Baird Investment Banking Pitch Book

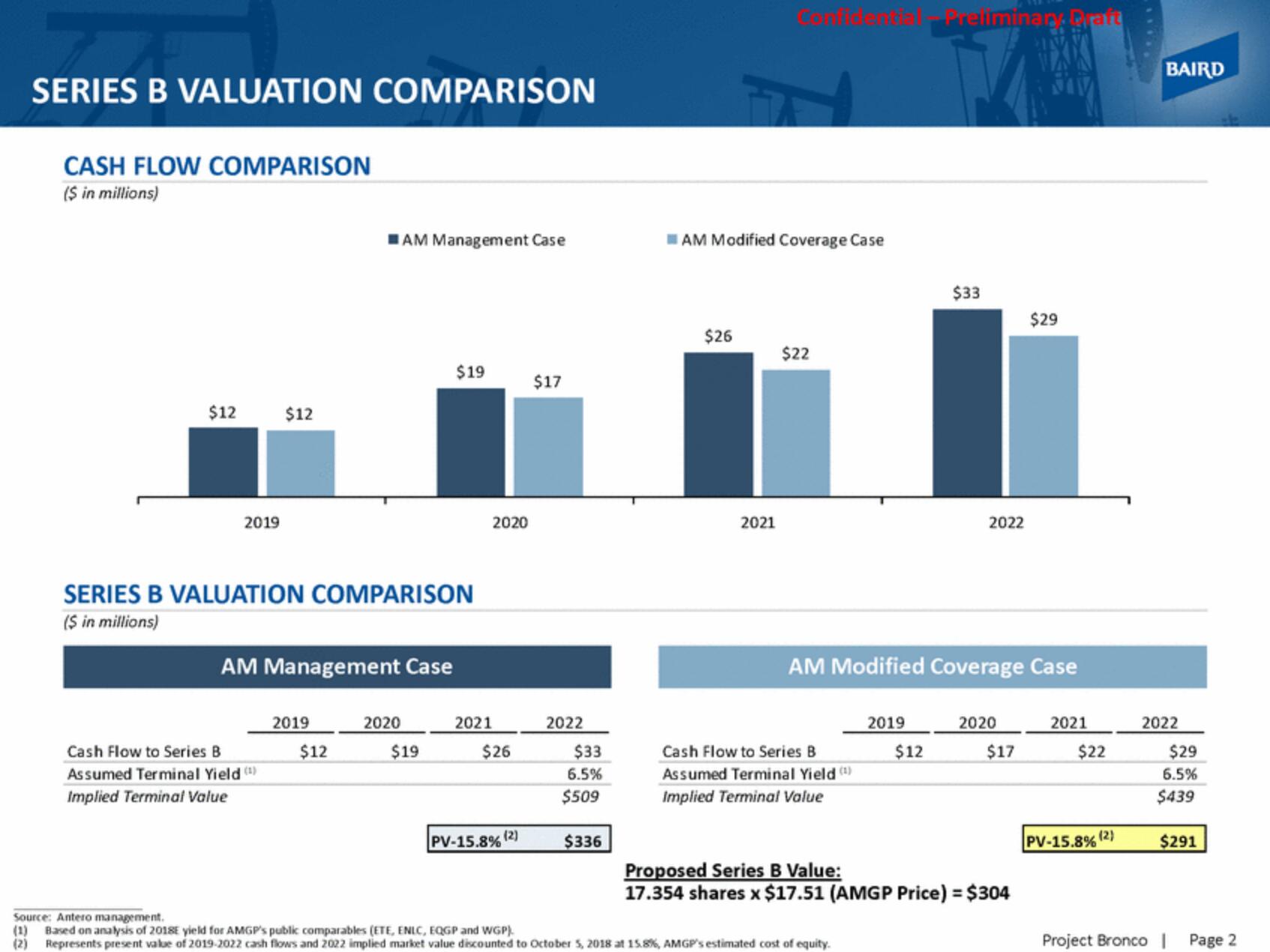

SERIES B VALUATION COMPARISON

CASH FLOW COMPARISON

($ in millions)

$12

2019

$12

Cash Flow to Series B

Assumed Terminal Yield (¹)

Implied Terminal Value

SERIES B VALUATION COMPARISON

($ in millions)

AM Management Case

IAM Management Case

2019

$12

2020

$19

$19

2021

2020

$26

PV-15.8% (2)

$17

2022

$33

6.5%

$509

$336

AM Modified Coverage Case

$26

2021

$22

Cash Flow to Series B

Assumed Terminal Yield (¹)

Implied Terminal Value

2019

Source: Antero management.

(1) Based on analysis of 2018 yield for AMGP's public comparables (ETE, ENLC, EQGP and WGP).

(2)

Represents present value of 2019-2022 cash flows and 2022 implied market value discounted to October 5, 2018 at 15.8%, AMGP's estimated cost of equity.

Treliminar. Praft

AM Modified Coverage Case

$12

$33

2022

2020

$17

Proposed Series B Value:

17.354 shares x $17.51 (AMGP Price) = $304

$29

2021

$22

PV-15.8% (2)

BAIRD

2022

$29

6.5%

$439

$291

Project Bronco |

Page 2View entire presentation