jetBlue Results Presentation Deck

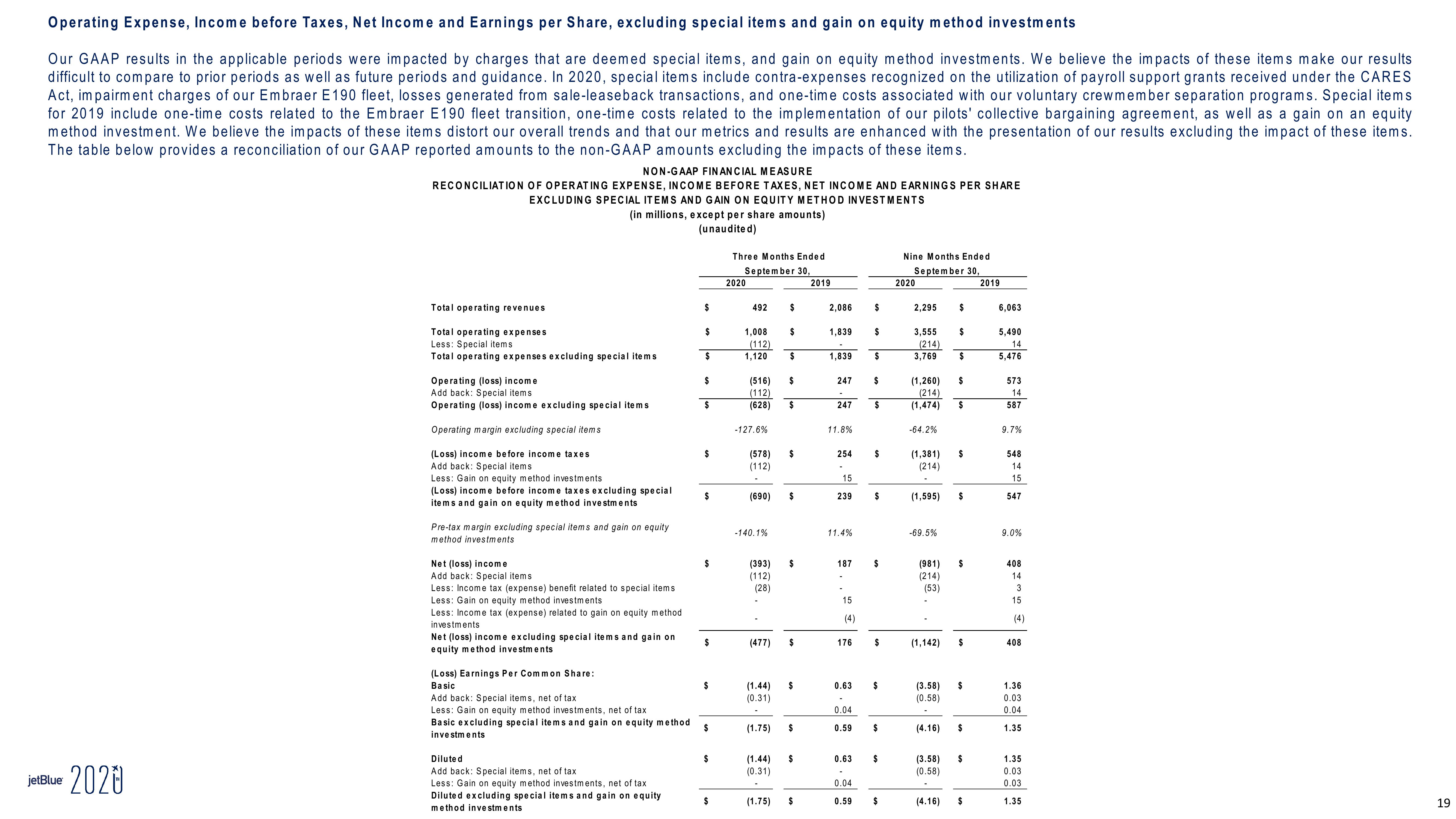

Operating Expense, Income before Taxes, Net Income and Earnings per Share, excluding special items and gain on equity method investments

Our GAAP results in the applicable periods were impacted by charges that are deemed special items, and gain on equity method investments. We believe the impacts of these items make our results

difficult to compare to prior periods as well as future periods and guidance. In 2020, special items include contra-expenses recognized on the utilization of payroll support grants received under the CARES

Act, impairment charges of our Embraer E190 fleet, losses generated from sale-leaseback transactions, and one-time costs associated with our voluntary crew member separation programs. Special items

for 2019 include one-time costs related to the Embraer E190 fleet transition, one-time costs related to the implementation of our pilots' collective bargaining agreement, as well as a gain on an equity

method investment. We believe the impacts of these items distort our overall trends and that our metrics and results are enhanced with the presentation of our results excluding the impact of these items.

The table below provides a reconciliation of our GAAP reported amounts to the non-GAAP amounts excluding the impacts of these items.

jetBlue 2020

NON-GAAP FINANCIAL MEASURE

RECONCILIATION OF OPERATING EXPENSE, INCOME BEFORE TAXES, NET INCOME AND EARNINGS PER SHARE

EXCLUDING SPECIAL ITEMS AND GAIN ON EQUITY METHOD INVESTMENTS

(in millions, except per share amounts)

(unaudited)

Total operating revenues

Total operating expenses

Less: Special items

Total operating expenses excluding special items

Operating (loss) income

Add back: Special items

Operating (loss) income excluding special items

Operating margin excluding special items

(Loss) income before income taxes

Add back: Special items.

Less: Gain on equity method investments

(Loss) income before income taxes excluding special

items and gain on equity method investments

Pre-tax margin excluding special items and gain on equity

method investments

Net (loss) income

Add back: Special items.

Less: Income tax (expense) benefit related to special items.

Less: Gain on equity method investments

Less: Income tax (expense) related to gain on equity method

investments

Net (loss) income excluding special items and gain on

equity method investments

(Loss) Earnings Per Common Share:

Basic

Add back: Special items, net of tax

Less: Gain on equity method investments, net of tax

Basic excluding special items and gain on equity method

investments

Diluted

Add back: Special items, net of tax

Less: Gain on equity method investments, net of tax

Diluted excluding special items and gain on equity

method investments

$

$

$

$

$

$

$

$

$

$

$

$

$

Three Months Ended

September 30,

2019

2020

492

1,008

(112)

1,120 $

(516)

(112)

(628)

-127.6%

(578)

(112)

(690)

-140.1%

(393)

(112)

(28)

(477)

(1.44)

(0.31)

(1.75)

(1.44)

(0.31)

$

(1.75)

$

$

$

$

$

$

$

$

$

$

$

2,086

1,839

1,839

247

247

11.8%

254

15

239

11.4%

187

15

(4)

176

0.63

0.04

0.59

0.63

0.04

0.59

$

$

$

S

$

$

$

$

$

$

$

$

$

Nine Months Ended

September 30,

2020

2,295 $

3,555

(214)

3,769 $

(1,260)

(214)

(1,474)

-64.2%

(1,381)

(214)

-69.5%

(981)

(214)

(53)

(1,595) $

(3.58)

(0.58)

$

(4.16)

(3.58)

(0.58)

$

(4.16)

$

(1,142) $

$

$

$

$

$

$

2019

6,063

5,490

14

5,476

573

14

587

9.7%

548

14

15

547

9.0%

408

14

3

15

(4)

408

1.36

0.03

0.04

1.35

1.35

0.03

0.03

1.35

19View entire presentation