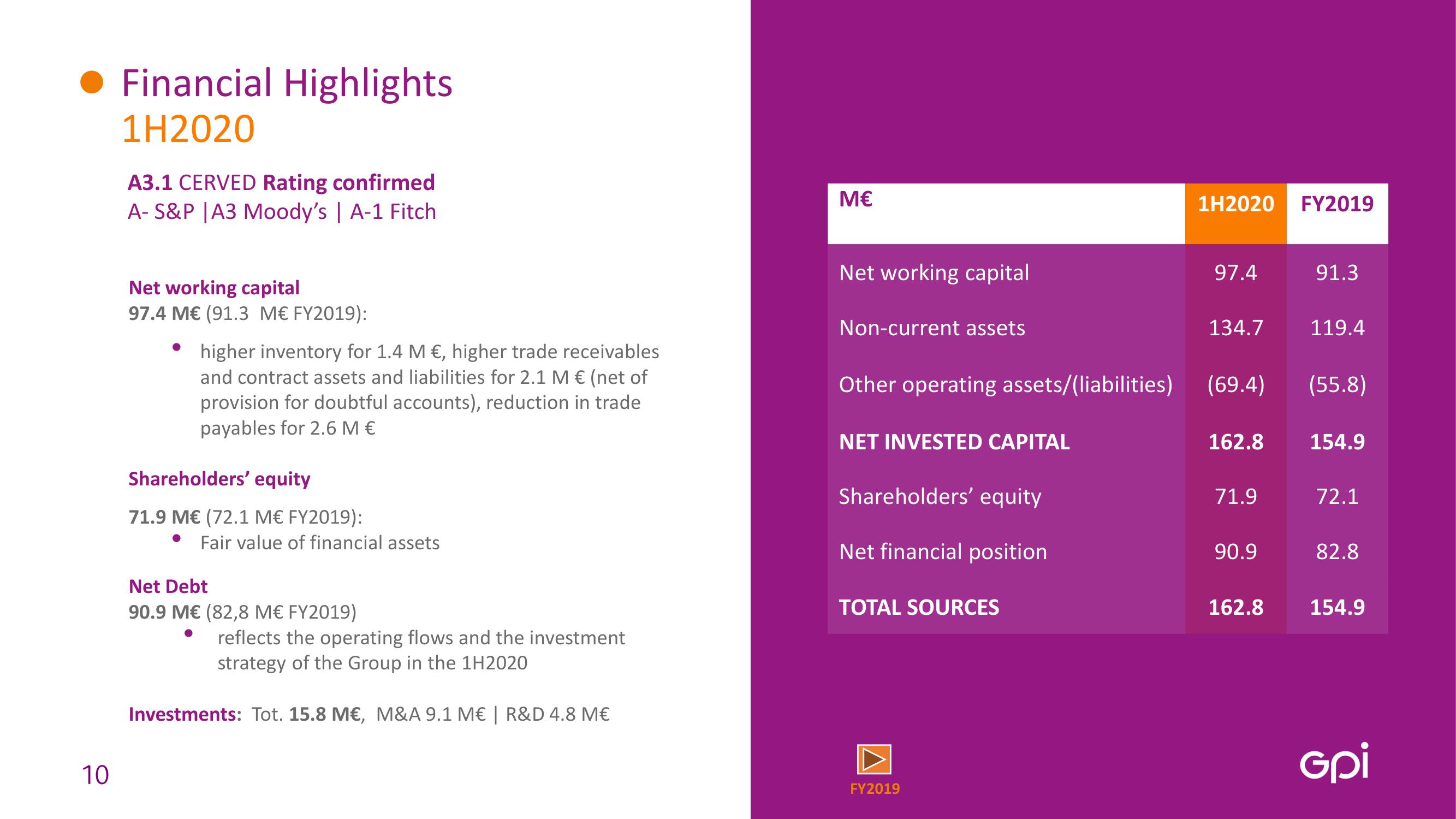

● Financial Highlights

1H2020

10

A3.1 CERVED Rating confirmed

A- S&P | A3 Moody's | A-1 Fitch

Net working capital

97.4 M€ (91.3 M€ FY2019):

higher inventory for 1.4 M €, higher trade receivables

and contract assets and liabilities for 2.1 M € (net of

provision for doubtful accounts), reduction in trade

payables for 2.6 M €

Shareholders' equity

71.9 M€ (72.1 M€ FY2019):

Fair value of financial assets

Net Debt

90.9 M€ (82,8 M€ FY2019)

reflects the operating flows and the investment

strategy of the Group in the 1H2020

Investments: Tot. 15.8 M€, M&A 9.1 M€ | R&D 4.8 M€

M€

Net working capital

Non-current assets

Other operating assets/(liabilities)

NET INVESTED CAPITAL

Shareholders' equity

Net financial position

TOTAL SOURCES

FY2019

1H2020 FY2019

97.4

134.7

(69.4)

162.8

71.9

90.9

162.8

91.3

119.4

(55.8)

154.9

72.1

82.8

154.9

GpiView entire presentation