Confluent IPO Presentation Deck

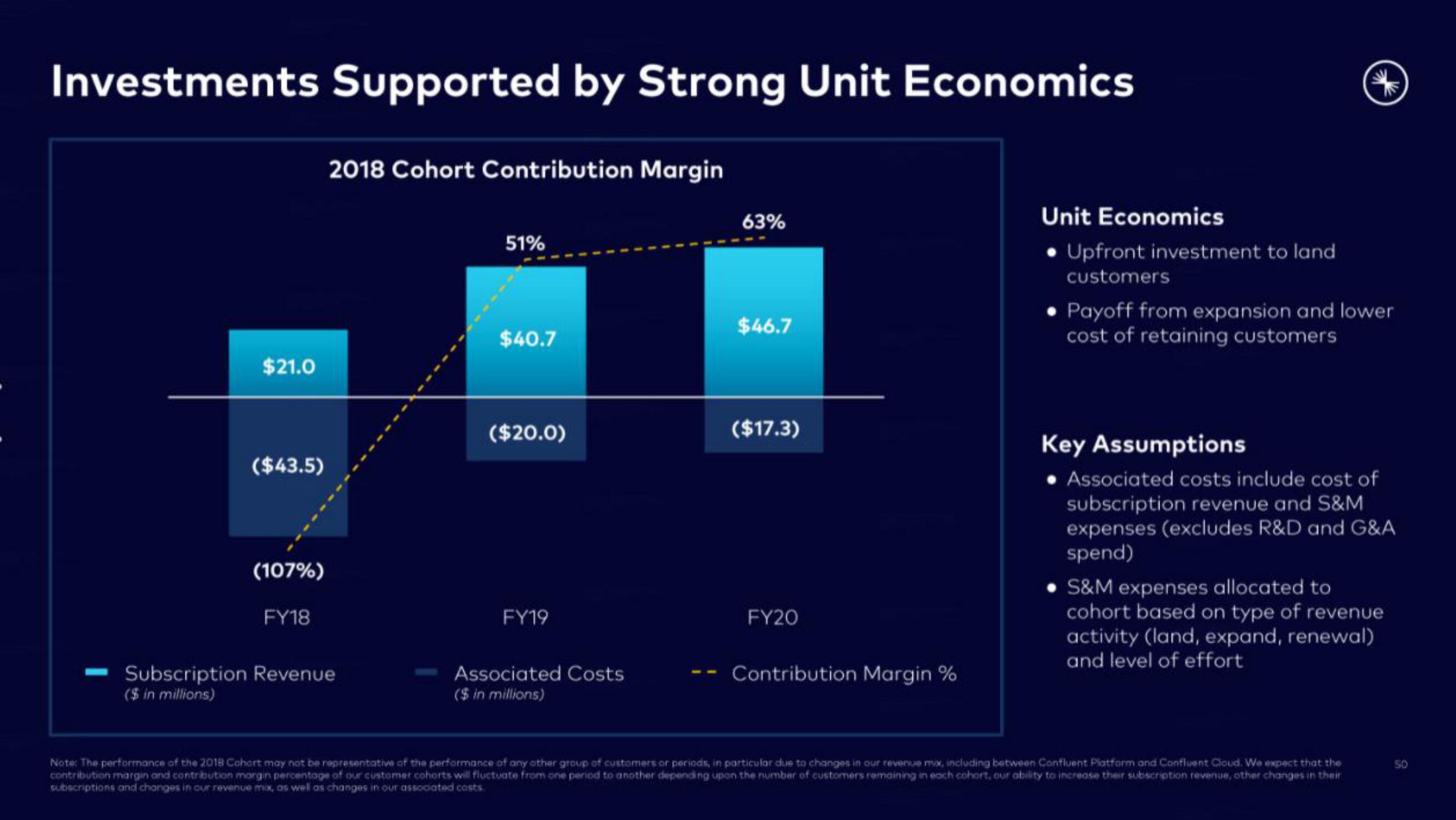

Investments Supported by Strong Unit Economics

$21.0

($43.5)

(107%)

FY18

2018 Cohort Contribution Margin

Subscription Revenue

($ in millions)

51%

$40.7

($20.0)

FY19

Associated Costs

($ in millions)

63%

$46.7

($17.3)

FY20

Contribution Margin %

Unit Economics

• Upfront investment to land

customers

Payoff from expansion and lower

cost of retaining customers

Key Assumptions

Associated costs include cost of

subscription revenue and S&M

expenses (excludes R&D and G&A

spend)

• S&M expenses allocated to

cohort based on type of revenue

activity (land, expand, renewal)

and level of effort

Note: The performance of the 2018 Cohort may not be representative of the performance of any other group of customers or periods, in particular due to changes in our revenue mix, including between Confluent Platform and Confluent Cloud. We expect that the

contribution margin and contribution margin percentage of our customer cohorts will fluctuate from one period to another depending upon the number of customers remaining in each cohort, our ability to increase their subscription revenue, other changes in their

subscriptions and changes in our revenue mix, as well as changes in our associated costs.

50View entire presentation