Baird Investment Banking Pitch Book

RELATIVE CONTRIBUTION ANALYSIS APPROACH (CONT.)

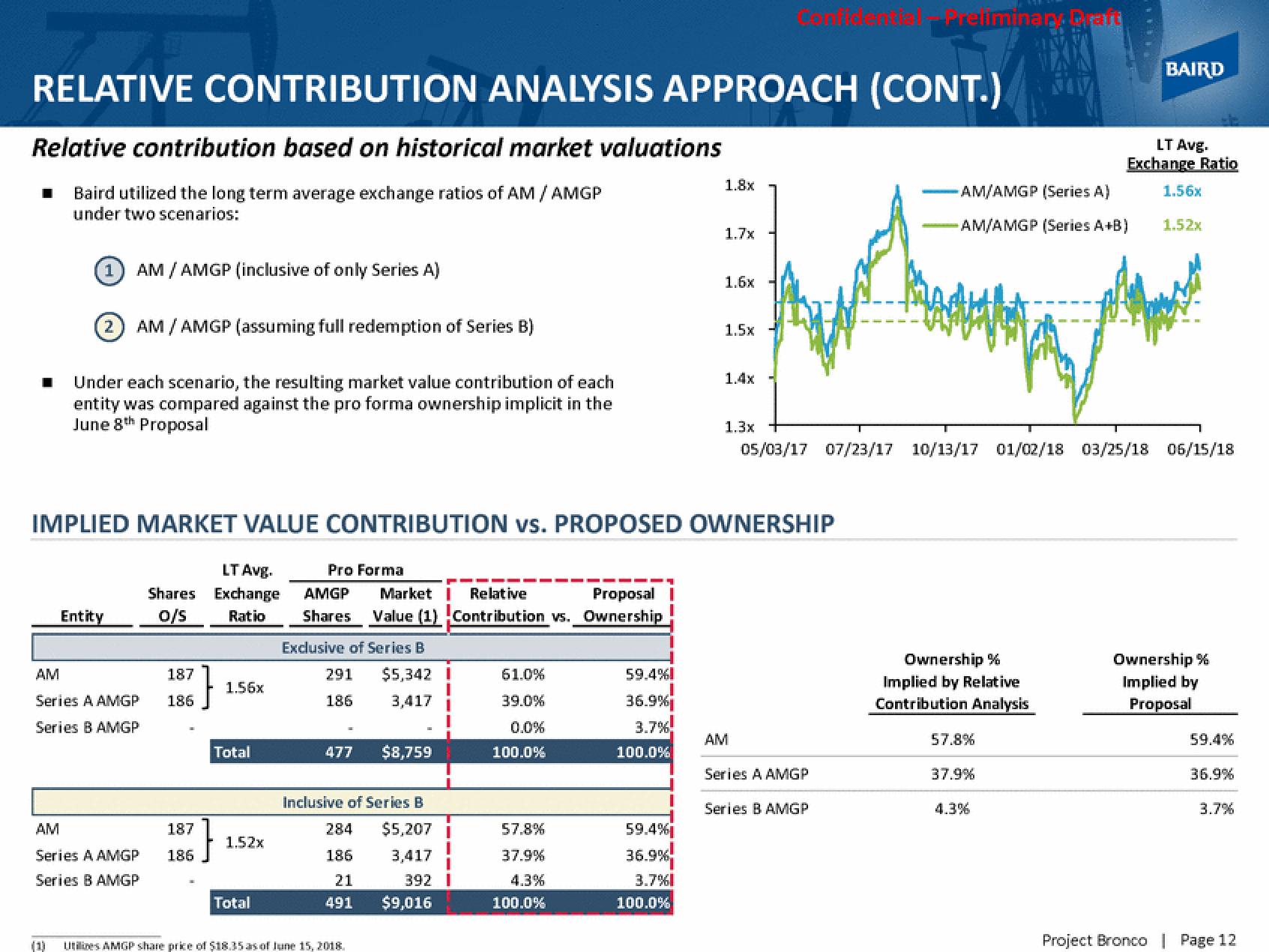

Relative contribution based on historical market valuations

Baird utilized the long term average exchange ratios of AM / AMGP

under two scenarios:

AM / AMGP (inclusive of only Series A)

2 AM / AMGP (assuming full redemption of Series B)

Under each scenario, the resulting market value contribution of each

entity was compared against the pro forma ownership implicit in the

June 8th Proposal

(1)

Entity

AM

Series A AMGP

Series B AMGP

AM

Series A AMGP

Series B AMGP

LT Avg.

Shares Exchange

0/S Ratio

187

186

IMPLIED MARKET VALUE CONTRIBUTION vs. PROPOSED OWNERSHIP

187

186

}

1.56x

Total

}

1.52x

Total

Pro Forma

Proposal

AMGP Market I Relative

Shares Value (1) Contribution vs. Ownership

Exclusive of Series B

291

186

477 $8,759

$5,342 I

3,417

Inclusive of Series B

284 $5,207 I

3,417

392

$9,016

186

21

491

Utilies AMGP share price of $18.35 as of June 15, 2018.

61.0%

39.0%

0.0%

100.0%

57.8%

37.9%

4.3%

100.0%

59.4%

36.9%

3.7%

100.0%

59.4%

36.9%

3.7%1

1.8x

100.0%

1.7x

1.6x

1.5x

1.4x

1.3x

Cantideksel Freliminara. Draft

AM

Series A AMGP

Series B AMGP

-AM/AMGP (Series A)

-AM/AMGP (Series A+B)

Ownership %

Implied by Relative

Contribution Analysis

05/03/17 07/23/17 10/13/17 01/02/18 03/25/18 06/15/18

57.8%

37.9%

BAIRD

LT Avg.

Exchange Ratio

4.3%

1.56x

1.52x

Ownership %

Implied by

Proposal

59.4%

36.9%

3.7%

Project Bronco | Page 12View entire presentation