Main Street Capital Fixed Income Presentation Deck

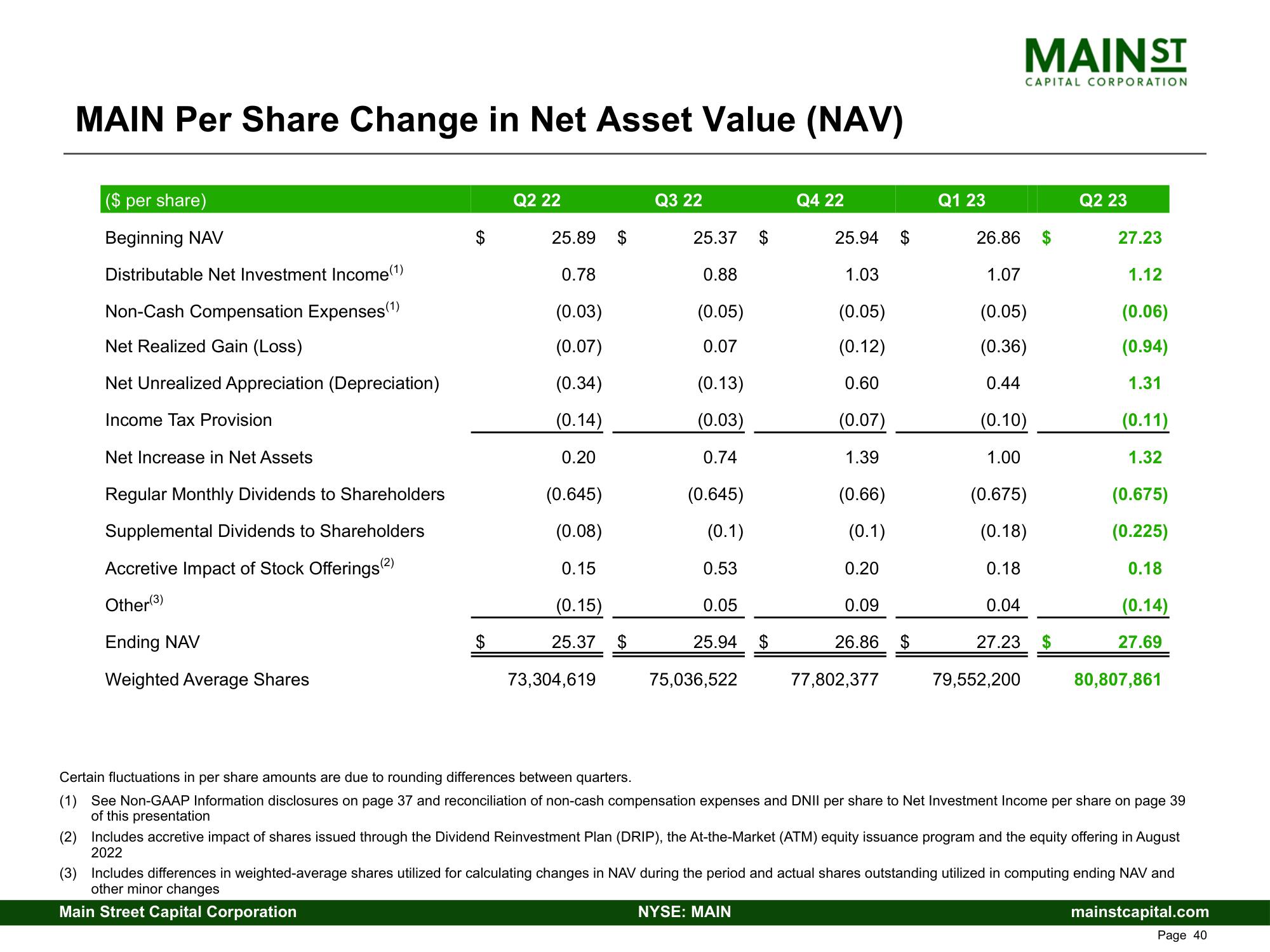

MAIN Per Share Change in Net Asset Value (NAV)

($ per share)

Beginning NAV

Distributable Net Investment Income(¹)

Non-Cash Compensation Expenses (1)

Net Realized Gain (Loss)

Net Unrealized Appreciation (Depreciation)

Income Tax Provision

Net Increase in Net Assets

Regular Monthly Dividends to Shareholders

Supplemental Dividends to Shareholders

Accretive Impact of Stock Offerings (²)

Other(3)

Ending NAV

Weighted Average Shares

$

Q2 22

25.89 $

0.78

(0.03)

(0.07)

(0.34)

(0.14)

0.20

(0.645)

(0.08)

0.15

(0.15)

25.37

73,304,619

$

Q3 22

25.37

0.88

(0.05)

0.07

(0.13)

(0.03)

0.74

(0.645)

(0.1)

0.53

0.05

25.94 $

75,036,522

$

Q4 22

25.94

NYSE: MAIN

1.03

(0.05)

(0.12)

0.60

(0.07)

1.39

$

(0.66)

(0.1)

0.20

0.09

26.86 $

77,802,377

Q1 23

MAIN ST

CAPITAL CORPORATION

26.86

1.07

(0.05)

(0.36)

0.44

(0.10)

1.00

79,552,200

(0.675)

(0.18)

0.18

0.04

27.23

$

Q2 23

27.23

1.12

(0.06)

(0.94)

1.31

(0.11)

1.32

(0.675)

(0.225)

0.18

(0.14)

27.69

80,807,861

Certain fluctuations in per share amounts are due to rounding differences between quarters.

(1) See Non-GAAP Information disclosures on page 37 and reconciliation of non-cash compensation expenses and DNII per share to Net Investment Income per share on page 39

of this presentation

(2) Includes accretive impact of shares issued through the Dividend Reinvestment Plan (DRIP), the At-the-Market (ATM) equity issuance program and the equity offering in August

2022

(3) Includes differences in weighted-average shares utilized for calculating changes in NAV during the period and actual shares outstanding utilized in computing ending NAV and

other minor changes

Main Street Capital Corporation

mainstcapital.com

Page 40View entire presentation