Baird Investment Banking Pitch Book

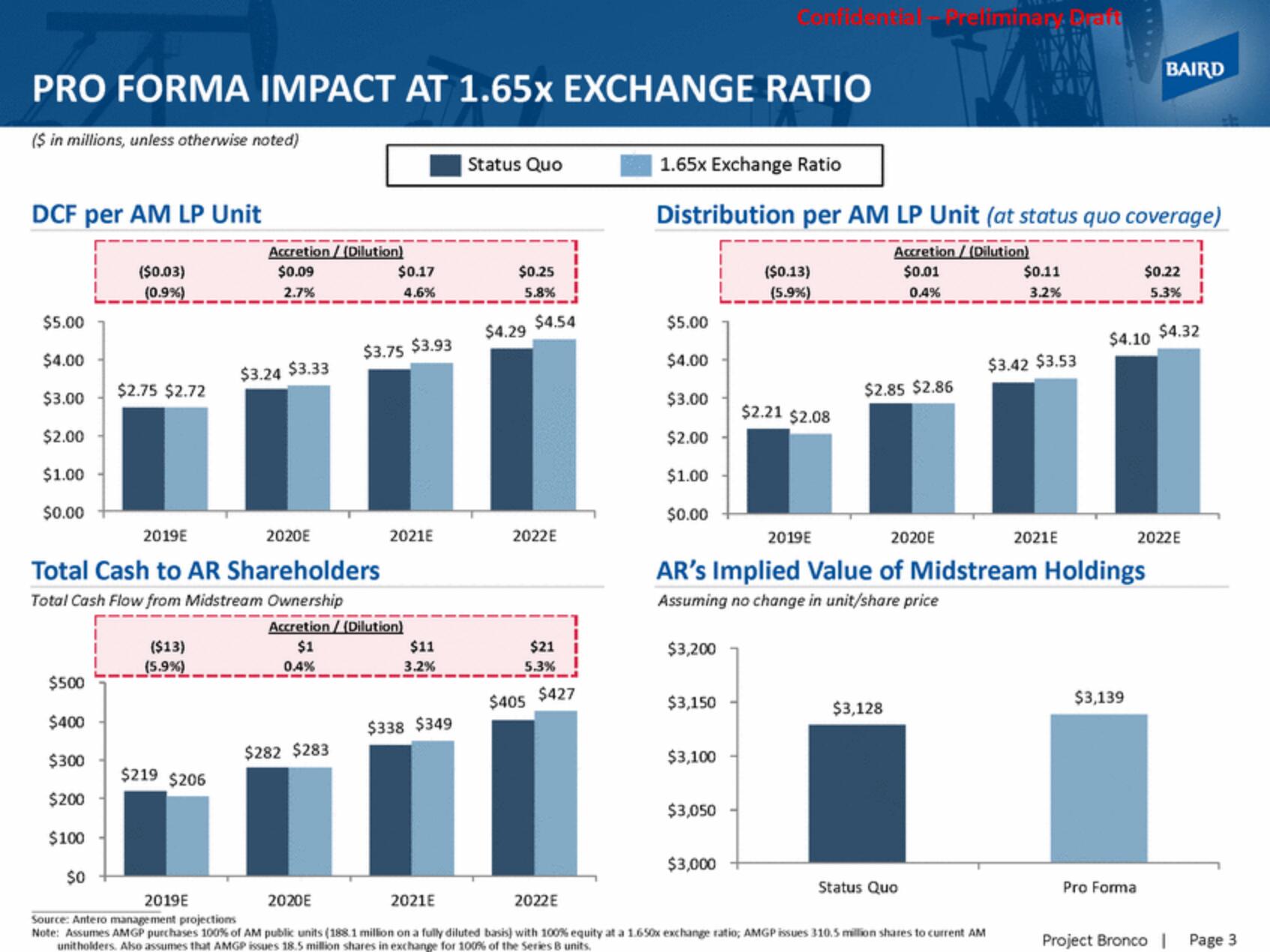

PRO FORMA IMPACT AT 1.65x EXCHANGE RATIO

($ in millions, unless otherwise noted)

DCF per AM LP Unit

$5.00

$4.00

$3.00

$2.00

$1.00

$0.00

($0.03)

(0.9%)

$500

$400

$300

$200

$100

$0

$2.75 $2.72

($13)

(5.9%)

Accretion/(Dilution)

$219 $206

$0.09

2.7%

2019E

2020E

Total Cash to AR Shareholders

Total Cash Flow from Midstream Ownership

$3.24 $3.33

$0.17

4.6%

$3.75 $3.93

$282 $283

2021E

Accretion/ (Dilution)

$1

0.4%

$11

3.2%

$338 $349

Status Quo

$0.25

5.8%

$4.29

$4.54

2022E

$21

5.3%

$405 $427

$5.00

$4.00

1.65x Exchange Ratio

Distribution per AM LP Unit (at status quo coverage)

Accretion / (Dilution)

$0.01

0.4%

$3.00

$2.00

$1.00

$0.00

$3,150

$3,100

$3,050

($0.13)

(5.9%)

$3,000

$2.21 $2.08

Preliminar Draft

$2.85 $2.86

2019E

2020E

AR's Implied Value of Midstream Holdings

Assuming no change in unit/share price

$3,200

$3,128

Status Quo

$0.11

3.2%

2019E

2020E

2021E

2022E

Source: Antero management projections

Note: Assumes AMGP purchases 100% of AM public units (188.1 million on a fully diluted basis) with 100% equity at a 1.650x exchange ratio; AMGP issues 310.5 million shares to current AM

unitholders. Also assumes that AMGP issues 18.5 million shares in exchange for 100% of the Series B units.

$3.42 $3.53

2021E

$4.10

$3,139

BAIRD

$0.22

5.3%

Pro Forma

$4.32

2022E

Project Bronco | Page 3View entire presentation