Hilltop Holdings Results Presentation Deck

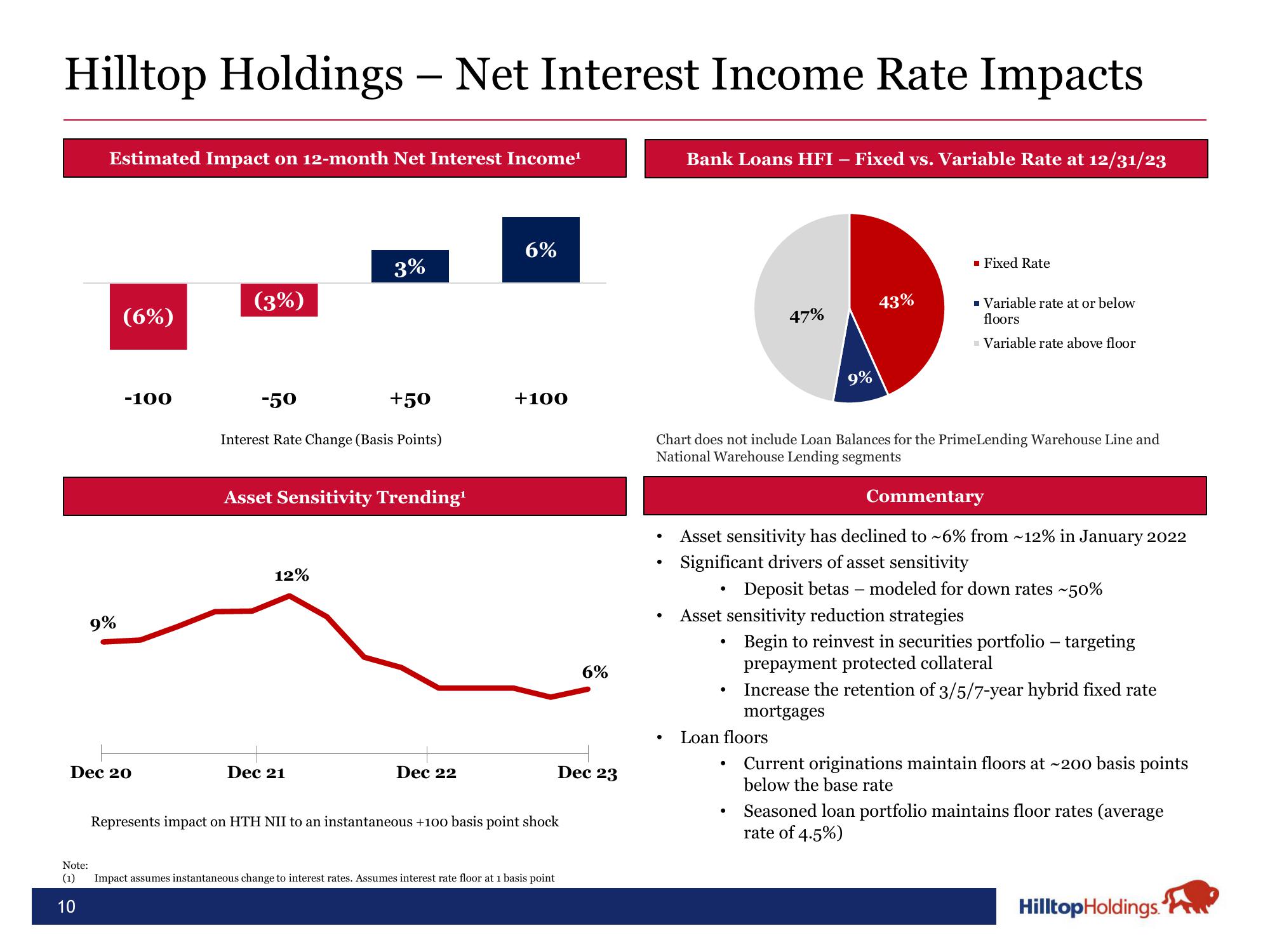

Hilltop Holdings - Net Interest Income Rate Impacts

Note:

(1)

Estimated Impact on 12-month Net Interest Income¹

10

9%

(6%)

Dec 20

-100

(3%)

-50

+50

Interest Rate Change (Basis Points)

3%

Asset Sensitivity Trending¹

12%

Dec 21

Dec 22

6%

+100

Represents impact on HTH NII to an instantaneous +100 basis point shock

Impact assumes instantaneous change to interest rates. Assumes interest rate floor at 1 basis point

6%

Dec 23

Bank Loans HFI – Fixed vs. Variable Rate at 12/31/23

●

●

Chart does not include Loan Balances for the PrimeLending Warehouse Line and

National Warehouse Lending segments

.

●

47%

Commentary

Asset sensitivity has declined to -6% from ~12% in January 2022

Significant drivers of asset sensitivity

9%

Asset sensitivity reduction strategies

●

43%

●

Loan floors

■ Fixed Rate

■ Variable rate at or below

floors

Variable rate above floor

Deposit betas - modeled for down rates ~50%

Begin to reinvest in securities portfolio - targeting

prepayment protected collateral

Increase the retention of 3/5/7-year hybrid fixed rate

mortgages

Current originations maintain floors at ~200 basis points

below the base rate

Seasoned loan portfolio maintains floor rates (average

rate of 4.5%)

Hilltop Holdings.View entire presentation