TradeStation SPAC Presentation Deck

8

●

Investment Highlights - Transaction Rationale

TradeStation is a FinTech Pioneer in Online Trading for the Self-Directed Investor

●

0

Positioned to Capitalize on Large Addressable Market Opportunity

TradeStation targets individual investors who are looking for better trading technology

and tools to achieve their goals and for more choices of what they can trade

Multi-asset online broker - stocks, ETFs, options, futures and crypto

Disruptive, fast-growing crypto brokerage offering

Trusted brand name and FinTech heritage

Strong Operations and Public Company Ready

Seasoned and sophisticated senior management team

Solid in-house legal, compliance, enterprise risk management, internal audit,

finance and accounting and information security departments

Self clears all asset classes and directly connects to exchanges, market makers and

liquidity providers

Committed Owners

Monex, 100% owner today, not selling any shares - rolling 100% of its equity

Monex also to subscribe for $50mm of PIPE

Over 80% of shares post-closing subject to lock-up, some up to 3 years(¹)

Attractive Valuation

Pricing compared to peer group(2) creates attractive value proposition

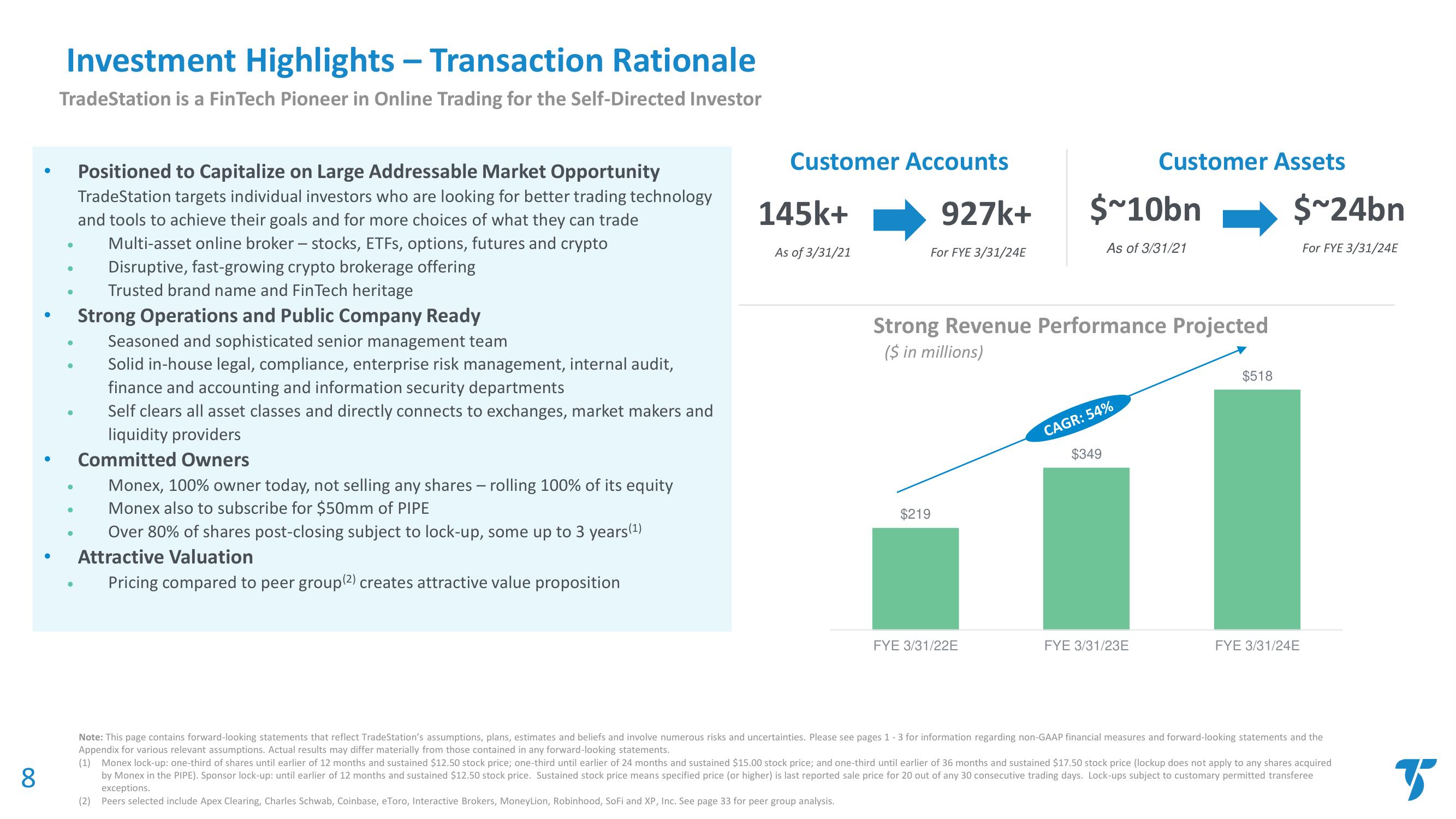

Customer Accounts

145k+

As of 3/31/21

927k+

For FYE 3/31/24E

$219

FYE 3/31/22E

$~10bn

Strong Revenue Performance Projected

($ in millions)

Customer Assets

As of 3/31/21

CAGR: 54%

$349

FYE 3/31/23E

$518

$~24bn

For FYE 3/31/24E

FYE 3/31/24E

Note: This page contains forward-looking statements that reflect TradeStation's assumptions, plans, estimates and beliefs and involve numerous risks and uncertainties. Please see pages 1 - 3 for information regarding non-GAAP financial measures and forward-looking statements and the

Appendix for various relevant assumptions. Actual results may differ materially from those contained in any forward-looking statements.

(1) Monex lock-up: one-third of shares until earlier of 12 months and sustained $12.50 stock price; one-third until earlier of 24 months and sustained $15.00 stock price; and one-third until earlier of 36 months and sustained $17.50 stock price (lockup does not apply to any shares acquired

by Monex in the PIPE). Sponsor lock-up: until earlier of 12 months and sustained $12.50 stock price. Sustained stock price means specified price (or higher) is last reported sale price for 20 out of any 30 consecutive trading days. Lock-ups subject to customary permitted transferee

exceptions.

(2) Peers selected include Apex Clearing, Charles Schwab, Coinbase, eToro, Interactive Brokers, MoneyLion, Robinhood, SoFi and XP, Inc. See page 33 for peer group analysis.

BView entire presentation